Featured

- Get link

- X

- Other Apps

California Sales Tax By City

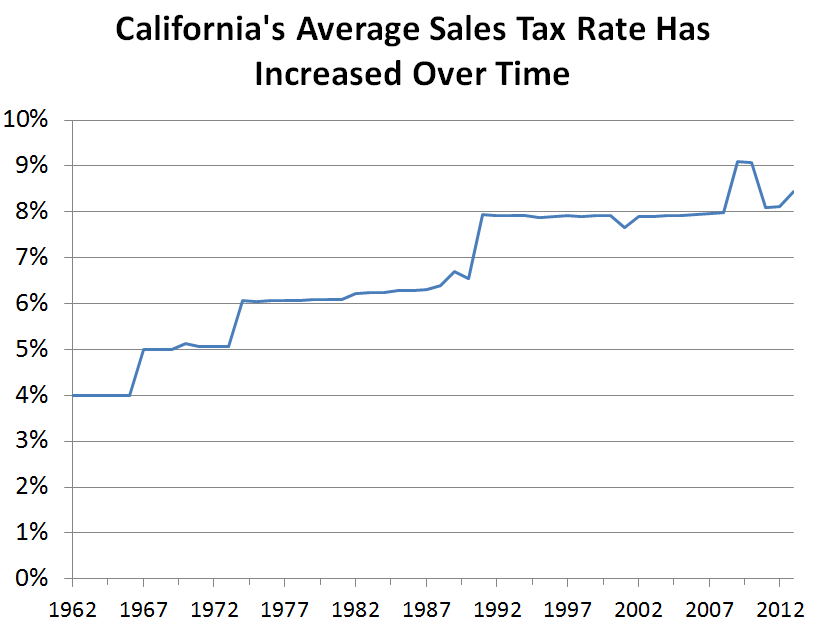

State sales and use taxes provide revenue to the states General Fund to cities and counties through specific. The raise was approved by California voters in the Nov.

Fillable Online Boe Ca California City And County Sales And Use Tax Rates Tax Rates Effective 1 1 13 To 3 31 13 Boe Ca Fax Email Print Pdffiller

Fillable Online Boe Ca California City And County Sales And Use Tax Rates Tax Rates Effective 1 1 13 To 3 31 13 Boe Ca Fax Email Print Pdffiller

Only about a quarter of the cities in California actually charge a sales tax of 725.

California sales tax by city. The minimum combined 2021 sales tax rate for City Of Industry California is 1025. So if you buy something in downtown Los Angeles youll pay a sales tax of 95. A special tax requires two-thirds voter approval.

This table shows the city-imposed Bradley-Burns local sales tax rates on July 1. Current Tax Rates Tax Rates Effective April 1 2021 Find a Sales and Use Tax Rate by Address Tax Rates by County and City Tax Rate Charts Tax Resources The following files are provided to download tax rates for California Cities and Counties. The state sales tax rate in California is.

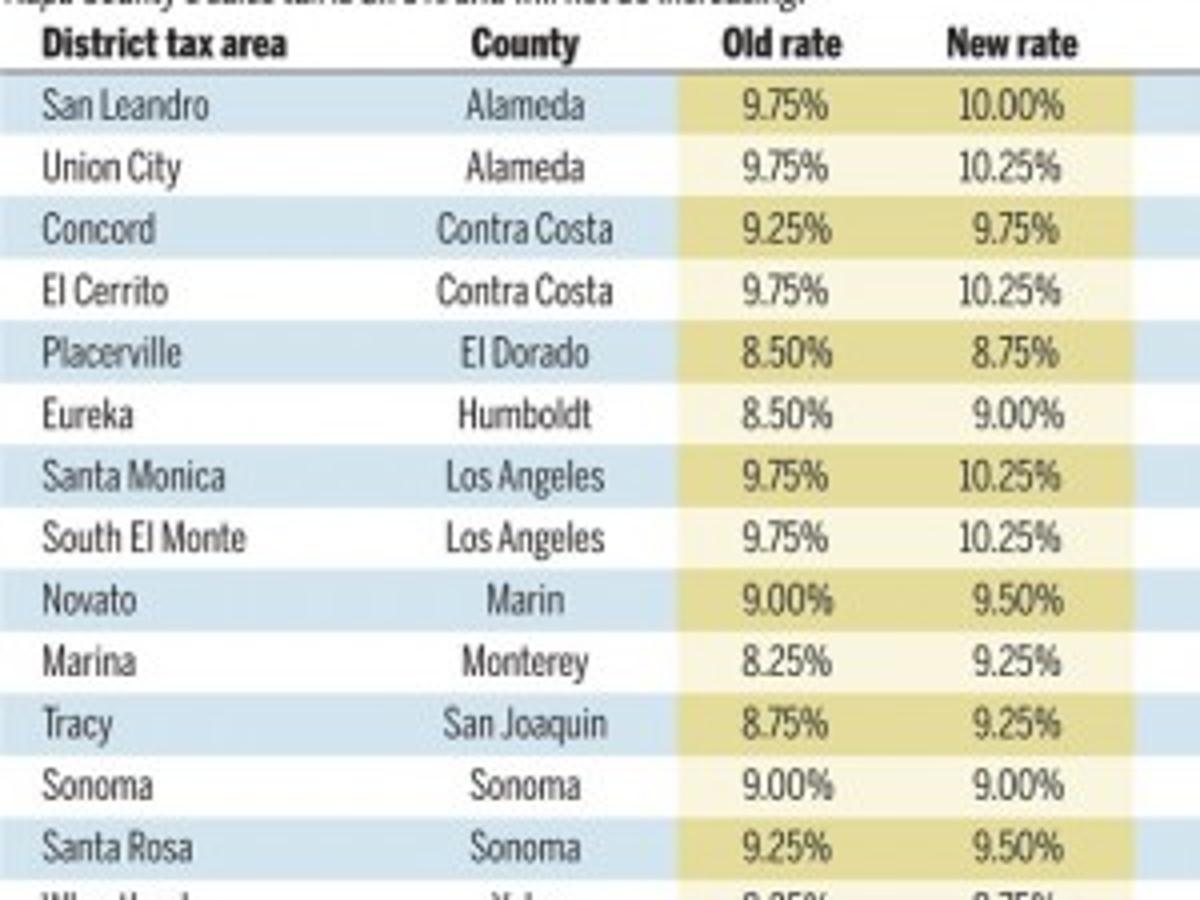

SAN FRANCISCO KRON Several Bay Area cities saw a Sales Use tax hike go into effect on April 1. Looking for the Tax Rate API. For more information about tax rates visit our California City County Sales Use Tax Rates webpage.

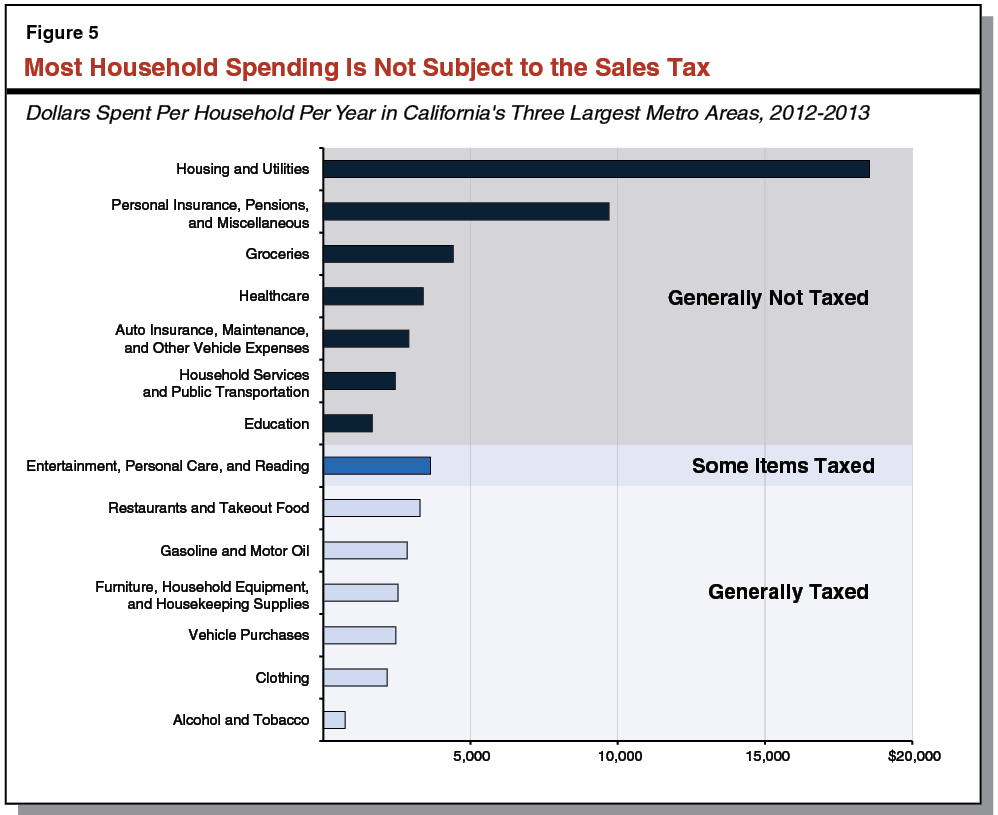

The state tax rate the local tax rate and any district tax rate that may be in effect. This is the total of state county and city sales tax rates. The sales and use tax rate in a specific California location has three parts.

The basic statewide sales and use tax rate is 725 and is divided as follows. 100 Local Jurisdiction City or county of place of sale or use 025 Local Transportation Fund County of place of sale or use District Taxes are imposed locally under the Transactions and Use Tax Law. Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

1305 rows There are a total of 511 local tax jurisdictions across the state collecting an average. Try the new Beta version of the Find a Sales and Use Tax Rate application For more information about tax rates visit our California City County Sales Use Tax Rates webpage. District tax areas consist of both counties and cities.

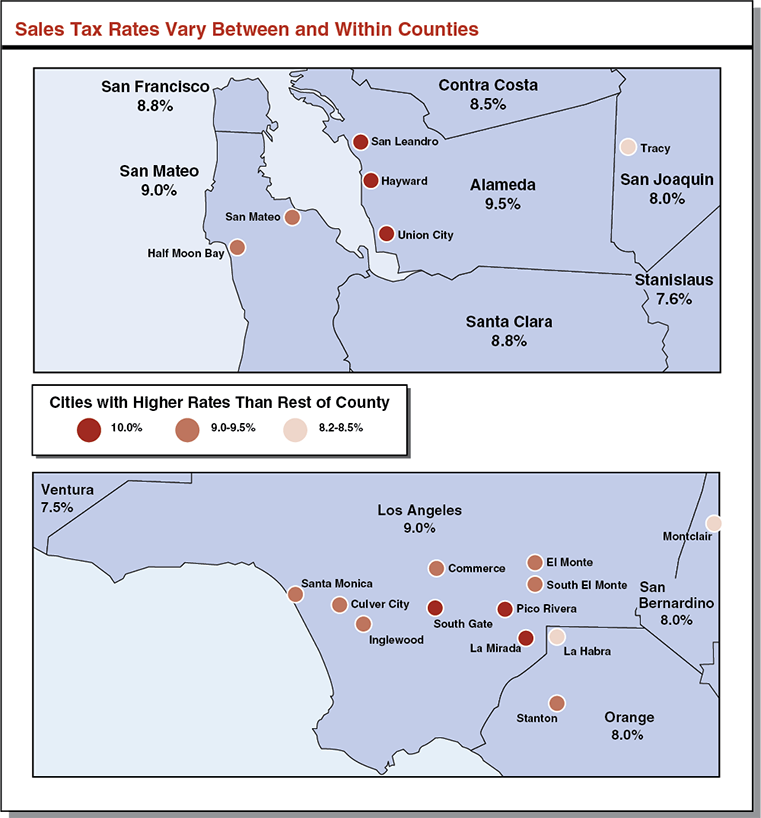

In addition to the statewide sales and use tax rate some cities and counties have voter- or local government-approved district taxes. Although cities vary widely sales and use tax revenue provides on average 30 percent of city general purpose revenue and often as much as 45 percent. As an example consider Los Angeles County.

A base sales and use tax rate of 725 percent is applied statewide. Determining District Taxes by Location. The California sales tax rate is currently 6.

The County sales tax rate is 025. Vista California sales tax rate details. The County sales tax rate is.

While most locally approved taxes cover entire counties some are limited to specific cities. The minimum combined 2021 sales tax rate for Vista California is 825. The county has a sales tax of 95.

30 rows California CA Sales Tax Rates by City. Cities and counties may impose additional transaction and use taxes in increments of 0125 percent with two-thirds city council approval and majority voter approval for a general tax. City Of Industry California sales tax rate details.

The sales and use tax rates vary depending on your retail location. Within the county a handful of cities charge a higher sales tax. 1788 rows California City County Sales Use Tax Rates effective April 1 2021 These rates may be.

The use tax generally applies to the storage use or other consumption in California of goods purchased from retailers in. Contact us at CDTFA-AddressLookupQuestionscdtfacagov responses are generally within 24 hours GIS. The citys tax rate is credited against the countys one percent tax.

SALES AND USE TAX RATES MONTEREY COUNTY 775 City of Carmel-by-the-Sea 925 City of Del Rey Oaks 925 City of Gonzales 875 City of Greenfield 950 City of King City 875 City of Marina 925 City of Monterey 925 City of Pacific Grove 875 City of Salinas 925 City of Sand City 875 City of Seaside 925 City of Soledad 925 NAPA COUNTY 775. Looking for the Tax Rate API. This is the total of state county and city sales tax rates.

The California sales tax rate is currently 6. Local Sales and Use Tax Rates Imposed by California Cities on July 1 Under the Bradley-Burns Uniform Local Sales and Use Tax Law a citys local tax may be imposed up to one percent. The California Department of Tax and Fee Administration provides a complete list of City and County Sales and Use Tax Rates.

If you drive 25 minutes an hour with traffic to buy something in Culver City youll pay a. District taxes should be reported on Schedule A of your sales and use tax return.

California Sales Tax Rate In 2015 Rating Walls

Understanding California S Sales Tax

Understanding California S Sales Tax

Understanding California S Sales Tax

Understanding California S Sales Tax

Sales Tax Rate Map Released For California News Vvdailypress Com Victorville Ca

Sales Tax Rate Map Released For California News Vvdailypress Com Victorville Ca

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

California Sales And Use Tax Rates Lookup By City Zip2tax Llc

California Sales And Use Tax Rates Lookup By City Zip2tax Llc

New Sales And Use Tax Rates In Newark East Bay Effective April 1 Newark Ca Patch

New Sales And Use Tax Rates In Newark East Bay Effective April 1 Newark Ca Patch

California Sales Tax Rate Rates Calculator Avalara

New California City Sales Tax Rates Take Effect On April 1 Business Napavalleyregister Com

New California City Sales Tax Rates Take Effect On April 1 Business Napavalleyregister Com

New California City Sales Tax Rates Take Effect On April 1 Business Napavalleyregister Com

New California City Sales Tax Rates Take Effect On April 1 Business Napavalleyregister Com

How To Calculate California Unincorporated Area Sales Tax

Comments

Post a Comment