Featured

Is Vanguard A Brokerage

On the other hand Fidelity offers in. The Cost of Trading.

Vanguard Review 2021 Pros And Cons Uncovered

Vanguard Review 2021 Pros And Cons Uncovered

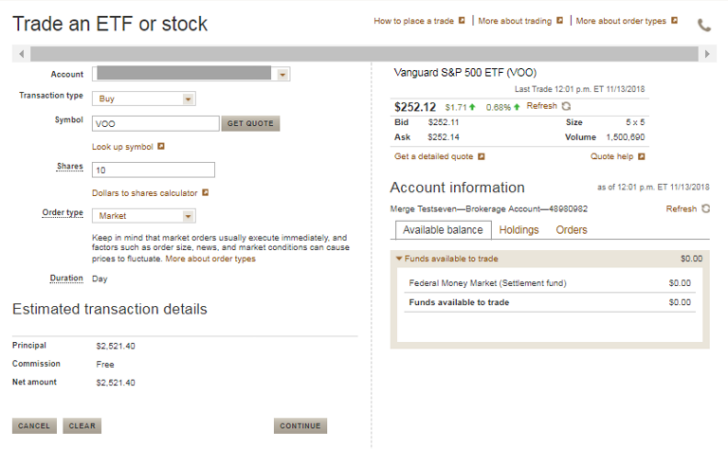

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions.

Is vanguard a brokerage. International Canada Europe Australia New. It now offers zero trade fees on most but not all securities. Vanguard is also a great platform for those who want a no-frills and cost effective option for their portfolio.

The company has a band of loyal followers who swear by the ownership model and pricing structure. Vanguard has finally succumbed to the brokerage price war. But active traders will find the broker falls short despite its 0.

Active traders will want to put a hard pass on Vanguard Brokerage Services. Vanguard is a top brokerage platform that offers low-cost mutual funds with no account minimums. Nevertheless since corporations consist of people there is no guarantee that an unscrupulous individual wont try to defraud an investor.

Vanguard is also widely known for its in-house selection of low-cost funds as it runs a number of its own indexes. The company currently manages about 51 trillion in global assets from over 20 million investors in about 170 countries. But does it have enough to outdo them.

Flexibility You can hold Vanguard mutual funds and ETFs exchange-traded funds stocks bonds and CDs. Vanguard ETF Shares arent redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. See the Vanguard Brokerage Services commission and fee schedules for limits.

Vanguard is the best online brokerage for the buy and hold investor and particularly those with large portfolios of 500k but they are also good for smaller portfolios of at least 3000. Vanguard Personal Advisory Services and Vanguard Digital Advisor the firms robo-advisories are not integrated into the brokerage. While in some ways Vanguard is still an old-school brokerage firm the company has launched a new 0 commission schedule for 2021 that attempts to rival cutting-edge firms.

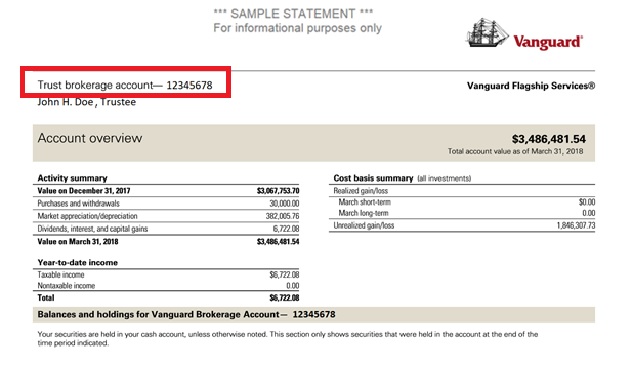

The Vanguard Brokerage Account offers an easy way to organize and manage all your investments and so much more. Vanguard Brokerage Services is one of the ten largest brokerages in the country and is a legitimate firm that agrees to abide by the rules of its governing bodies. Lets have a look.

Vanguard is the king of low-cost investing making it ideal for buy-and-hold investors and retirement savers. Lets take a closer look at this unique broker and see what it has to offer for investors. The first thing that is important to understand is that there is a difference between Vanguards products and Vanguard as a broker.

The personal advisor service does come with a fee of 003 of your total assets. The bottom line. Vanguards platform only allows you to buy Vanguard funds of which there are around 78 covering a range of regions assets and investment styles.

The Vanguard brokerage platform also offers personal advisor services that include a customized financial plan goal-setting and investment advice. Even if you dislike the way Vanguard has set up its investment process you would still be able to invest in Vanguard products through other. Vanguard Brokerage Services is a full-service self-directed discount brokerage firm but the company specializes in no-load low-cost mutual funds and ETFs.

For the right kind of investor the lack of a trading platform is not. You can trade stocks options and more but the Vanguard website doesnt make it easy. Check out this in-depth Vanguard review and.

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Each have broad financial offerings from DIY brokerage accounts to financial advisors robo-advisors and financial planning services. You cant buy funds from other companies shares or investment trusts.

When you sell a stock or bond you can reinvest your profits in Vanguard funds right away. The sooner you move your Vanguard funds to a brokerage account the sooner you can take advantage of these great benefits. Read our guide to the best and worst investment platforms.

Vanguard is a client-owned brokerage firm that provides some unique investment services. When buying or selling an ETF youll pay or. Vanguard Brokerage Review Vanguard began operations back in 1975 although its oldest fund the Vanguard Wellington Fund was incepted in 1929.

Vanguard ETF Shares arent redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Vanguard Pros Commission-free trading. Is Vanguard good or bad.

ETFs are subject to market volatility. Vanguard and Fidelity are both major brokerage firms with some of the largest client bases in the country. Vanguard is not a broker for active traders so the broker does not offer anything more than a basic order interface.

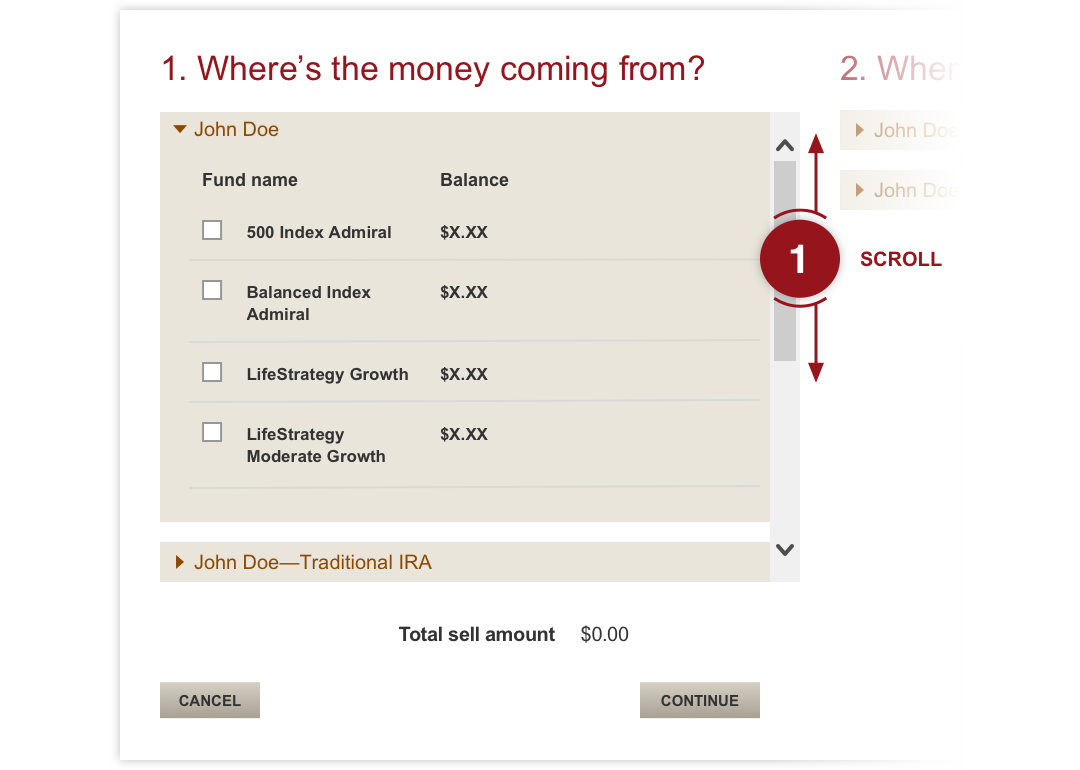

How Do I Exchange A Vanguard Mutual Fund For Another Vanguard Mutual Fund Online Vanguard

How Do I Exchange A Vanguard Mutual Fund For Another Vanguard Mutual Fund Online Vanguard

Vanguard Brokerage Review Smartasset

Vanguard Brokerage Review Smartasset

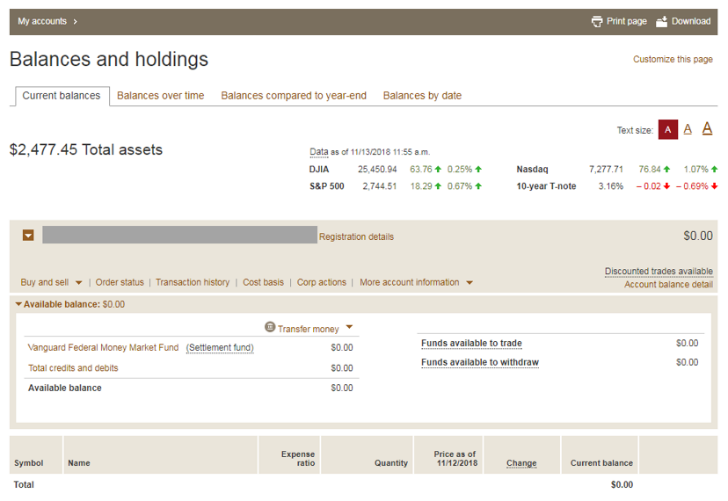

Vanguard Merged Brokerage Account Review Pros And Cons My Money Blog

Vanguard Merged Brokerage Account Review Pros And Cons My Money Blog

Vanguard Review 2021 Pros Cons Fees Features Benzinga

Vanguard Review 2021 Pros Cons Fees Features Benzinga

Vanguard Review 2021 Pros And Cons Uncovered

Vanguard Review 2021 Pros And Cons Uncovered

How Do I Buy A Vanguard Mutual Fund Online Vanguard

How Do I Buy A Vanguard Mutual Fund Online Vanguard

How To Close A Vanguard Account Closing Fee 2021

How To Close A Vanguard Account Closing Fee 2021

Vanguard Brokerage Review Smartasset

Vanguard Brokerage Review Smartasset

Vanguard Review 2021 Pros And Cons Uncovered

Vanguard Review 2021 Pros And Cons Uncovered

Vanguard Vs J P Morgan Chase 2021

Vanguard Vs J P Morgan Chase 2021

:max_bytes(150000):strip_icc()/ScreenShot2020-03-16at5.09.54PM-e542d6ef5216476dbe0428c9d467a6c9.png)

/Vanguard_portfolio_watch-eeb3c935ef08429dbd129bd37aba586b.jpg)

Comments

Post a Comment