Featured

- Get link

- X

- Other Apps

How Can I Avoid Paying Taxes On My 401k Withdrawal

Roll over your 401k without tax withholding. Any amounts distributed from an IRA however are not subject to the 20 withholding as the IRA owner can elect out of withholding.

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

Any money you withdraw from your 401k is considered income and will be taxed as such alongside other sources of taxable income you may receive.

How can i avoid paying taxes on my 401k withdrawal. Taking early distributions from your 401 k plan triggers a federal penalty tax of 10 percent. Withdrawing money before that age results in a penalty worth 10 of the amount you withdraw. Fortunately most states dont impose a separate penalty tax.

The Cares Act lets people of any age take up to 100000 from their IRA or 401 k by Dec. If you withdrew 15000 from your 401 k you may be able to pay a 12 tax rate on that money instead of the 22 you might pay in a higher earning year. Heres how to minimize 401k and IRA withdrawal taxes in retirement.

Avoid the early withdrawal penalty. If you withdraw money from your 401 k account before age 59 12 you will need to pay a 10 early withdrawal penalty in. This is your once in a lifetime chance to do so.

At the very least youll pay federal income tax on the amount you withdraw. Keeping your withdrawals at the minimum you need can help keep your tax burden as low as possible. If you have several traditional IRAs you add up the total RMDs required from all of them and then you can withdraw the money from one or more.

As a result any amounts distributed from a 401k to its owner will be reduced by 20 and that 20 will be sent to the IRS in expectation of the taxes that will be due from the account owner for the distribution. One of the easiest ways to lower the amount of taxes you have to pay on 401 k withdrawals is to convert to a Roth IRA or Roth 401 k. This is in addition to the federal and state income taxes you pay on this withdrawal.

While you dont avoid paying taxes entirely a Roth 401k allows you to avoid paying tax on any earnings and interest you may have accumulated over 20-30 years. Keeping yourself in a lower tax bracket will reduce the amount of your tax liability. Avoid the early withdrawal penalty.

Withdrawals from those accounts are not taxed. One exception is California where the. Delay taking social security as long as possible.

Reduce Taxes on 401k and IRA Distributions. Heres how to minimize 401k and IRA withdrawal taxes in retirement. 30 without a penalty.

You can cash out entirely and pay ordinary tax on the investment income or you can avoid paying taxes by rolling the 401k distribution into another retirement account like an IRA. You still have to pay regular taxes on withdrawals. There isnt a separate 401k withdrawal tax.

Avoid two distributions in the same year. This illustration is on a healthy male age 45. If you dont need that much money right now you can live off your 401k withdrawals starting at age 595.

There are exceptions to this early withdrawal penalty though. If you want to remove money from a 401k account without paying taxes you will need to meet certain criteria. Be Smart About Asset Location.

You can then take whatever amount you need from your IRA if you must withdraw money for any reason rather than being taxed on the entire balance. At some point you will pay taxes to withdraw that money but you wont right away. When youre ready contact your plan administrator and start withdrawing the money.

If youre in a Roth 401k in most cases you wont owe any taxes at all when you withdraw the money because you will have already paid the taxes upfront. Avoid the 401 k early withdrawal penalty. To avoid this 401k tax you can repay your qualified plan over the next three to five years.

You can avoid taxes altogether by transferring your 401 k money over to another qualified plan such as an IRA if you have a 401 k and dont need the money now. As with any taxable income the rate you pay depends on the amount of total taxable income you receive that year. In 2021 singles with.

Obviously you will have to pay the 401k tax es on that money regardless of when you take your money out so here is a way to recover the 401k withdrawal tax over time so you dont have to pay it later. Roll over your 401k without tax withholding. Keep Your Capital Gains Taxes Low Try to only take withdrawals from your 401 k up to the earned income amount that will allow your long-term capital gains to be taxed at 0.

The discrepancy in the rules is one advantage of using an IRA in. According to the IRS you generally dont. Remember required minimum distributions.

But those who take a withdrawal do. Start withdrawals before you have to. Then collect the documentation so you can present it to your 401k plan administrator and the IRS and prove youre entitled to the withdrawal.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png) How To Take Money Out Of A 401 K Plan

How To Take Money Out Of A 401 K Plan

/what-to-know-before-taking-a-401-k-hardship-withdrawal-2388214-v2-211c0d162ae64a95bbe3813f1f9243ad.png) 401 K Hardship Withdrawals Here S How They Work

401 K Hardship Withdrawals Here S How They Work

/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png) Can I Withdraw Money From My 401 K Before I Retire

Can I Withdraw Money From My 401 K Before I Retire

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png) At What Age Can I Withdraw Funds From My 401 K Plan

At What Age Can I Withdraw Funds From My 401 K Plan

/exceptions-ira-early-withdrawal-penalty-2388980-Final-38a20015611944799acc47f83bba47af.png) Exceptions To The Ira Early Withdrawal Penalty Tax

Exceptions To The Ira Early Withdrawal Penalty Tax

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

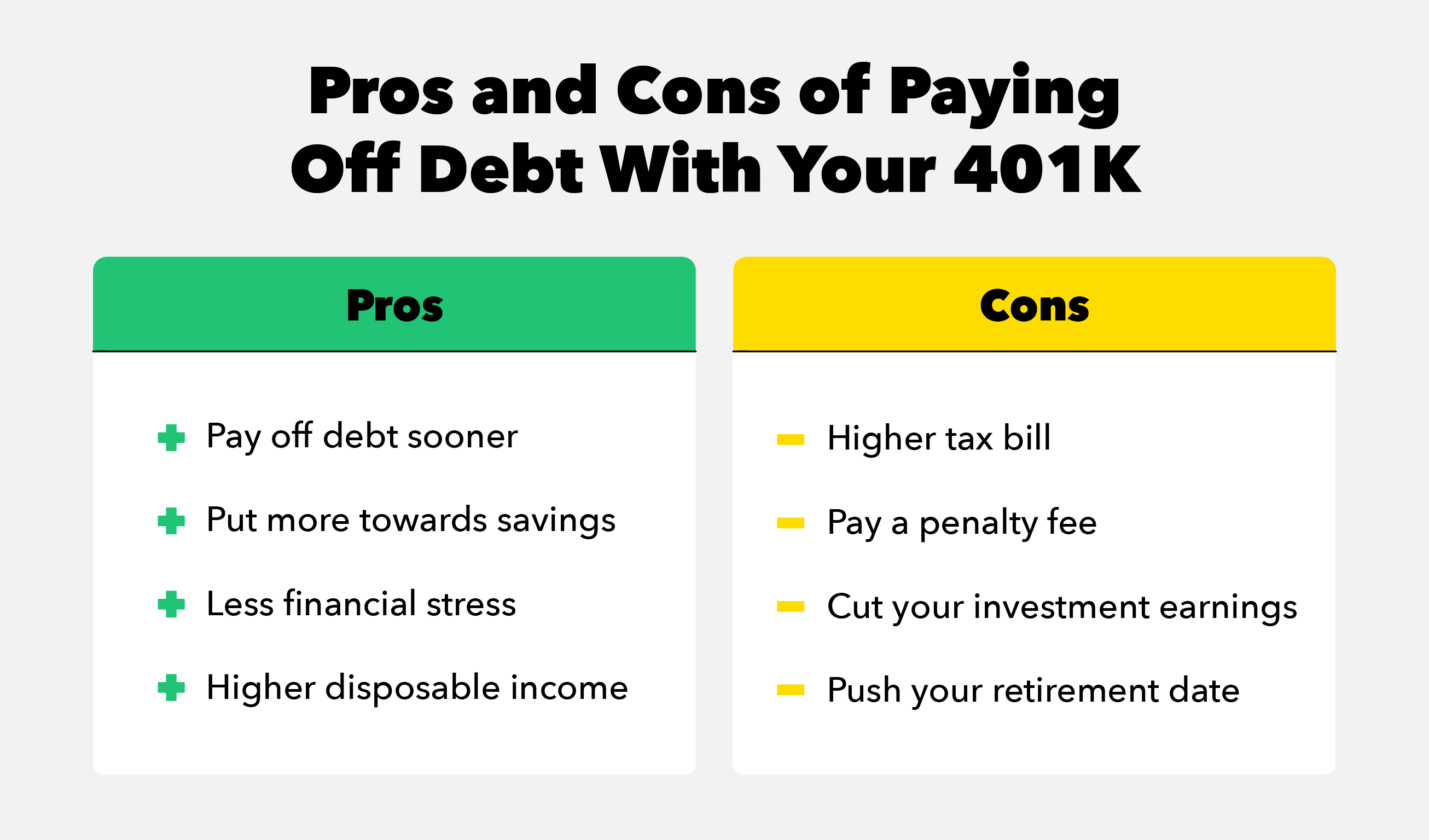

Should I Cash Out My 401k To Pay Off Debt

Should I Cash Out My 401k To Pay Off Debt

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png) At What Age Can I Withdraw Funds From My 401 K Plan

At What Age Can I Withdraw Funds From My 401 K Plan

/Facts-about-401k-loans-9b8c3bd3d0314c338c0a50bc3c75728c.gif) What You Need To Know About 401 K Loans Before You Take One

What You Need To Know About 401 K Loans Before You Take One

How Can I Avoid Paying Taxes On My 401 K Withdrawal Ubiquity

How Can I Avoid Paying Taxes On My 401 K Withdrawal Ubiquity

Should I Cash Out My 401k To Pay Off Debt

Should I Cash Out My 401k To Pay Off Debt

Taking A 401k Loan Or Withdrawal What You Should Know Fidelity

Taking A 401k Loan Or Withdrawal What You Should Know Fidelity

Recovering From Covid Withdrawals Retirement Setbacks Fidelity

Recovering From Covid Withdrawals Retirement Setbacks Fidelity

Comments

Post a Comment