Featured

How Much Money Do I Need To Retire At 50

Number of Years Until Retiring. The money needed to retire at 50 60 or 65 therefore depends on two very important factors.

How Much Do I Need To Retire Fidelity

How Much Do I Need To Retire Fidelity

Put in that same 20000 beginning at age 35 and shell only end up with 531000.

How much money do i need to retire at 50. By the time you reach 50 you will have close to 1 million saved for retirement. Exactly how much you need to save depends on a variety of factors. If you wait until 35 to start saving and put that same 20000 away at the same return on investment youll have only about 450000 for your retirement by age 50.

Take the time to do it right. Deciding when to retire is a critical decision. Maximum amount needed to retire at age 50.

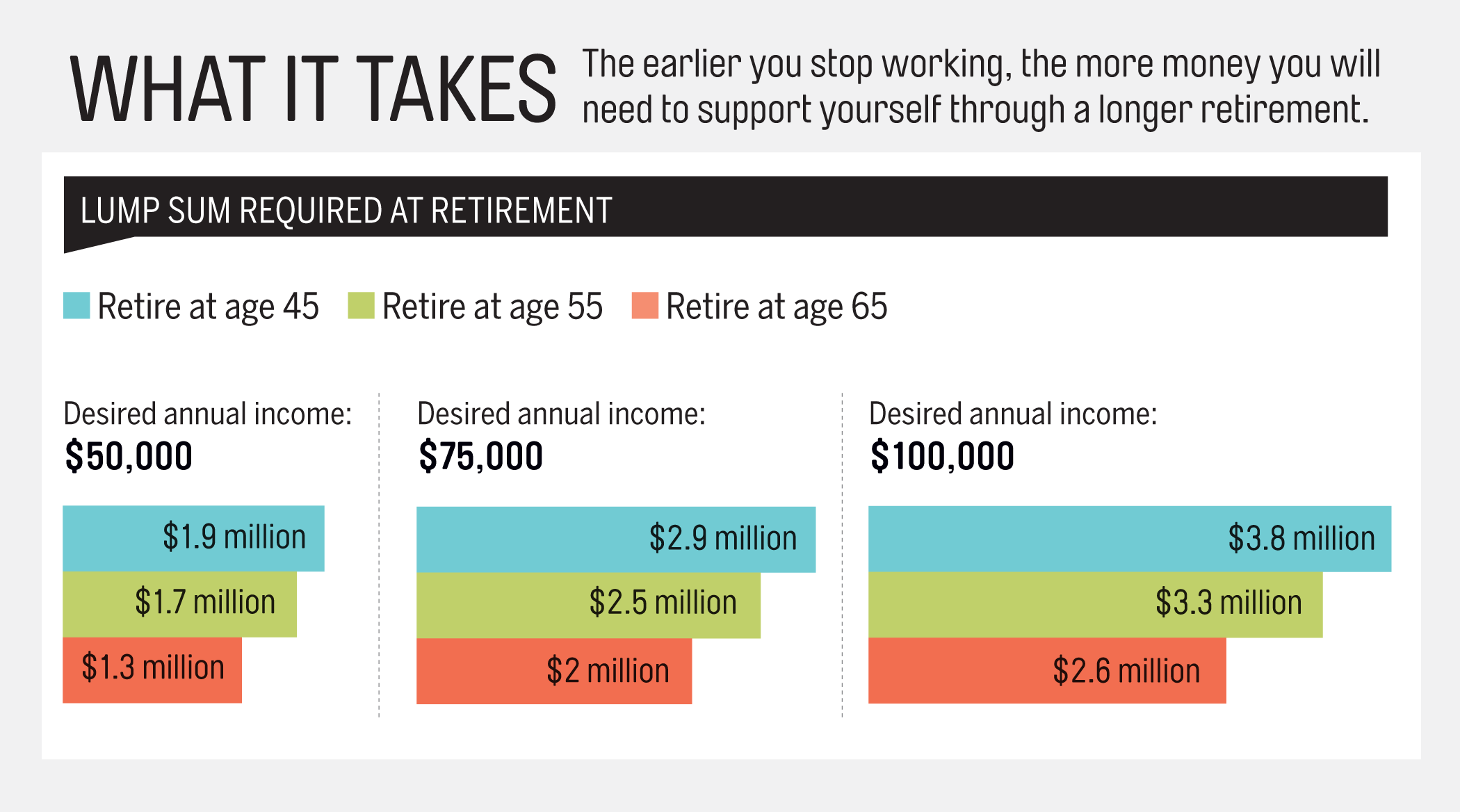

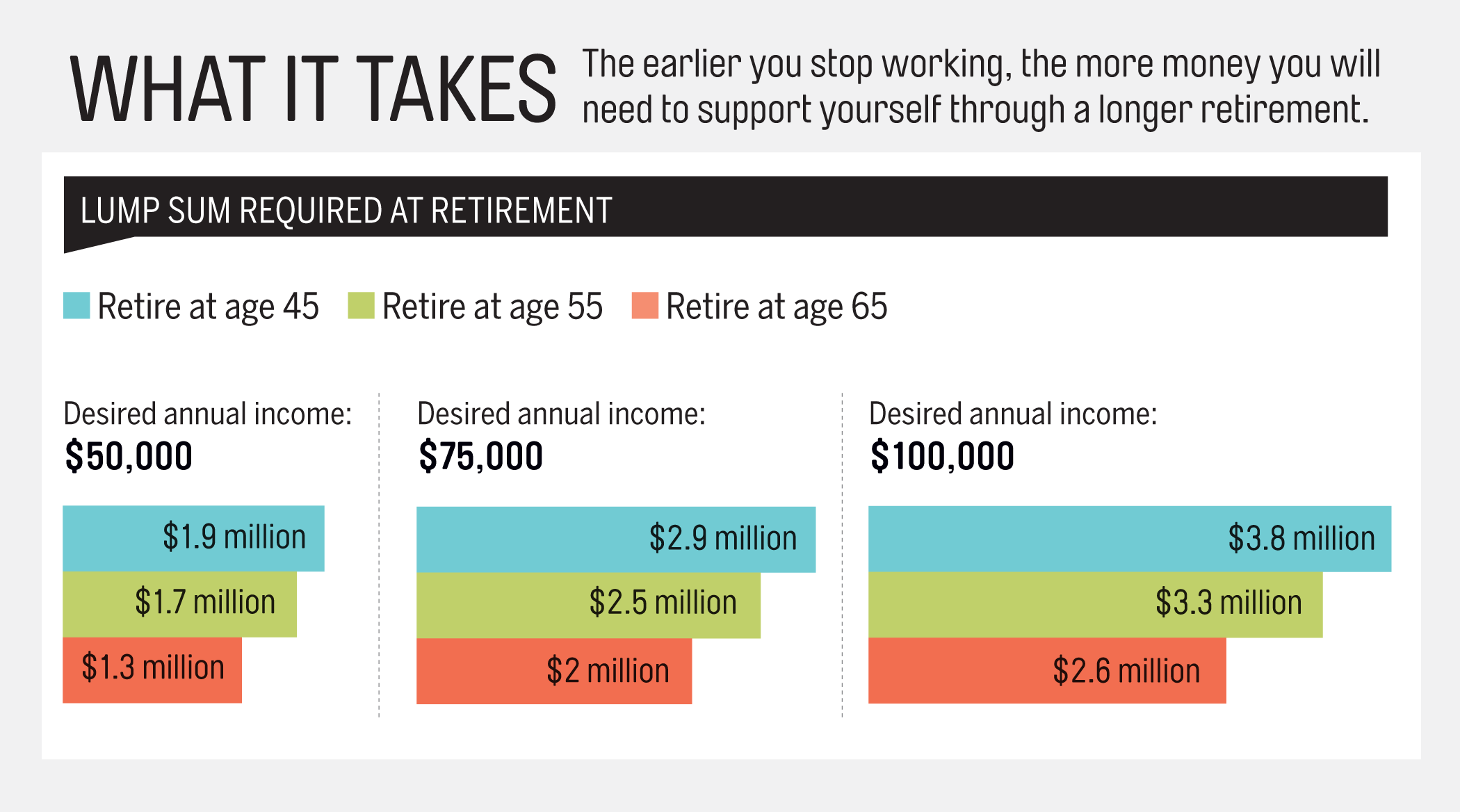

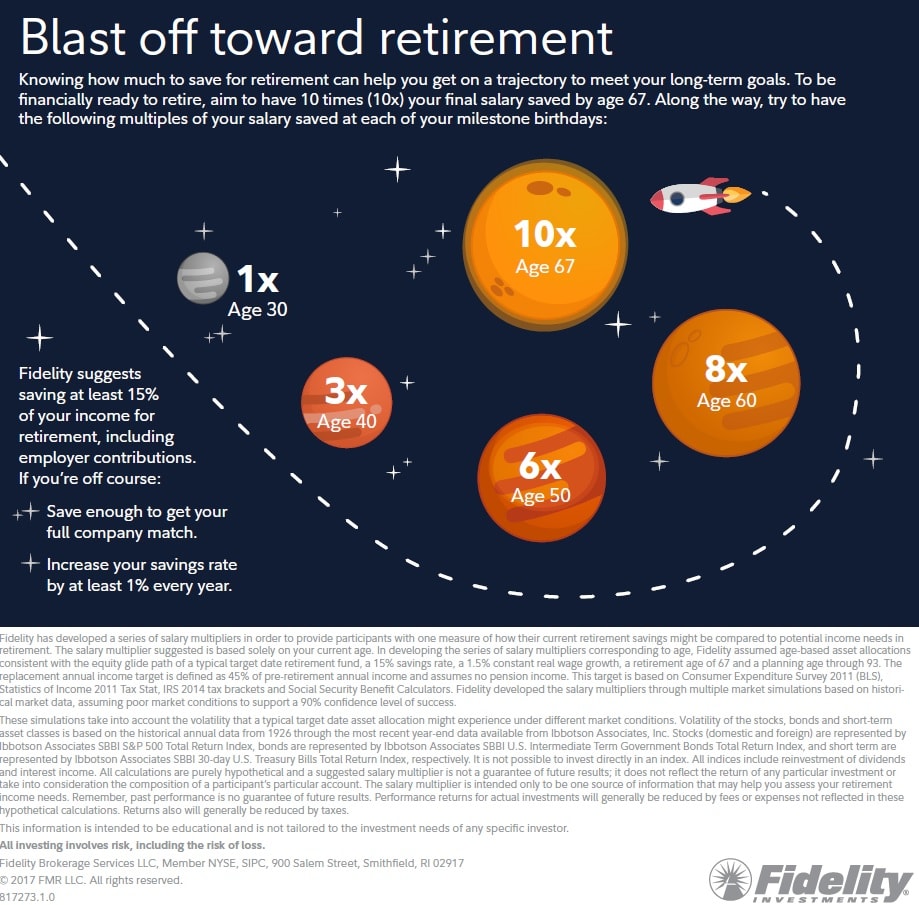

But by 50 you should ideally have around six times your salary saved for retirement according to research from Fidelity. As the table below shows if your goal is to retire on 70000 a year at age 50 youll need 1223026 but if youre happy to wait until youre 67 youll need 854522 almost 370000 less. Theyre on track to have between 560K and 990K when they retire at age 50.

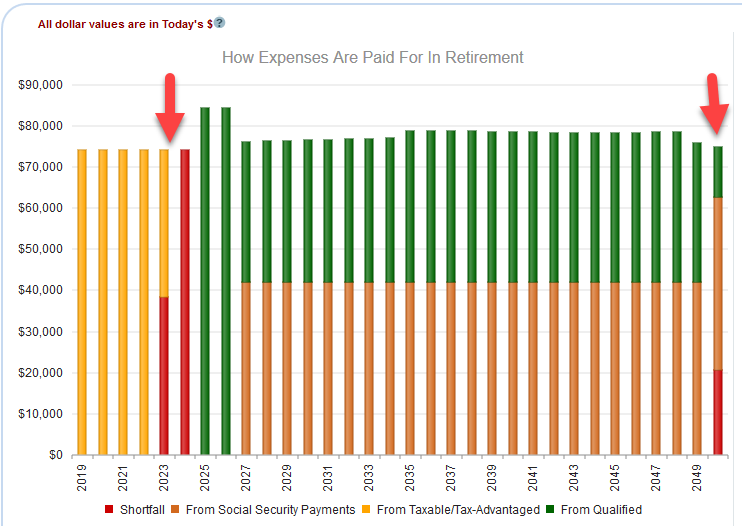

So if you retire at 50 youre going to have to have a lot more saved or. Annual inflation on Required Income. If youre in your late 50s or 60s deciding when and how to retire is one of the most important decisions you.

How much you have saved prior to retirement. If your annual pre-retirement expenses are 50000 for example youd want retirement income of 40000 if you followed the 80 percent rule of thumb. For example health insurance coverage.

Your money grows and the growth earns returns too. So given the assumptions above youd need to save about 25 million dollars to retire at 50 with 95000 per year in income from your retirement savings at 6 for 50 years with 3 inflation. In addition to saving a lot of money there are a few other practical considerations to keep in mind if you want to retire at 50.

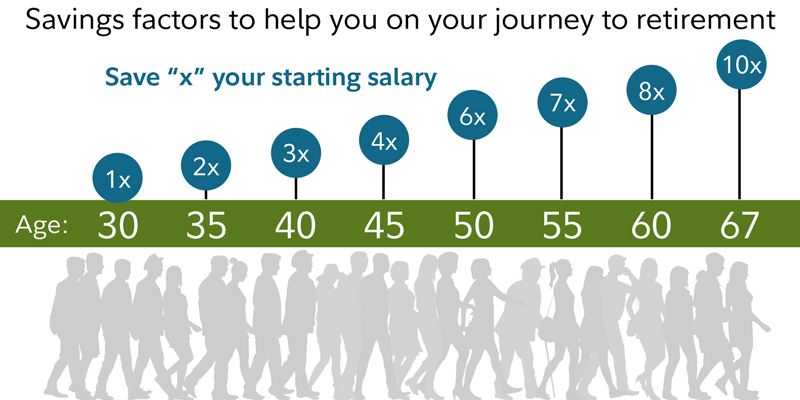

How much money do I need to retire at 50. In fact according to retirement-plan provider Fidelity Investments you should have 6 times your income saved by age 50 in order to leave the workforce at. So lets assume thats.

The second input in calculating how much you need to retire at 50 is your target withdrawal rateAs a rule of thumb retirees can typically withdraw 4 adjusted for. If you and your spouse will collect 2000 a month from Social Security or 24000 a year youd need about 16000 a year from your savings. To retire early at 55 and live on investment income of 100000 a year youd need to have 345 million invested on the day you leave work.

Required Income Future Dollars. Decide WHEN you want to retire. That comes to 46740 a year.

How much that pot will grow and deplete during retirement. Summing it all up then to find out how much money do you need for retirement follow these steps. But their projected retirement needs fall between 700K and 44M.

If you use an even more conservative 3 withdrawal rate you should be able to safely withdraw 46500 from your 1550000 retirement nest egg. Number of Years After Retiring. Annual Yield of Balance.

If they added a lifetime annuity Medicare Supplemental Insurance and long-term care insurance their need could change to 14M. Many financial advisors recommend budgeting to spend at least 70 to 80 percent of your annual pre-retirement income to keep your standard of living. Assuming a hypothetical though historically reasonable 7 annual rate of return on an investment a 25 year-old who manages to put 20000 away every year will end up with almost 138 million by age 50.

In this scenario the maximum that a retiree in 2021 could collect is 3895 per month.

How Much Money Do You Need To Retire At 50

How Much Money Do You Need To Retire At 50

How Much Money Do You Need For 25 Years Of Retired Life

How Much Money Do You Need For 25 Years Of Retired Life

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Does A Doctor Need To Retire White Coat Investor

How Much Money Does A Doctor Need To Retire White Coat Investor

Retirement Plan Early Retirement Moves To Make Now Money

Retirement Plan Early Retirement Moves To Make Now Money

How Much Money You Need To Retire At 55 And Live On Investment Income

Who Can Retire In Their Early 50s With 1 Million Seeking Alpha

Who Can Retire In Their Early 50s With 1 Million Seeking Alpha

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Should You Have Saved For Retirement The Irrelevant Investor

How Much Money Should You Have Saved For Retirement The Irrelevant Investor

How Much Money Do You Need To Retire The Money Ways

This Is How Much Money Employees Need To Retire Eba Employee Benefit News

This Is How Much Money Employees Need To Retire Eba Employee Benefit News

Best Retirement Calculator 2021 See How Much You Ll Need Smartasset

Best Retirement Calculator 2021 See How Much You Ll Need Smartasset

How To Calculate How Much Money You Need To Retire

You May Have All You Really Need To Retire Here S Why The Star

You May Have All You Really Need To Retire Here S Why The Star

Comments

Post a Comment