Featured

How To Hedge Portfolio

SPX 24752225 bear put spread 10 hedge. Technically to hedge requires you to make offsetting trades in securities with negative correlations.

To Hedge Or Not To Hedge Currency Risk In Your Stock Portfolio

To Hedge Or Not To Hedge Currency Risk In Your Stock Portfolio

How Portfolio Hedging Works Portfolio hedging typically entails the use of financial derivatives options and futures to curtail losses.

How to hedge portfolio. Choose A Proxy Exchange-Traded Fund Step 2. Divide your holdings value by the put strike price times 100. For example an investor worried about short-term price swings in ABC stock can hedge their stock portfolio against short-term losses by purchasing the same number of ABC put options.

Hedging strategies should always be combined with other portfolios management techniques like asset class diversification and periodic portfolio rebalancing. They use Exchange-Traded Funds ETFs used alongside your main equity portfolio. Hedging a bond portfolio protects it to some extent from rising interest rates.

So should I hedge my portfolio with index put options. These hedging concepts all have one thing in common. In other words you would have paid 19 of the nominal value of your portfolio and achieved a net hedge of 308 7700250000 all else being equal.

How to Hedge a 1 Million Portfolio Step 1. If we assume our portfolio will almost always slightly outperform the broader market putting on a hedge will limit risk while reducing returns by a less than proportional amount How does this work out. A well-diversified portfolio across different asset classes with low correlation will ensure that one sleeps well at night.

The most direct hedge you could implement would be to buy an investment that offsets 100 of losses in an investment during a specific. And we can hedge our risk as we see fit. If you feel the need to hedge it makes sense to identify and prepare for what you anticipate might occur.

If you want to hedge your entire portfolio that would be considered a hedge ratio of one. LongShort Portfolio Management Longshort equity is typically credited as the original hedge fund. Hedging strategies are used by investors to reduce their exposure to risk in the event that an asset in their portfolio is subject to a sudden price decline.

Put another way investors hedge one investment by making a trade in another. A hedge shields you by increasing in value as your portfolio declines but hedging can be expensive and only partially effective. Round the final number because the answer might include a fractional contract.

Hedging is done to protect the portfolio from the market fallHedging can be done by going Short SELL on the corresponding futures contract of the same und. Return to Portfolio Hedging. The cost of this spread is 8600 218-132 x 1 contract x 100 multiplier excluding commissions or roughly 34 of your portfolio.

For the purposes of hedging your portfolio I would recommend using an inverse index follower such as the Short QQQ PSQ or ProShares Short SP 500 SH. For more detail visit the Chicago Board Options. The Significance of Portfolio Hedging we talk about the inevitability of market downturns and we introduce the concept of portfolio hedging as a way to help mitigate their effectsBut how exactly do you build a hedge.

SP 500 ETF Puts. To do this we might consider buying put options on the broader market ie. Portfolio hedging with index put options in reality requires juggling of basis risk you can only hedge in 100 share units and correlation risk where correlation risk is the risk of hedging on the basis of the betas of the components of your portfolio.

How To Hedge And Protect Your Portfolio From Bear Markets 1. Volatility Targeting One bias that many investors have is that they focus on the return of their portfolio without. Should you only hedge 50 percent of your portfolio against a drop in value that would be considered a hedge ratio of 05.

Pick A Number Of Shares Step 3.

How To Hedge Your Stock Portfolio Barron S

How To Hedge Your Stock Portfolio Barron S

How To Hedge A 0 000 Shares Portfolio Using Cfds Contracts For Difference Com

How To Hedge A 0 000 Shares Portfolio Using Cfds Contracts For Difference Com

Https Www Ft Com Origami Service Image V2 Images Raw Https 3a 2f 2fd6c748xw2pzm8 Cloudfront Net 2fprod 2fbe69f240 1ab1 11eb 94e5 D5238d7057fb Standard Png Fit Scale Down Source Next Width 700

Https Www Ft Com Origami Service Image V2 Images Raw Https 3a 2f 2fd6c748xw2pzm8 Cloudfront Net 2fprod 2fbe69f240 1ab1 11eb 94e5 D5238d7057fb Standard Png Fit Scale Down Source Next Width 700

How To Hedge A Portfolio W Nasdaq 100 Index Options Youtube

How To Hedge A Portfolio W Nasdaq 100 Index Options Youtube

Amazon Com Hedge Your Investment Portfolio How To Hedge Your Investment Portfolio With Diversification Options And Futures Ebook James Keith Kindle Store

Amazon Com Hedge Your Investment Portfolio How To Hedge Your Investment Portfolio With Diversification Options And Futures Ebook James Keith Kindle Store

How To Hedge Your Portfolio Using Derivatives With Suitable Examples

How To Hedge Your Portfolio Using Derivatives With Suitable Examples

Portfolio Hedging Using Index Options Explained Online Option Trading Guide

Portfolio Hedging Using Index Options Explained Online Option Trading Guide

Portfolio Hedging Targeting Risk Not Returns Man Institute Man Group

Portfolio Hedging Targeting Risk Not Returns Man Institute Man Group

Portfolio Hedging 10 Ways To Hedge Your Stock Portfolio Against Risk

Portfolio Hedging 10 Ways To Hedge Your Stock Portfolio Against Risk

How To Hedge An Altcoin Portfolio

How To Hedge An Altcoin Portfolio

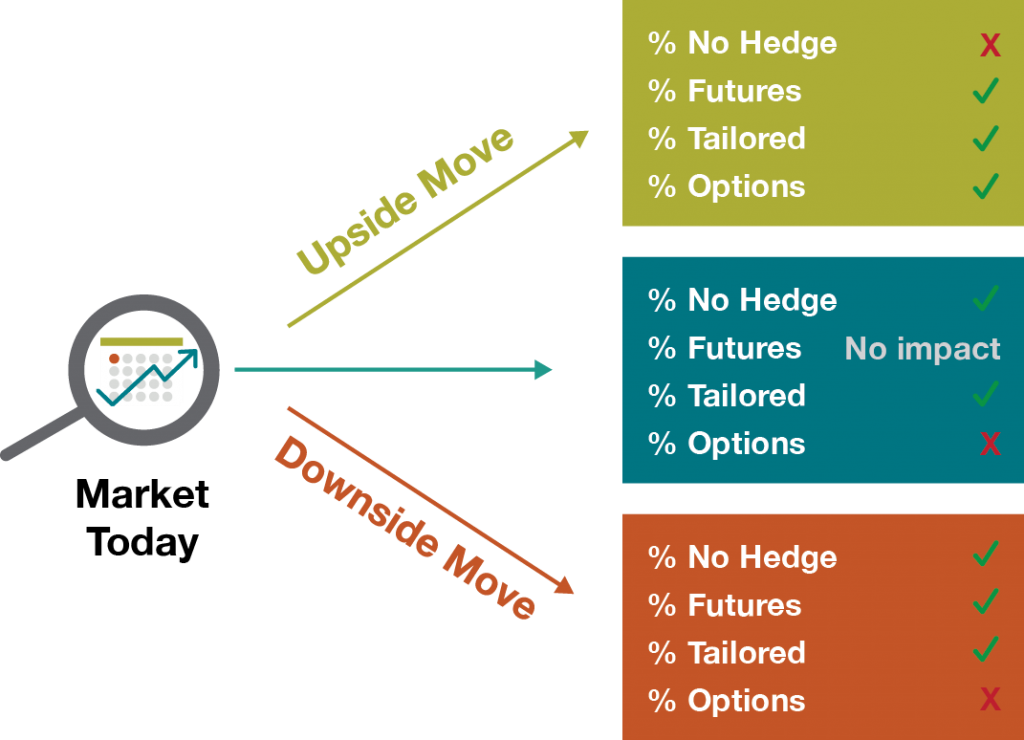

How To Build A Diversified Hedging Portfolio Using A Delta 1 Or 1 Approach Cargill

How To Build A Diversified Hedging Portfolio Using A Delta 1 Or 1 Approach Cargill

Portfolio Hedging 10 Ways To Hedge Your Stock Portfolio Against Risk

Portfolio Hedging 10 Ways To Hedge Your Stock Portfolio Against Risk

Comments

Post a Comment