Featured

- Get link

- X

- Other Apps

Huntington Bank Dividend

The current dividend yield for Huntington Bancshares as of April 05 2021 is 375. Save more with Money Scout.

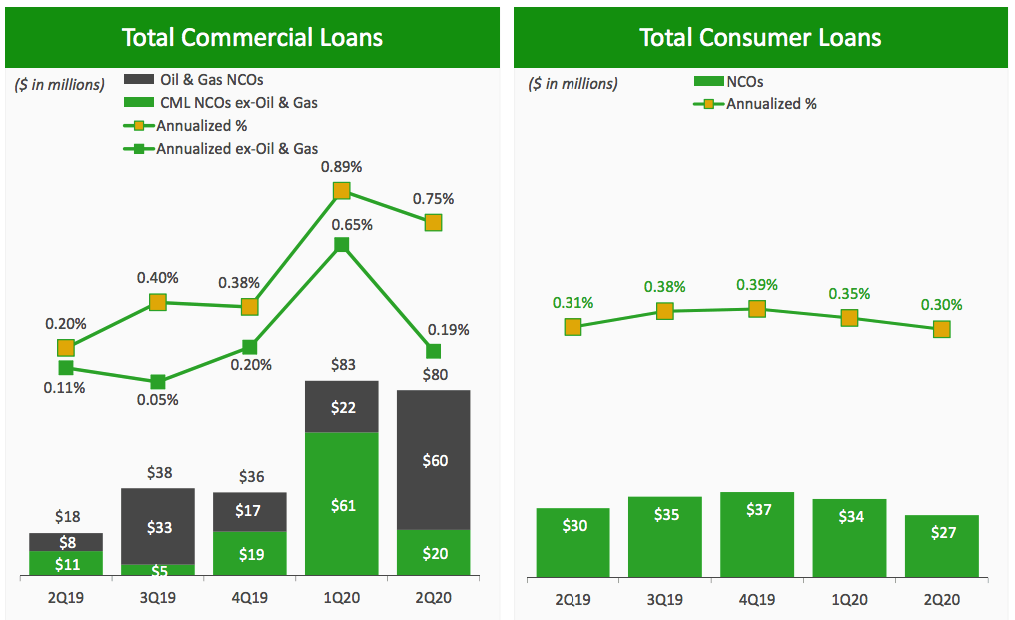

Buy Huntington Bancshares Before It S Too Late Nasdaq Hban Seeking Alpha

Buy Huntington Bancshares Before It S Too Late Nasdaq Hban Seeking Alpha

Voice Credit Card.

Huntington bank dividend. A cash dividend payment of 015 per share is. Huntington Bancshares is a multi-state bank holding company. Huntington Bancshares is a bank holding company.

Through its subsidiaries Co. HBAN dividend history yield payout ratio and stock fundamentals. 23 Zeilen Huntington Bancshares HBAN Declares 015 Quarterly Dividend.

See upcoming ex-dividends and access Dividatas ratings for Huntington Bancshrs Inc. Yield payout growth announce date ex-dividend date payout date and Seeking Alpha Premium dividend score. Historical dividend payout and yield for Huntington Bancshares HBAN since 1992.

HBAN Dividend History Description Huntington Bancshares Inc. The 154-year-old bank has 120 billion in assets with 800 branches in seven Midwestern states. It divides the Forward Annualized Dividend by FY1 EPS.

The amount of revenue Huntington Bancshares Inc earns annually is around 4 billion. COLUMBUS Ohio Oct. Huntington Bancshares Incorporated HBAN dividend summary.

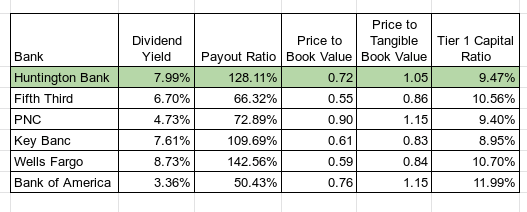

57 Zeilen The previous Huntington Bancshares Inc. Relative to its peers in the mid-sized revenue class it has a dividend yield higher than 917. Its subsidiaries conduct a full-service commercial and consumer bankingbusiness engage in mortgage banking lease financing trust services discount brokerage services underwriting credit life and disability insurance selling other insurance products and issuing commercial.

LTM stands for Last Twelve Months and implies that the calculation uses the dividends paid over the last twelve months. Rating as of Apr 26 2021. In the past ten years Huntington Bancshares has increased its dividend at approximately 31 a year on average.

Fwd Payout Ratio is used to examine if a companys earnings can support the current dividend payment amount. H untington Bancshares Incorporated HBAN will begin trading ex-dividend on September 16 2020. 8 Zeilen Huntington Bancshares pays an annual dividend of 060 per share with a dividend yield of.

Quote Stock Analysis News Price vs Fair Value Trailing Returns Financials Valuation Operating Performance Dividends. Money Scout analyzes your spending income and upcoming expenses to find money youre not using in your checking accountfrom 5 to 50then moves it to your savings automatically. Some interesting points we thought investors may wish to consider regarding the dividend discount model forecast for Huntington Bancshares Inc are.

Its exciting to see that both earnings and dividends per share have grown rapidly. It currently pays a 015 per share quarterly dividend which comes out to a 5 yield. Dividend was 15c and it went ex 1 month ago.

The bank has raised its dividend every year since 2011. Huntington Bancshares is the holding company for Columbus Ohio-based Huntington Bank. Provides commercial small business consumer banking services mortgage banking services automobile financing recreational vehicle and marine financing equipment leasing investment management trust.

You choose 3X rewards in one of ten spending categories or a 2 lower rate. Growing Net Interest. The current TTM dividend payout for Huntington Bancshares HBAN as of April 05 2021 is 060.

Current Dividend Yield Calculator Huntington.

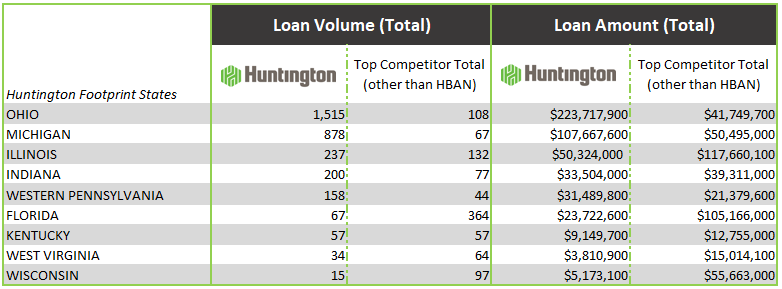

Huntington Bank Takes Top Spot Nationally For Sba 7 A Loan Origination By Volume For Third Consecutive Year

Huntington Bank Takes Top Spot Nationally For Sba 7 A Loan Origination By Volume For Third Consecutive Year

Huntington Bancshares Inc Hban Dividends

Huntington Bancshares Inc Hban Dividends

Huntington Bancshares Incorporated Declares Quarterly Cash Dividends On Its Common And Preferred Stocks

Huntington Bancshares Incorporated Declares Quarterly Cash Dividends On Its Common And Preferred Stocks

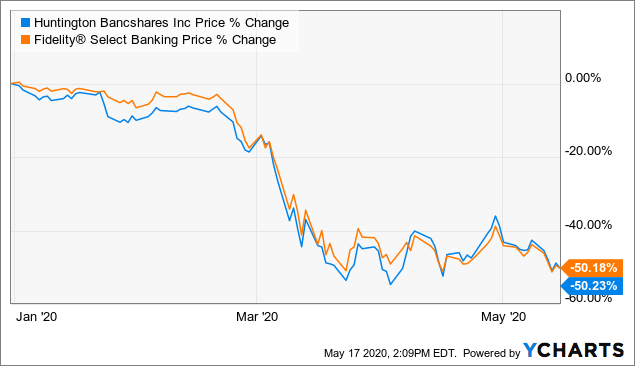

Huntington Bancshares A Solid Midwestern Regional Bank Nasdaq Hban Seeking Alpha

Huntington Bancshares A Solid Midwestern Regional Bank Nasdaq Hban Seeking Alpha

Huntington Bancshares A Solid Dividend Investment Nasdaq Hban Seeking Alpha

Huntington Bancshares A Solid Dividend Investment Nasdaq Hban Seeking Alpha

Huntington Bancshares A Solid Dividend Investment Nasdaq Hban Seeking Alpha

Huntington Bancshares A Solid Dividend Investment Nasdaq Hban Seeking Alpha

Huntington Bancshares Taking Steps To Raise Dividend Bank S Third Quarter Earnings Top Estimates Pittsburgh Business Times

Huntington Bancshares Taking Steps To Raise Dividend Bank S Third Quarter Earnings Top Estimates Pittsburgh Business Times

3 Reasons To Buy This Small Bank With A Big Dividend The Motley Fool

3 Reasons To Buy This Small Bank With A Big Dividend The Motley Fool

Huntington Bancshares Hban Shares Cross 7 Yield Mark Nasdaq

Huntington Bancshares Hban Shares Cross 7 Yield Mark Nasdaq

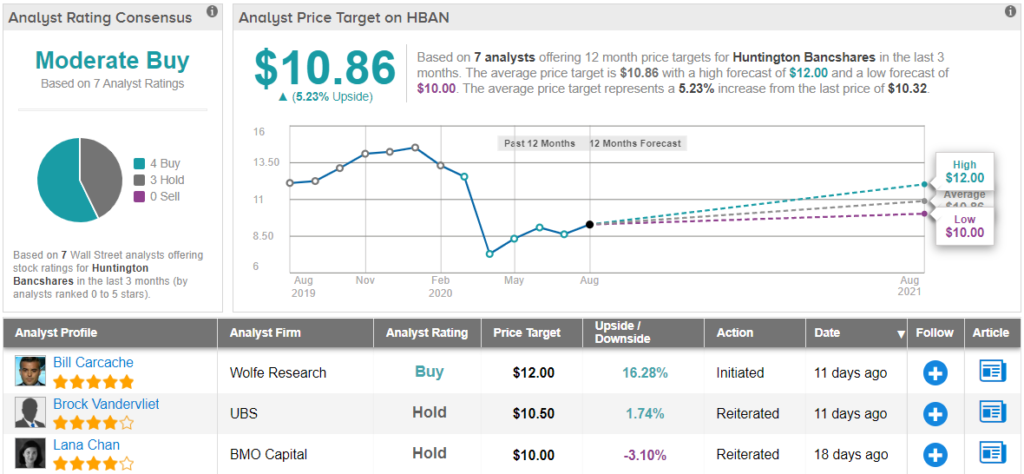

3 Under The Radar Dividend Stocks Yielding Over 5 Wolfe Says Buy Nasdaq

3 Under The Radar Dividend Stocks Yielding Over 5 Wolfe Says Buy Nasdaq

Huntington Bancshares Dividend Safety

Huntington Bancshares Dividend Safety

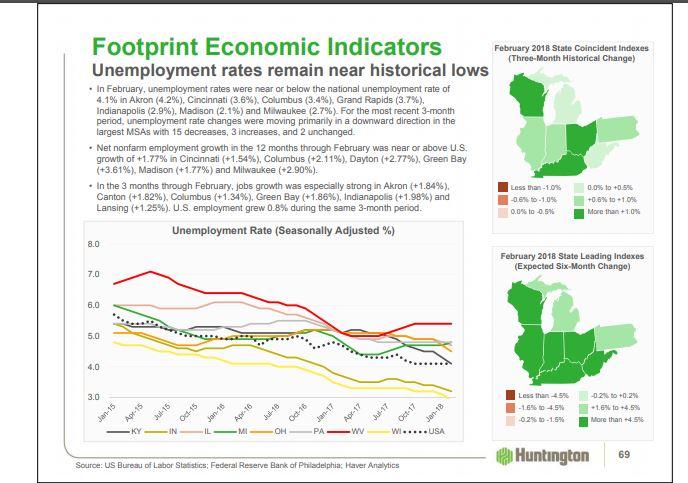

Huntington Bancshares A Solid Midwestern Regional Bank Nasdaq Hban Seeking Alpha

Huntington Bancshares A Solid Midwestern Regional Bank Nasdaq Hban Seeking Alpha

Comments

Post a Comment