Featured

- Get link

- X

- Other Apps

Federal Tax Contributions By State

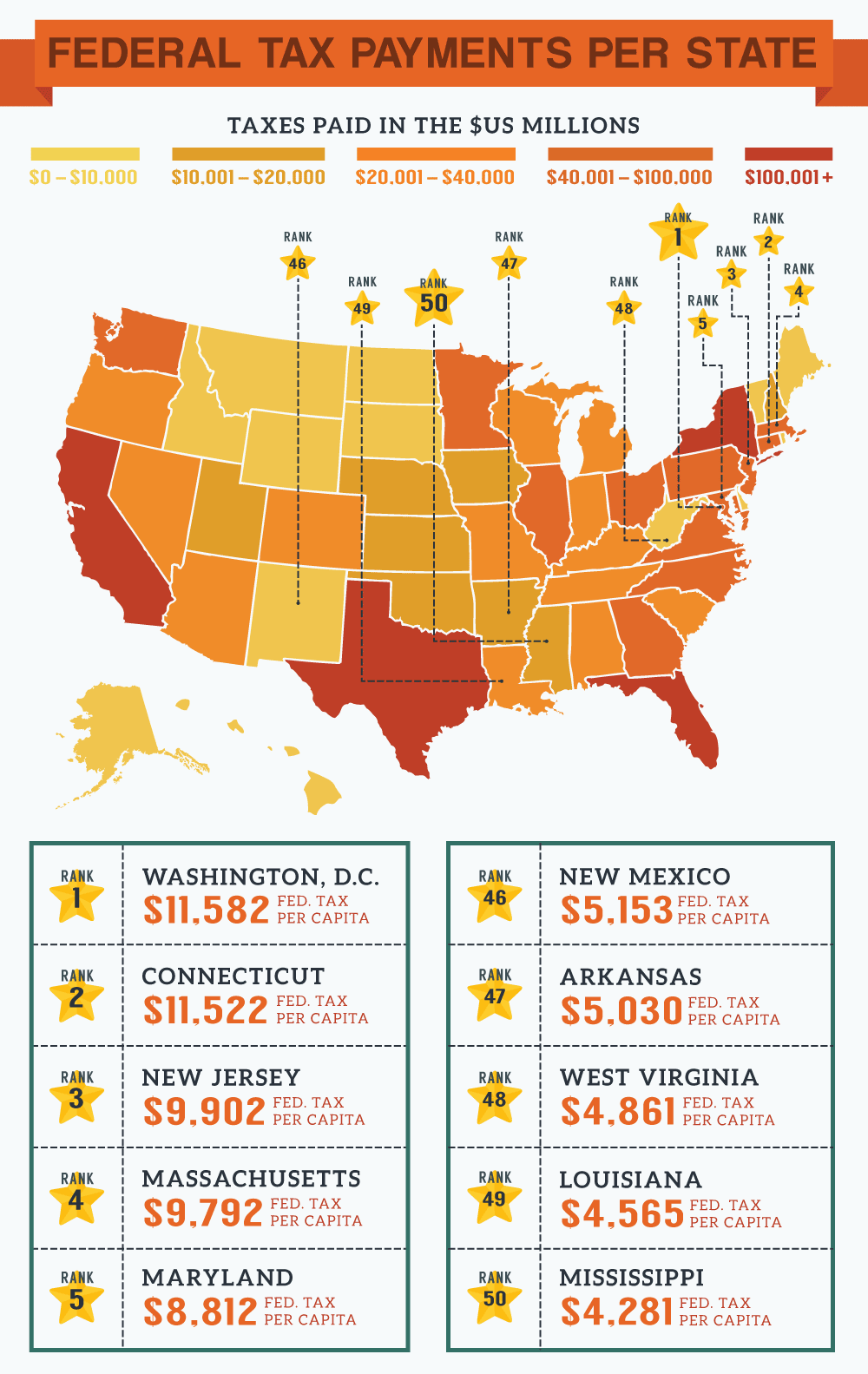

In contrast the top 1 percent of all taxpayers taxpayers with AGI of 515371 and above earned 210 percent of all AGI in 2017 and paid 385 percent of all federal income taxes. Connecticut contributed 15462 in federal taxes per capita and only got 11462 per person from the federal government making it the state with the biggest net negative gap between federal taxes and federal spending.

Which Us States Get More Than They Give Voice Of America English

Which Us States Get More Than They Give Voice Of America English

For example in the initial 150 billion given to states from the stimulus package which was allocated by population New York got less than 24000 per positive case while Alaska received over 33 million.

Federal tax contributions by state. The states for which federal aid made up the smallest share of state general revenue were Hawaii 207 percent Virginia 211 percent Kansas 233 percent Utah 242 percent and Minnesota 260 percent. The few states where this isnt the case include Connecticut New Jersey and Massachusetts. 51 Zeilen These states have paid to the federal government in taxes more than they receive back in.

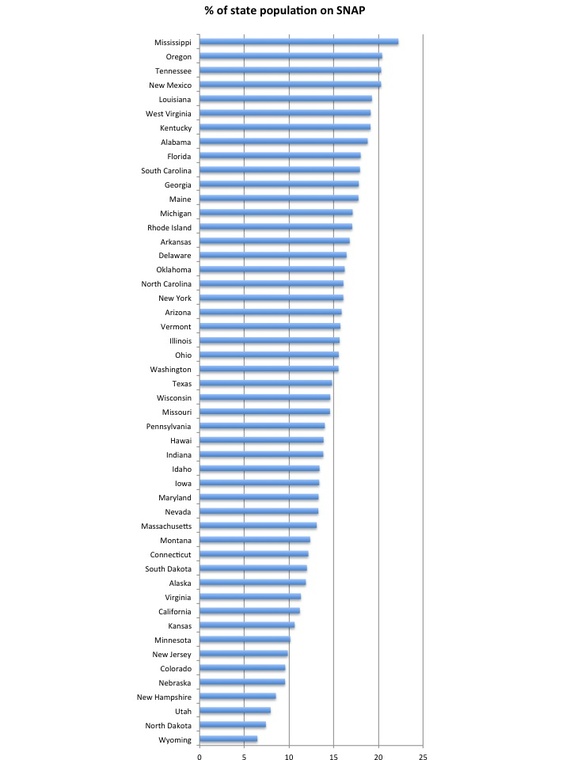

Californias progressive tax system has the highest top tax rate of 133 which applies to singles with taxable incomes over 1 million and married couples with incomes over 1181484. States that rely heavily on federal grants-in-aid tend to have sizable low-income populations and relatively lower tax revenues. Virginia Kentucky and New Mexico top the charts as the top three getting the most money back.

Read more at HowMuch. The remaining 42 states received more than they contributed with. In California each resident is sending in 348 more than they get back.

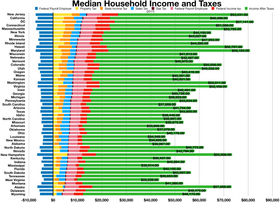

The states that keep the government solvent are the ones where taxpayers contribute more. Marginal tax rates range from 10 to 37. While most states use a marginal bracketed income tax system similar to the federal income tax every state has a completely unique income tax code.

The majority of states. Choose any state from the list above for detailed state income tax information including 2021 income tax tables state tax deductions and state-specific income tax calculators. Over the past four years New York contributed 1162 billion more to the federal government than it got back in federal spending.

If you look only at the first measurehow much the federal government spends per person in each state compared with the amount its citizens pay in federal income taxesother states stand out. The federal income tax system is progressive so the rate of taxation increases as income increases. Income in America is taxed by the federal government most state governments and many local governments.

FEDERAL TAXES PAID BY STATE. Federal assistance to states has come into the spotlight recently during the coronavirus pandemic where some states have received far more money per case than others. Not surprisingly nine of the top ten states in federal taxes paid per capita are on the net payers list with Connecticut leading the way at 16052.

Enter your financial details to calculate your taxes. For example in Virginia people on average contribute 10571 in federal tax revenue but benefit from 20872 in federal outlays. In Iowa each resident is receiving 797 more back in federal services than they paid in taxes.

A taxpayer who itemizes deductions must reduce the 1000 federal charitable contribution deduction by the 700 state tax credit leaving a federal charitable contribution deduction of 300. This group of taxpayers paid 498 billion in taxes or roughly 3 percent of all federal individual income taxes in 2017. FEDERAL TAXES PAID BY STATE in thousands 1.

New Mexico is on top of the net taker states with a per capita surplus of 9693. For example if a state grants a 70 percent state tax credit pursuant to a state tax credit program and an itemizing taxpayer contributes 1000 pursuant to that program the taxpayer receives a 700 state tax credit. States are not equal when it comes to how much tax revenue they send to the federal government.

Many state pages also provide direct links to selected income tax.

Federal Tax Revenue By State Wikipedia

Federal Tax Revenue By State Wikipedia

United States Federal Tax Dollars Creditloan Com

United States Federal Tax Dollars Creditloan Com

Which States Are Givers And Which Are Takers The Atlantic

Is Your State A Net Payer Or A Net Taker Moneytips

Is Your State A Net Payer Or A Net Taker Moneytips

Federal Tax Revenue By State Wikipedia

Federal Tax Revenue By State Wikipedia

Federal Tax Revenue By State Wikipedia

Federal Tax Revenue By State Wikipedia

Federal Tax Burden Per Person By State

Which States Are Givers And Which Are Takers The Atlantic

Which States Are Givers And Which Are Takers The Atlantic

Which States Pay The Most Federal Taxes Moneyrates

Which States Pay The Most Federal Taxes Moneyrates

Corporate Tax Contributions To The States Mahmoud Associates

Which States Rely The Most On Federal Aid Tax Foundation

Which States Rely The Most On Federal Aid Tax Foundation

The Red And The Black The Economist

Federal Insurance Contributions Act Tax Wikipedia

Federal Insurance Contributions Act Tax Wikipedia

Federal Tax Reform The Impact On States Tax Foundation

Federal Tax Reform The Impact On States Tax Foundation

Comments

Post a Comment