Featured

Tax On 10000

An individual who receives 923500 net salary after taxes is paid 1000000 salary per year after deducting State Tax Federal Tax Medicare and Social Security. You now have a 10000 capital gain 20000 10000 10000.

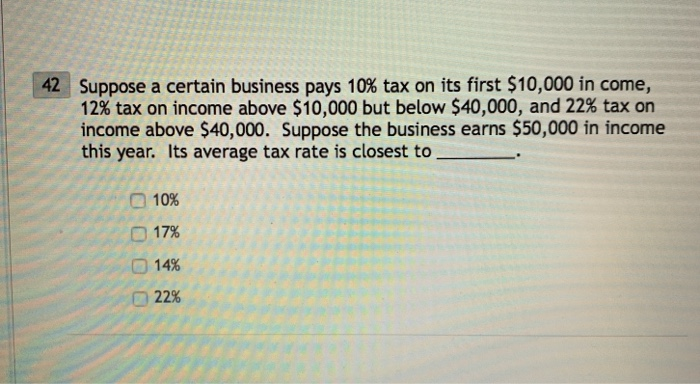

Solved Suppose A Certain Business Pays 10 Tax On Its Fir Chegg Com

Solved Suppose A Certain Business Pays 10 Tax On Its Fir Chegg Com

You kiss some of the deduction goodbye under the tax laws that went into effect for 2018 and beyond.

Tax on 10000. Single mom earns 10000month on. If unemployment benefits put you in a hole on your 2020 tax return. Of course those numbers add up to more than 10000.

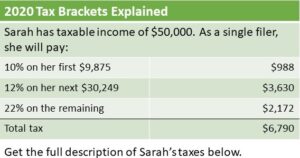

If you withdraw 10000 from your 401k over the course of the year you will only pay income taxes on that 10000. Lets look at how to calculate the payroll deductions in the US. Based on the rates in the table above a single filer with an income of 50000 would have a top marginal tax rate of 22.

Filing 1000000 of earnings will result in 5341 of your earnings being taxed as state tax calculation based on 2020 California State Tax Tables. Alberta Provincial Tax Calculation 2021. It is possible to withdraw your entire account in one lump sum though this will likely push you into a higher tax bracket for the year so.

Let Tax10000 provide assistance to resolve your tax liability delinquent tax problems tax disputes and IRS back taxes. But only the portion of your income that exceeds 518400 will be taxed at 37. The latest updates to the 19 trillion coronavirus package could save millions of people from a surprise tax bill.

This results in roughly 818 of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on. Calls to end the 10000 cap on state and local tax deductions are growing from lawmakers. This typically equates to your tax bracket.

Table shows the change in the distribution of federal taxes by expanded cash income level from repealing the 10000 limit on deductible state and local taxes. That may threaten President Joe Bidens new tax plan before its. If youre single and your income is 65000 for 2018 you are in the 15 percent capital gains tax bracket.

However that taxpayer would not pay that rate on all 50000. Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. Earning Bracket Tax Rate x Taxable Earnings This Bracket Tax Due.

The Tax Cuts and Jobs Act imposed a 10000 limit on the SALT deduction so regardless of how much you actually pay in state and local taxes youre only allowed to deduct a maximum of 10000 of. What is the tax on. Our tax specialists are exceptional at dealing with the IRS we can help reducing tax liabilities eliminating tax disputes negotiating IRS payments and providing ethical tax representation and tax.

Your marginal tax rate is the highest 37 because 518401 is the lowest threshold amount for that tax bracket which is the final one your income falls into. Cumulative Growth of a 10000 Investment in Stock Advisor Calculated by Time-Weighted Return. That amount is in addition to the tax on your ordinary income.

Butthe tax law says you cannot deduct more than 10000 for your state and local taxes and real estate taxes. For example if youre a. The rate on the first 9875 of taxable income would be 10 then 12 on the next 30250 then 22 on the final 9875 falling in the third bracket.

1000000 100000. Our nation-wide team of tax attorneys and enrolled agents is here 247 to help you resolve your tax debt. 26 rows 1 You buy a item on Ebay for 10000 dollars and pay 75 percent in tax.

In this example that means you pay 1500 in capital gains tax 10000 X 15 percent 1500.

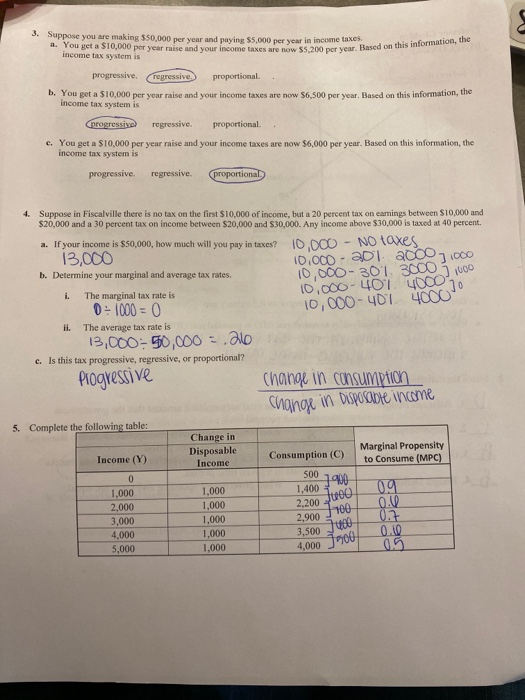

Solved 3 Suppose You Are Making 50 000 Per Year And Pay Chegg Com

Solved 3 Suppose You Are Making 50 000 Per Year And Pay Chegg Com

Tax 10000 A Referral Service Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Tax 10000 A Referral Service Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

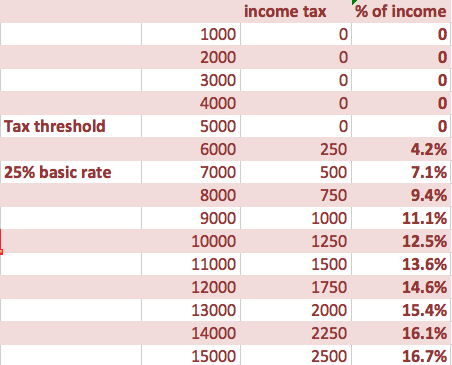

Progressive Tax Economics Help

Progressive Tax Economics Help

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

What Are The Tax Brackets H R Block

What Are The Tax Brackets H R Block

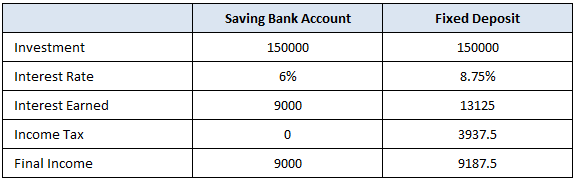

Rs 10 000 Income Tax Exemption On Saving Bank Interest Sec 80tta

Rs 10 000 Income Tax Exemption On Saving Bank Interest Sec 80tta

Progressive Tax Economics Help

Progressive Tax Economics Help

Solved Daniel Patrick Moynihan The Late Senator

Solved Daniel Patrick Moynihan The Late Senator

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Tax Post It Stick On 10000 Yen Banknote Canstock

Tax Post It Stick On 10000 Yen Banknote Canstock

How Much Tax Do You Pay On A 10 000 Lottery Ticket Lotto Library

How Much Tax Do You Pay On A 10 000 Lottery Ticket Lotto Library

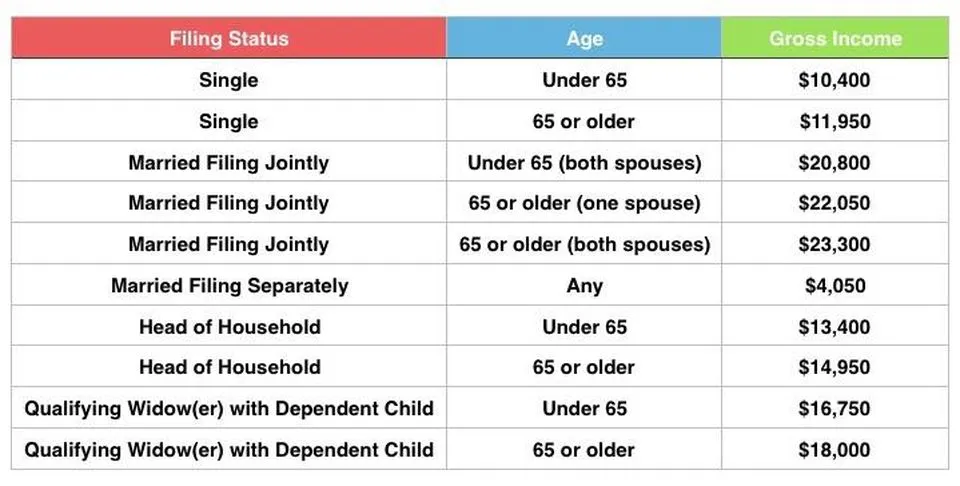

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

Hurry Up File Your Income Tax Return On Given Date From Most Trusted Company Akt Associates Avoid To Pay Late Fees Penalty Upto 10 000 Incometax

Hurry Up File Your Income Tax Return On Given Date From Most Trusted Company Akt Associates Avoid To Pay Late Fees Penalty Upto 10 000 Incometax

State Sales Tax Jurisdictions Approach 10 000 Tax Foundation

State Sales Tax Jurisdictions Approach 10 000 Tax Foundation

Comments

Post a Comment