Featured

- Get link

- X

- Other Apps

Employer Unemployment Insurance

The Department of Unemployment Assistance DUA manages the UI program. Employers play an important role in providing unemployment insurance UI benefits to workers.

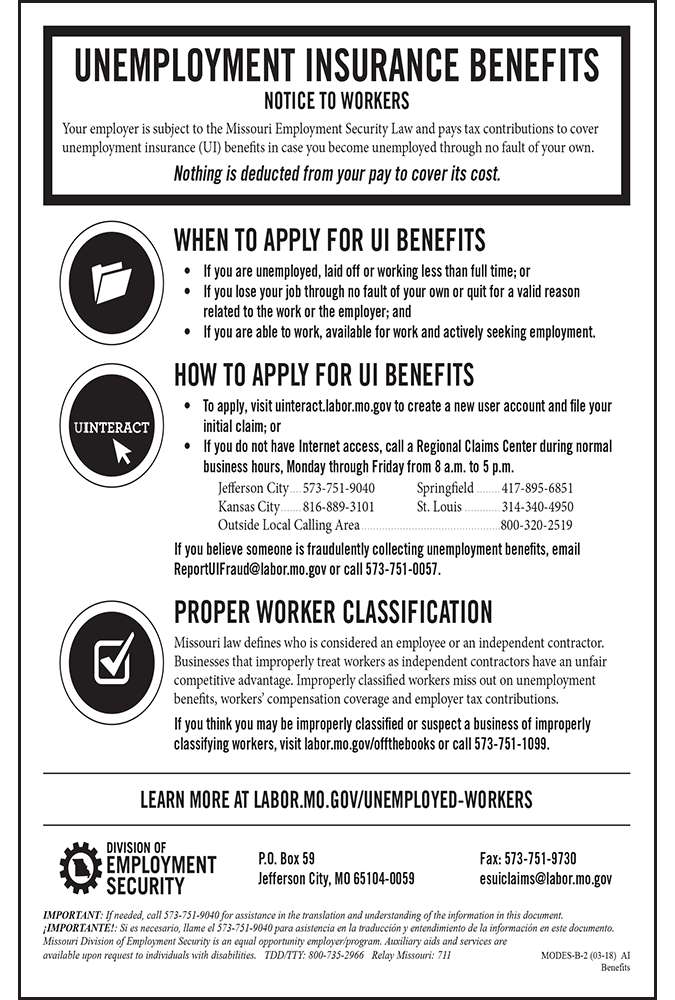

Missouri S Unemployment Insurance Posting Gets New Look Compliance Poster Company

Missouri S Unemployment Insurance Posting Gets New Look Compliance Poster Company

Find out how to file and prepare for an appeal.

Employer unemployment insurance. Welcome to the Maryland Division of Unemployment Insurance BEACON Application. Worker Adjustment and Retraining Notification WARN Information for Employers. Employers Employer Filed Claims Employer Portal Recruitment Services Taxes Unemployment Insurance Claims Specialized Services for Employers Child Labor FAQs for Employers Online Services Forms and Publications Select Programs.

Unemployment insurance effectively provides payments to workers who have been let go due to a factor out of their control usually when they have been laid off lost seasonal work or have been furloughed. The UI Bureau of Tax and Accounting collects controls and accounts for flow of funds into and out of the UI program. Employers finance the Unemployment Insurance UI program by making tax contributions.

UI benefits offer workers temporary income while theyre out of work or working reduced hours. View your Unemployment Insurance Employer Information Page. File a NYS 45 Quarterly Combined Withholding Wage Reporting and Unemployment Insurance Return.

Find tools to help manage your unemployment benefits claims. Employees do not pay unemployment taxes and employers cannot deduct unemployment taxes from employees paychecks. The Unemployment Insurance Divisions mission is to provide economic stability to Wisconsin communities employers and employees through innovative efficient services which facilitate connecting job seekers with jobs.

The Department of Labor issued a directive to remind employers of their obligation to provide information to employees to help them promptly complete the unemployment insurance benefits application. Unemployment for Employers Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by the United States Department of Labor USDOL and one administered by the State Workforce Agency which in Indiana is the Department of Workforce Development DWD. They also serve as a resource for unemployed workers seeking UI benefits.

TWC will request job separation and past wage information related to individuals unemployment claims. Our goal is to provide information and assistance to help you build a quality workforce and to help your business grow. If so you will need to pay Oklahoma unemployment insurance UI contributions.

Only three statesAlaska New Jersey and Pennsylvaniaassess unemployment taxes on employees and its a small portion of the overall cost. Important Notice to NYS Employers. You can respond online to unemployment notices and requests for wage verification.

In most states laid-off workers can receive 26 weeks of unemployment benefits and will receive a set percentage of their average annual pay. You will answer a series of questions about the ownership of the business and the number of locations operated. Employment Services for Senior Texans Provides information about special employment services for senior Texans who are 55 and older.

Employers pay unemployment insurance taxes and reimbursements which support unemployment benefit payments. For more information on layoff alternatives preventing fraud and more review the following resources. These contributions fund unemployment compensation programs for eligible employees in the state.

Apply for Shared Work - see the information below. Mass Layoffs. Employers fund the UI program.

Our vision is to provide information and services as rapidly as possible and to be proactive in promoting workforce development so that you. Unemployment is almost entirely funded by employers. If you are an existing employer accessing BEACON for the first time you will need to first activate your account.

Unemployment Claim Management Appeals. Employers must register with the Texas Workforce Commission TWC within 10 days of becoming subject to the Texas Unemployment Compensation ActTWC provides this quick free online service to make registering as easy as possible. Unemployment Insurance Information for Employers.

During the 2nd 3rd and 4th quarters of 2020 all eligible nonprofit reimbursing employers will only be billed for 50 of the unemployment benefits charged to their account with the. Unemployment is funded and taxed at both the federal and state level. Unemployment for Employers Does your business have employees in Oklahoma.

Learn more about contesting a chargeback and your rights and responsibilities for unemployment issues. Enroll in SIDES E-Response to respond electronically to requests for unemployment insurance information. Use this detailed guide to improve unemployment claims management and find the best approach to reduce unemployment insurance costs.

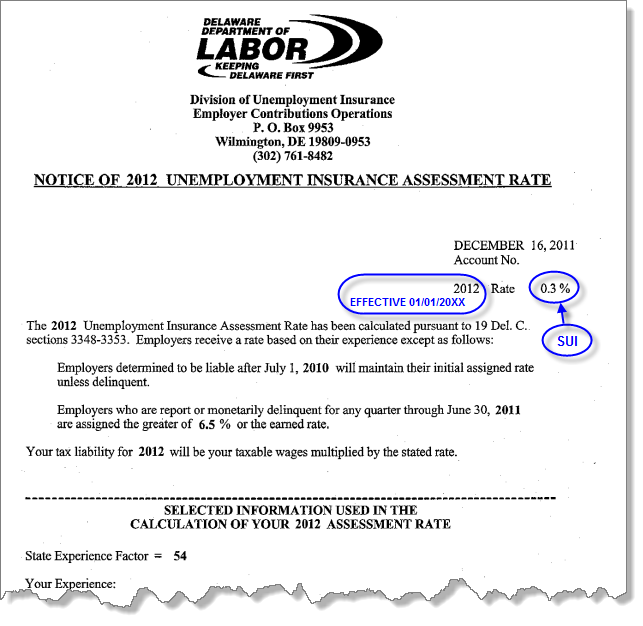

This is usually based on the number of employees how much has already been paid into the unemployment insurance system and the number of former employees that have claimed unemployment benefits. Use the employer online services portal to. Web Accessibility Mode for Visually Impaired.

The Virginia Employment Commission offers many programs and services for employers. If you are a new employer and need to set up your account you will need to start by registering your account. First it helps to understand how unemployment insurance is financed.

Reimbursing Employers - The Office of Unemployment Insurance has elected to participate in the 50 liability relief from the Protecting Nonprofits from Catastrophic Cash Flow Strain Act of 2020.

How Do I Find My Colorado Ui Rate Asap Help Center

How Do I Find My Colorado Ui Rate Asap Help Center

Benefit Rights Information For Claimants And Employers Unemployment Insurance

Benefit Rights Information For Claimants And Employers Unemployment Insurance

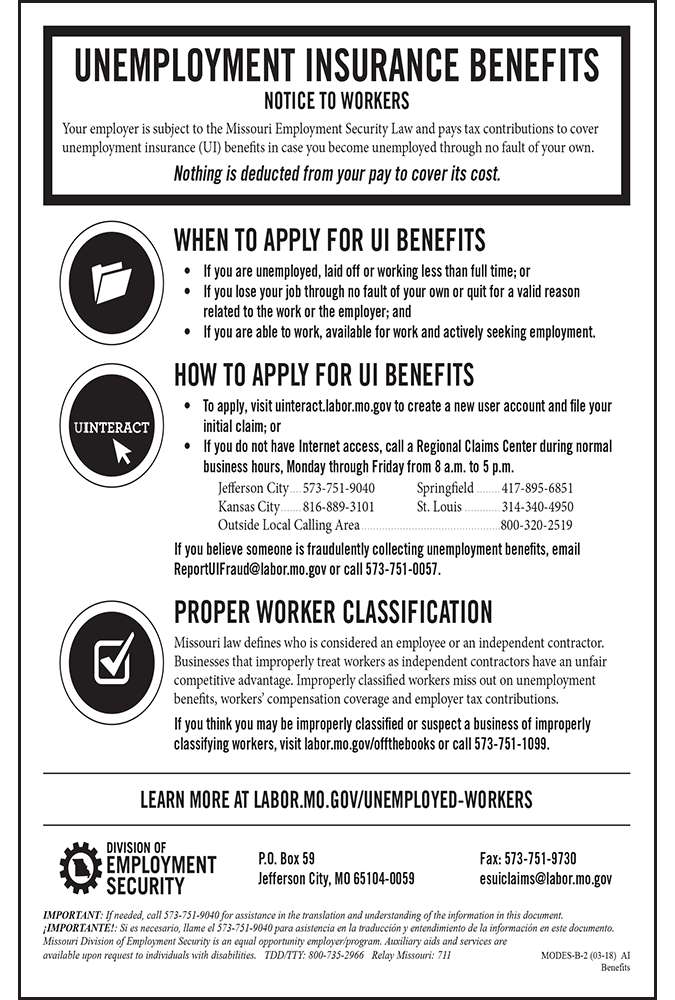

State Of Hawaii Unemployment Insurance What Employers Need To Know Hawaii Payroll Services Llc

State Of Hawaii Unemployment Insurance What Employers Need To Know Hawaii Payroll Services Llc

What To Do When A Former Employee Files An Unemployment Claim The Fitness Cpa

What To Do When A Former Employee Files An Unemployment Claim The Fitness Cpa

Employer Unemployment Insurance Information Department Of Labor

Employer Unemployment Insurance Information Department Of Labor

Washington State Covid 19 Emergency Rules That Allow For Expanded Access To Unemployment Insurance Ufcw 21

Washington State Covid 19 Emergency Rules That Allow For Expanded Access To Unemployment Insurance Ufcw 21

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes

Https Www Michigan Gov Documents Uia Miwam Toolkit For Employers 473402 7 Pdf

Https Www Michigan Gov Documents Uia Miwam Toolkit For Employers 473402 7 Pdf

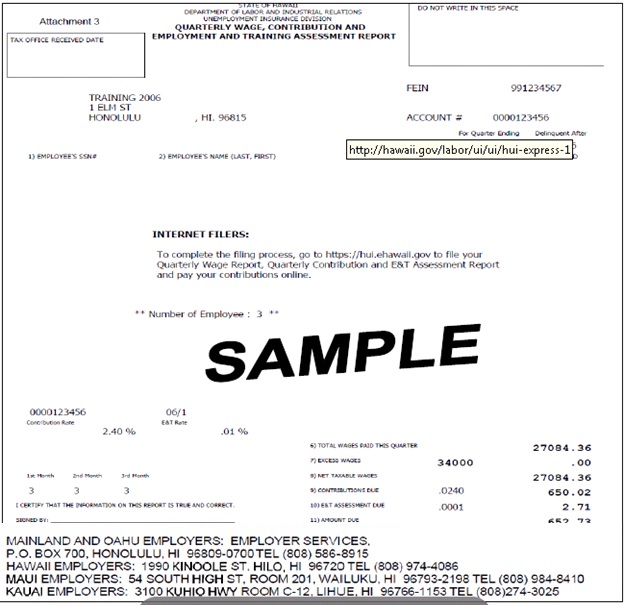

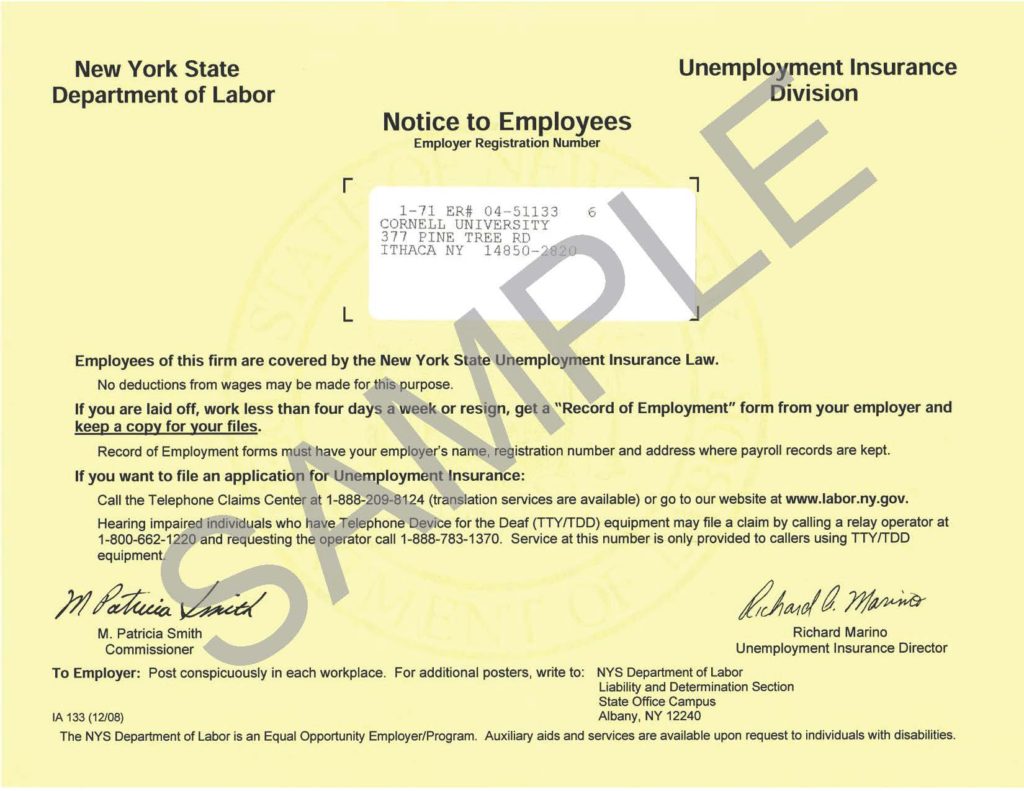

Furloughed Employees Need The Nys Record Of Employment Form From Employers Payroll Companies To Claim Unemployment Benefits Deb Best Practices Nys Certified Wbe

Furloughed Employees Need The Nys Record Of Employment Form From Employers Payroll Companies To Claim Unemployment Benefits Deb Best Practices Nys Certified Wbe

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

How Does Unemployment Work For Employers Handling Claims

How Does Unemployment Work For Employers Handling Claims

Comments

Post a Comment