Featured

Eic Tax Credit

You can only qualify for the EITC if you earned income during the year. In 2019 25 million taxpayers received about 63 billion in earned income credits.

Are You One Of The 380 000 Taxpayers Missing Out On Billions In Tax Credits

Are You One Of The 380 000 Taxpayers Missing Out On Billions In Tax Credits

1040 TAX AND EARNED INCOME CREDIT TABLES - Main Contents.

Eic tax credit. The Earned Income Credit EIC otherwise known as Earned Income Tax Credit EITC is a valuable credit for low-income taxpayers who work and earn an income of a certain amount. You may claim the EITC if your income is low- to moderate. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

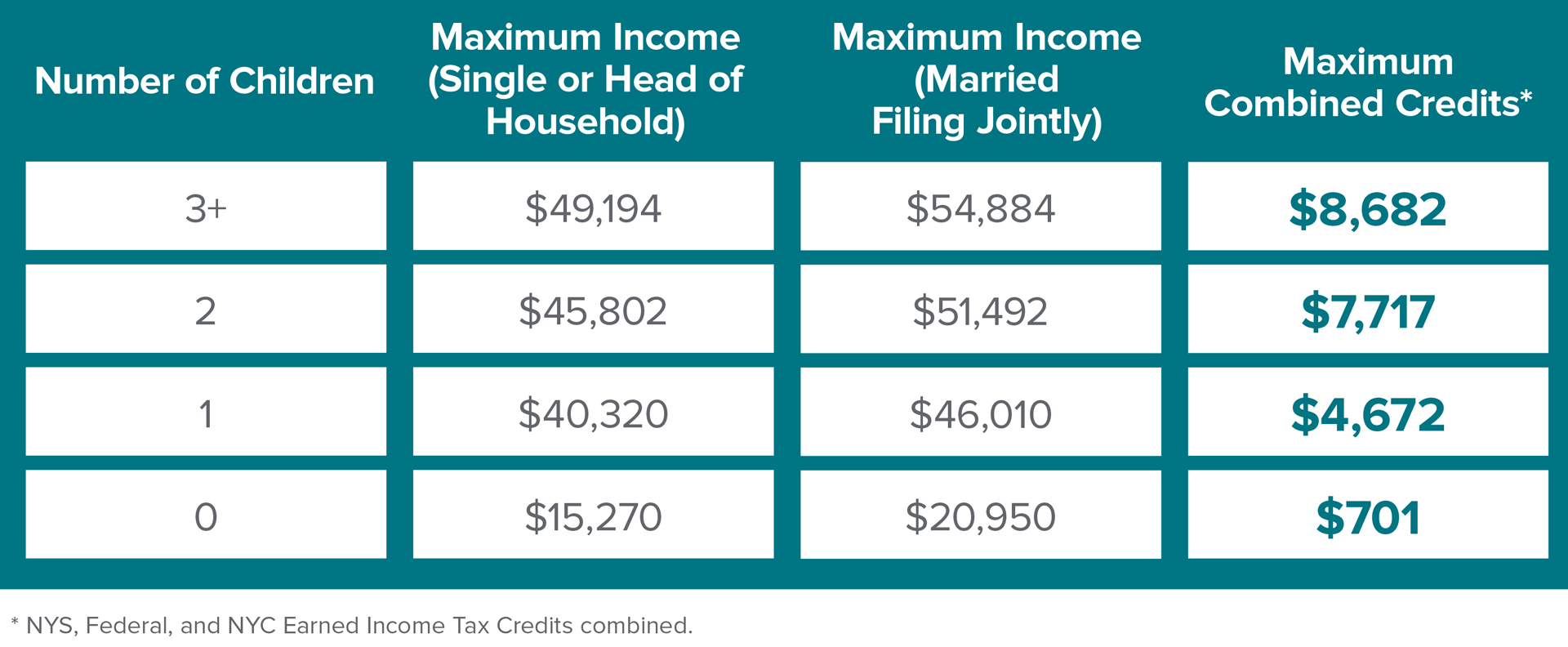

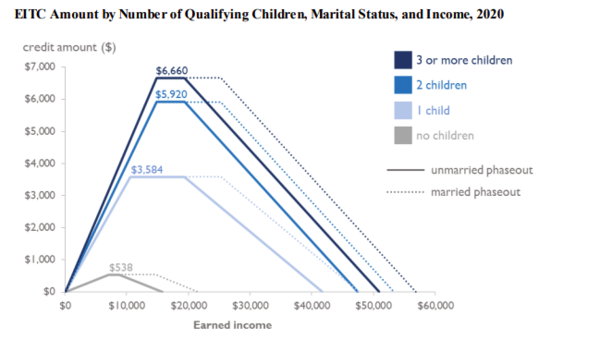

The earned income credit EIC is a refundable tax credit that helps certain US. The credit maxes out at 3 or more dependents. Tax Year 2020 Income Limits and Range of EITC Number of Qualifying Children For SingleHead of Household or Qualifying Widower Income Must be Less Than For Married Filing Jointly Income Must be Less Than Range of EITC No Child 15820 21710 2 to 538.

This credit is highly valuable and is often missedallowing you to keep more of your hard-earned money. The Earned Income Tax Credit is a refundable tax credit which means that it not only can be subtracted from taxes owed but can be refunded to the taxpayer if taxes are not owed. The maximum Earned Income Tax Credit amounts for the 2020 tax yearthe return youd file in 2021are as follows.

Earned income credit EIC is a US. The earned income tax credit is available to taxpayers with low and moderate incomes. The exact income limits depend on your.

How Much is the Earned Income Credit. You will not be eligible if you earned over 56844 or if you had investment income that exceeded 3600 Your credit should fall somewhere with-in these chart brackets based. For the tax year the credit will be worth a maximum of 6557.

Its a tax credit not a tax deduction so the EIC will reduce the amount of tax you owe directly rather than your taxable income. The taxpayer gets a refund if the tax amount owed is less than the credit amount. The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people.

Taxpayers with low earnings by reducing the amount of tax owed on a dollar-for-dollar basis. One valuable element of the EITC. 5 Zeilen The EIC provides support for low and moderate-income working parents with qualifying children in.

Did you receive a letter from the IRS about the EITC. The EIC is a type of tax credit available to claim for taxpayers earning either a low or moderate salary. 6660 if you have three or more qualifying children 5920 if you have two children 3584 if you have one child.

Earned income credit is a credit for taxpayers who have earned income from 1 up to maximum amounts depending on filing status and number of children. That means eligible filers can reap. Tax benefit offered to working families with low-to-moderate income especially those with children.

4 Zeilen The Earned Income Tax Credit EIC or EITC is a refundable tax credit for low- and. This year the EITC is getting a second look from taxpayers because many have experienced income changes due to COVID-19. The earned income tax credit is a federal tax credit for low-income or moderate-income filers.

Here is the most current EIC Earned Income Credit Table. Its a refundable tax credit. It lowers the tax amount owed on a dollar-for-dollar basis.

Your income must also fall within certain income limits. The credit decreases the amount of tax you owe and the credit is refundable you can get a refund even if your tax liability what you owe reaches 0. 1040 TAX AND EARNED INCOME CREDIT TABLES - Introductory Material.

The EITC can be worth as much as 6660 for the 2020 tax year and 6728 for the 2021 tax year. The amount of your credit may. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund.

Find out what to do.

Expanding The Earned Income Tax Credit Can Support Older Working Americans Urban Institute

Expanding The Earned Income Tax Credit Can Support Older Working Americans Urban Institute

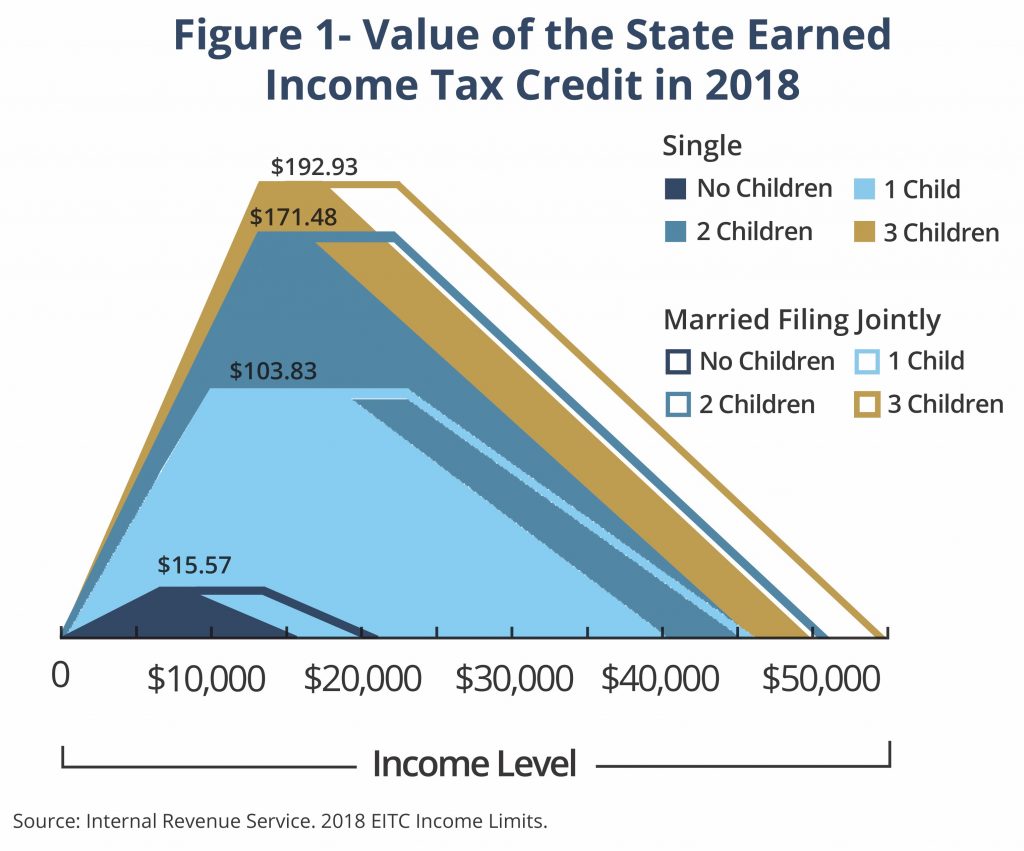

A State Earned Income Tax Credit Helping Montana S Working Families And Economy Montana Budget Policy Center

A State Earned Income Tax Credit Helping Montana S Working Families And Economy Montana Budget Policy Center

Eitc A State Tax Credit For Working Families North Carolina Justice Center

Eitc A State Tax Credit For Working Families North Carolina Justice Center

Earned Income Tax Credit Estimator Get It Back Tax Credits For People Who Work

Earned Income Tax Credit Estimator Get It Back Tax Credits For People Who Work

The Earned Income Tax Credit Helping Families At A Surprisingly Low Cost

The Earned Income Tax Credit Helping Families At A Surprisingly Low Cost

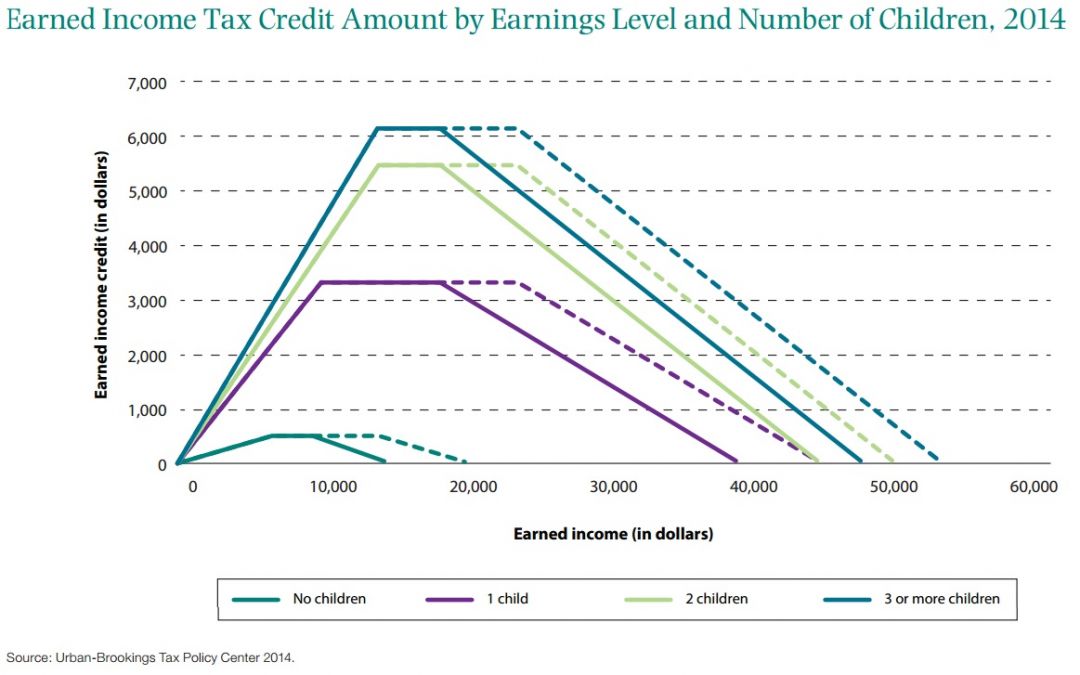

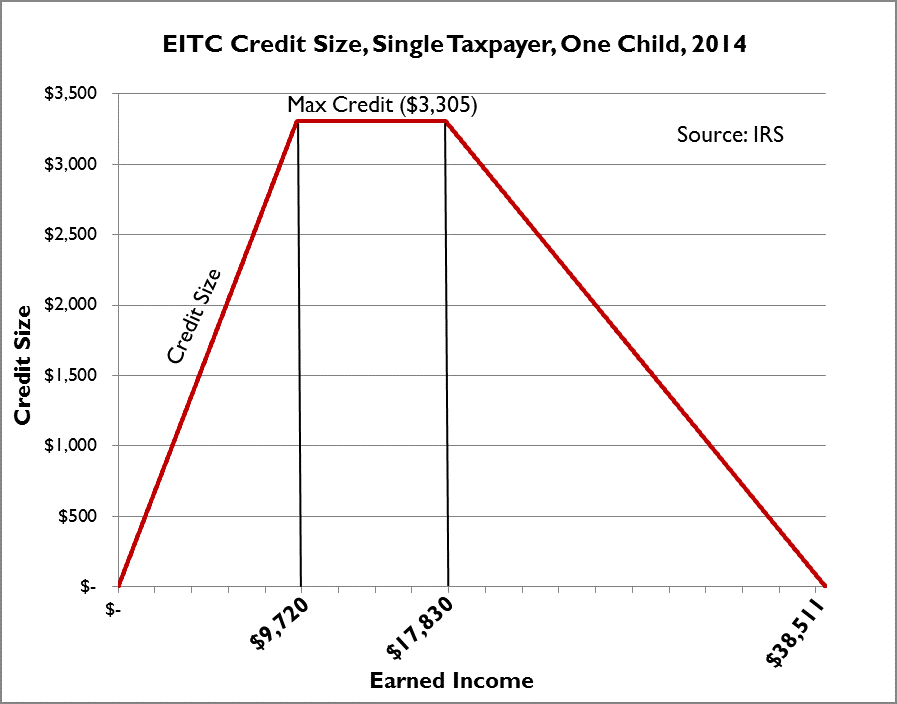

Earned Income Tax Credit Amount By Earnings Level And Number Of Children 2014 The Hamilton Project

Earned Income Tax Credit Amount By Earnings Level And Number Of Children 2014 The Hamilton Project

Earned Income Tax Credit Reform Eitc Reform Tax Foundation

Earned Income Tax Credit Reform Eitc Reform Tax Foundation

Earned Income Child Tax Credit Chart Danada

Overview Of The Earned Income Tax Credit On Eitc Awareness Day Tax Foundation

Overview Of The Earned Income Tax Credit On Eitc Awareness Day Tax Foundation

What Is The Earned Income Tax Credit Tax Policy Center

What Is The Earned Income Tax Credit Tax Policy Center

Maximizing The Earned Income Tax Credit Internal Revenue Service

Maximizing The Earned Income Tax Credit Internal Revenue Service

Earned Income Tax Credit Eitc A Primer Tax Foundation

Earned Income Tax Credit Eitc A Primer Tax Foundation

Earned Income Tax Credit Wikipedia

Earned Income Tax Credit Wikipedia

Earned Income Tax Credit Wikipedia

Earned Income Tax Credit Wikipedia

Comments

Post a Comment