Featured

Combined Tax Rates By State

Individual Income Tax as a Share of Personal Income. 567 CA 543 NY 542 NJ 533 OR 533 MN 524 DC 522 VT 507 HI 506.

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Sales Tax Rate 2020.

Combined tax rates by state. Since the two county taxes apply to every county in the state Nevadas minimum statewide tax rate. Based on the lowest average or highest tax brackets. Under President Bidens tax plan 13 states and DC.

Compare relative tax rates across the US. Average state tax burden. Tennessee 955 Arkansas 953.

The total state tax. 51 Zeilen In addition to this the average local sales tax is 131 equaling a combined rate of 856. Property Tax as a Share of Personal Income.

State Local Rate Combined Tax Rank B Alabama 4 1 - 75 7972 9 A Alaska NA 0 - 785 1653 44 D Arizona 56 0 - 56 7751 12 C Arkansas 65 0 - 5 8623 5 E California 6 125 - 45 8445 6 F Colorado 29 0 - 83 6281 29 G Connecticut 635. Average Local Tax Rate 2020. At 947 its average combined state and local sales tax rate is tied for the highest in the nation according to the Tax Foundation.

One state Connecticut is exactly average with a combine sales tax of 635. Scroll down for a list of income tax rates by state. 52 Zeilen State.

The average combined sales tax is 635. This is about the same distribution as the state sales tax. Total Sales Excise Tax as a Share of Personal Income Sources.

Two county taxes also apply 050 Basic City-County Relief Tax and 175 Supplemental City-County Relief Tax equals an additional citycounty rate of 225 for a total of 685. Sales and excise taxes. Two state taxes apply 200 Sales Tax and the 26 Local School Support Tax which equal the state rate of 46.

Four statesOregon New Hampshire Montana and Delawarehave a combined sales tax of 0. The combined sales taxes for state and average local range from 0 to 947. Would have a top combined capital gains tax rate at or above 50.

685 The Nevada Minimum Statewide Tax rate of 685 consists of several taxes combined. Data used to create this ranking were collected from the Tax. Tennessee also has the highest beer tax.

The charts below simply list the income tax rate youd pay in each state if you earned the median income in 2021 as calculated by the US. The state with the highest combined corporate income tax rate is Iowa at 295 percent. Average Oklahomans can expect to pay 166 of their income in property taxes 182 in income tax and 364 in sales and excise taxes.

Hover over any state for tax rates and click for more detailed information. Still the total tax burden remains relatively low due to low property tax rates and low income tax rates. The five states with the highest average combined state and local sales tax rates are Tennessee 953 percent Louisiana 952 percent Arkansas 947 percent Washington 921 percent and Alabama.

States and cities that impose income taxes typically have their own brackets with rates that tend to be lower than the federal governments. Factoring the combination of state and average local sales tax the top five highest total sales tax states as ranked by the Tax Foundation for 2020 are. Corporations in Alaska California Illinois Maine Minnesota New Jersey and Pennsylvania face combined corporate income tax rates at or above 28 percent.

California has the highest state income tax at 133 with Hawaii 11 New Jersey 1075 Oregon 99 and Minnesota 985 rounding out the top five. Oklahoma imposes all three tax types. 33 states fall above this average and 17 fall below.

California Hawaii Oregon Minnesota New York and New Jersey have some of the highest state income tax rates in the country and eight states have no tax on earned income at all. Overall state tax rates range from 0 to more than 13 as of 2021. In order to determine the states that tax their residents the most and least aggressively WalletHub compared the 50 states across the following three tax burdens and added the results to obtain the overall tax burden for each state.

Table of Sales Tax Rates By State Updated April 2021 State Name State Rate Range of Local Rates Avg. Lake Providence Louisiana has the dubious distinction of most expensive sales tax city in the country in 2020 with a combined state and city rate of 1145.

Marginal Tax Rates For Pass Through Businesses By State Tax Foundation

Marginal Tax Rates For Pass Through Businesses By State Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

.png) State And Local Sales Tax Rates Midyear 2013 Tax Foundation

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

Corporate Income Tax Rates By U S State 2020 Statista

Corporate Income Tax Rates By U S State 2020 Statista

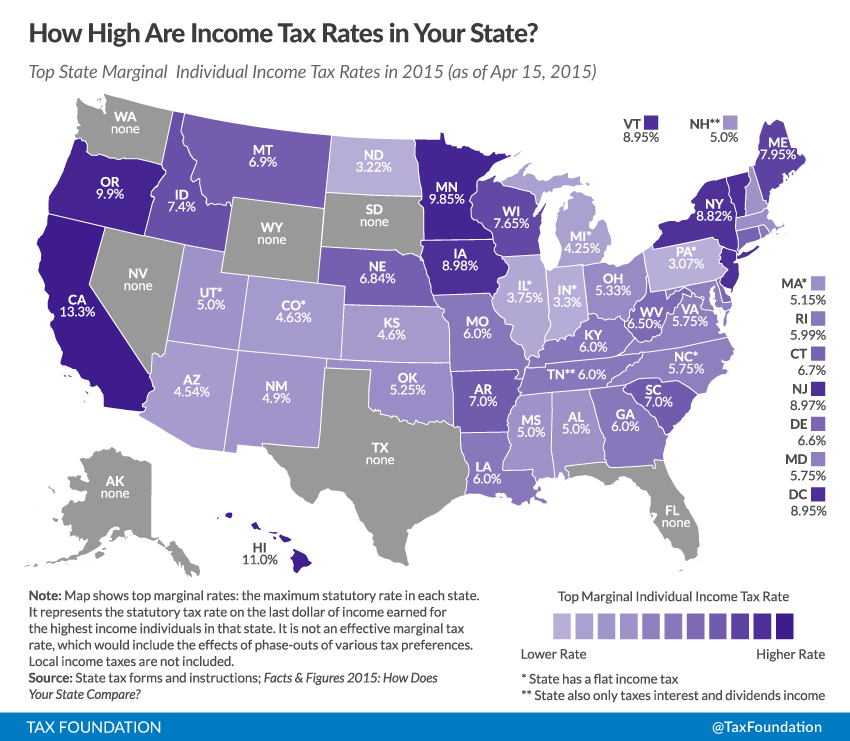

State Individual Income Tax Rates And Brackets For 2015 Tax Foundation

State Individual Income Tax Rates And Brackets For 2015 Tax Foundation

States With The Highest And Lowest Sales Taxes

States With The Highest And Lowest Sales Taxes

State Income Tax Rates And Brackets 2021 Tax Foundation

State Income Tax Rates And Brackets 2021 Tax Foundation

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Comments

Post a Comment