Featured

- Get link

- X

- Other Apps

Conventional Renovation Loan

Make a down payment as low as 3 Borrow a loan amount based on the homes post-renovation estimated value Finance one- to four-unit homes investment properties condos and manufactured homes Renovate a home youre buying or refinancing Do some of the. If monthly HOA fees are included in the renovation escrow account.

How Does A 203k Loan Work Fha 203k Requirements 2021

How Does A 203k Loan Work Fha 203k Requirements 2021

A payment reserve of up to six months PITIA is permitted when the borrower must vacate the property during renovation.

Conventional renovation loan. The competitive terms of this program help lenders do more volume in improvement loans and attract borrowers who are interested in this product. Conventional renovation loans can be used in conjunction with conventional mortgages for both appraiser-required and borrower-selected upgrades. Now you can give your customers the option to renovate and rehab a new or existing home by including financing in their conventional purchase or refinanced home loan.

Conventional HomeStyle Renovation Loan The HomeStyle Renovation Loan provides a convenient and economical way for borrowers considering moderate home improvements to make repairs and renovations with a single-close first mortgage. Several property types are allowed including single-family homes 2-4 unit properties modular homes second homes and homes in Planned Unit Developments PUDs. There are no required improvements or a minimum dollar amount for the repairs.

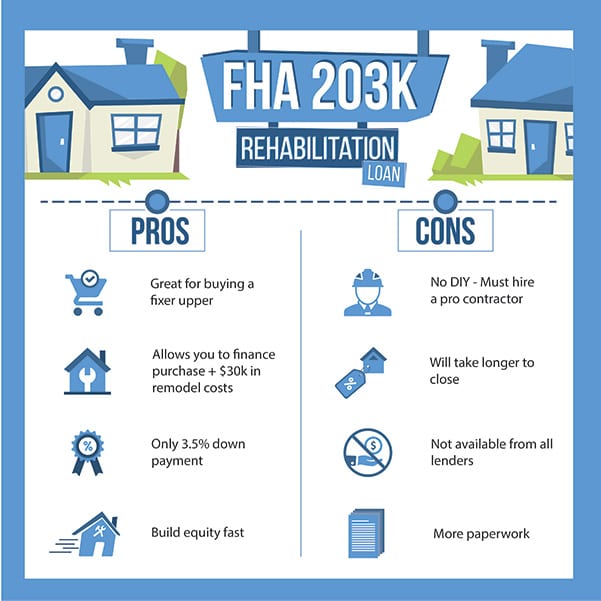

A 50000 renovation loan at 6 percent interest payable over 20 years will cost nearly 36000 in interest by the time the last check is written. A conventional loan and the FHA 203k -a renovation loan that can help you finance remodeling and renovation projects. This conventional renovation loan allows you to.

With conventional renovation loans orrowers can. Add or repair luxury items barbecue pits swimming pools etc loan limits are higher there are no mortgage insurance. But realistically you should expect to need a 20 percent down payment for conventional rehab financing.

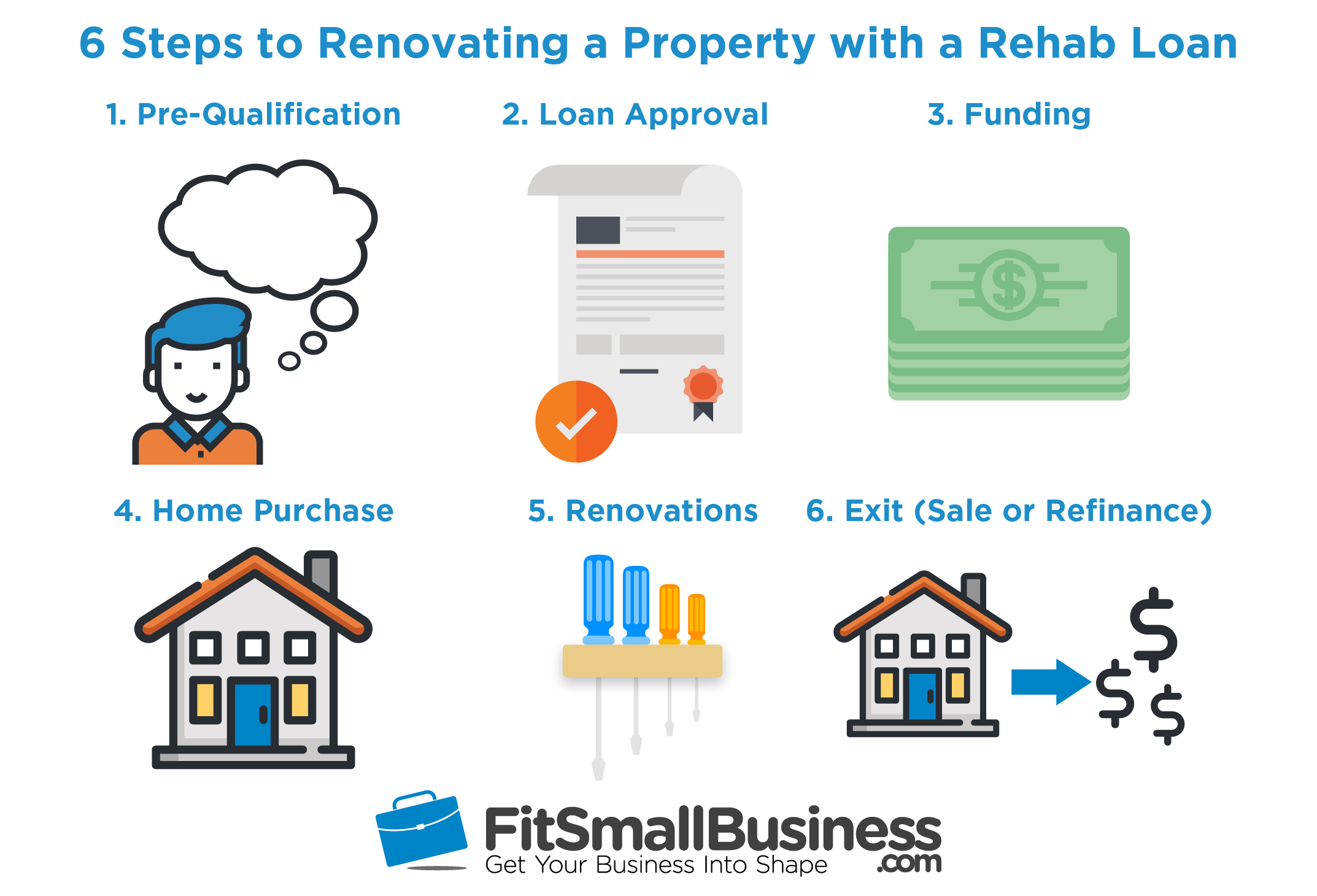

The loan amount is based on the as-completed value of the home. The reserve is allowed only for the period in which the property is uninhabitable due to the renovations. So whats the difference.

You may qualify for renovation fund amounts from 5000 up to 75 of your homes post-renovation value. The amount can be financed in the loan amount if the value will support such financing. Home renovation loan projects Some home.

In this blog well compare two popular mortgages. Luxury items not allowed. Conventional Rehab Loan provides the option of a no money down financing that covers the value of the property plus the cost of renovating the home.

The renovation dollar portion of the loan can be for up to 75 of ARV. While FHA 203k loans are a viable option for those interested in a rehab mortgage there are also conventional loans to consider. The Fannie Mae Homestyle renovation loan is a single close loan that enables borrowers to purchase a home that needs repairs or refinance their existing home and include the necessary funds for renovation in the loan balance.

A HomeStyle Renovation loan can make the difference between a house and a dream home or help restore an older home to its former glory. Conventional rehab loans can technically be done with as little as 5 percent down. Conventional Rehab Loans.

Renovation Mortgage program conventional improvement loans may have higher interest rates with shorter repayment terms. 14 Zeilen Structural repairs allowed. A conventional mortgage is a traditional home loan used to purchase a property.

As an example if purchasing for 100000 and adding 50000 for renovation with an ARV projected by an Appraiser to be 175000 then the renovation dollar portion can be as much as 131250 or 75 of 175000. This mortgage option includes the cost of necessary upgrades and improvements in the loan package. For instance the HomeStyle Renovation Mortgage was developed by the Federal National Mortgage Association Fannie Mae.

Lower closing costs since youre closing a single transaction. The conventional loan limit in most parts of the country for 2020 is 510400 for a single-family home and goes up to 981700 for a four-unit home. Below are a few facts about the Renovation Loan option for more information dont hesitate to fill out the form above and an experienced loan officer will guide you thru the process.

Conventional loans are popular because they typically offer the best interest rates and loan terms resulting in a lower monthly.

Conventional Renovation Loan Now Available Fort Lauderdale Mortgages The Truth About The Mortgage Climate

Conventional Renovation Loan Now Available Fort Lauderdale Mortgages The Truth About The Mortgage Climate

What Is A Conventional Loan 2021 Rates And Requirements

What Is A Conventional Loan 2021 Rates And Requirements

Rehab Loans For Investors Fha 203 K Loans Hard Money More

Rehab Loans For Investors Fha 203 K Loans Hard Money More

Home Renovation Loan 5 Down Buy Renovate In 1 Fixed Rate Loan

Home Renovation Loan 5 Down Buy Renovate In 1 Fixed Rate Loan

Conventional Renovation Rehab Loan The Robinson Appraisal Group Llc

Conventional Renovation Rehab Loan The Robinson Appraisal Group Llc

Conventional Homestyle Loans 203khud

Use A Rehab Loan To Affordably Renovate Your Home Wealthfit

Use A Rehab Loan To Affordably Renovate Your Home Wealthfit

Conventional Renovation Loan Page 1 Line 17qq Com

Conventional Renovation Loan Page 1 Line 17qq Com

Purchasing Or Refinancing With The Homestyle Renovation Program Benchmark

Purchasing Or Refinancing With The Homestyle Renovation Program Benchmark

What American Homeowners Need To Know About Renovation Loans

What American Homeowners Need To Know About Renovation Loans

Homestyle Renovation Fannie Mae

Homestyle Renovation Fannie Mae

Homestyle Renovation Fannie Mae

Homestyle Renovation Fannie Mae

Tumblr Renovation Loans Payday Loans Online Payday Loans

Tumblr Renovation Loans Payday Loans Online Payday Loans

What Is A Renovation Loan How Does It Work Tidewater Mortgage Services Inc

What Is A Renovation Loan How Does It Work Tidewater Mortgage Services Inc

Comments

Post a Comment