Featured

- Get link

- X

- Other Apps

What Is Coinsurance Vs Copay

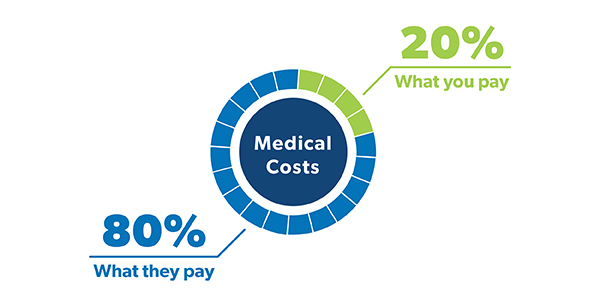

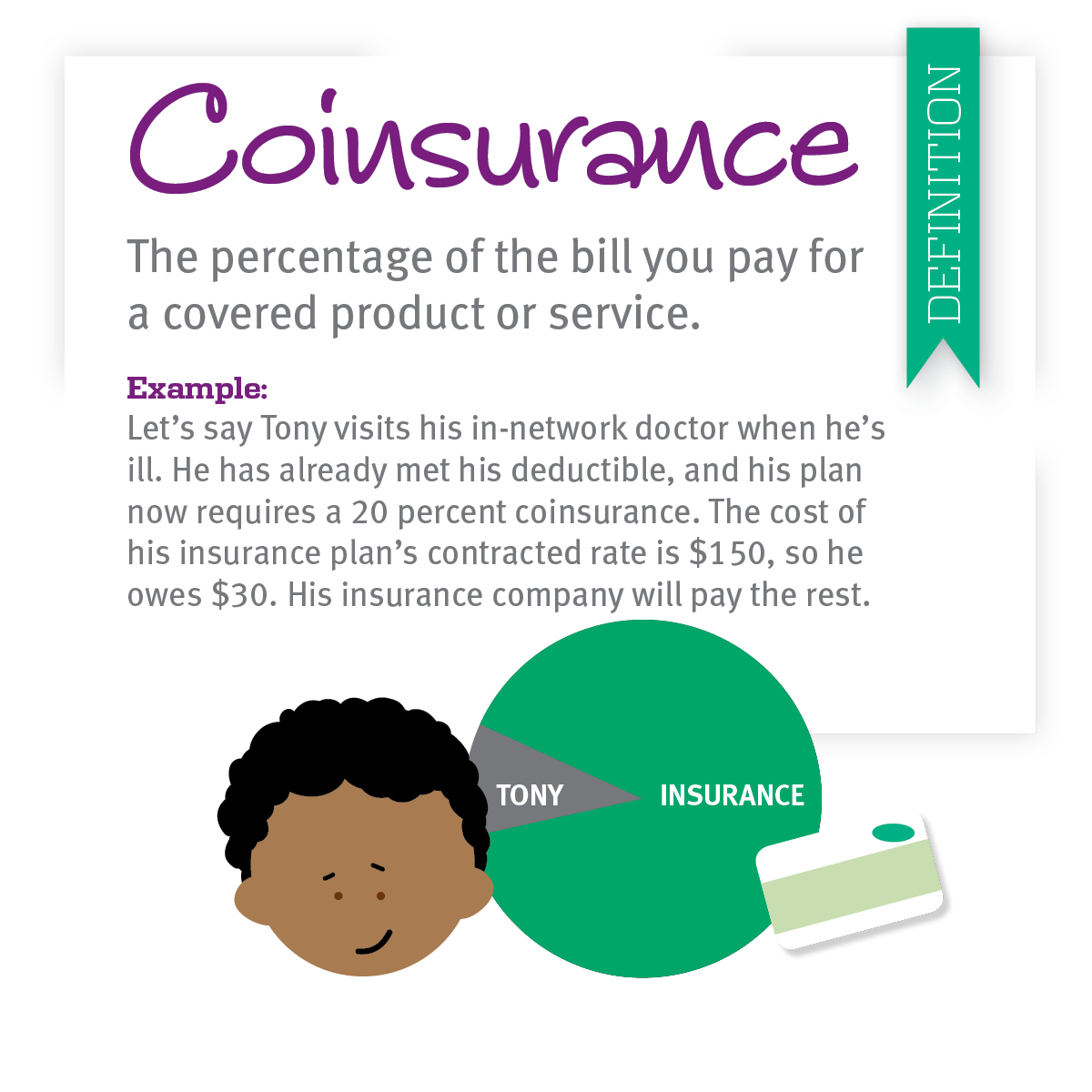

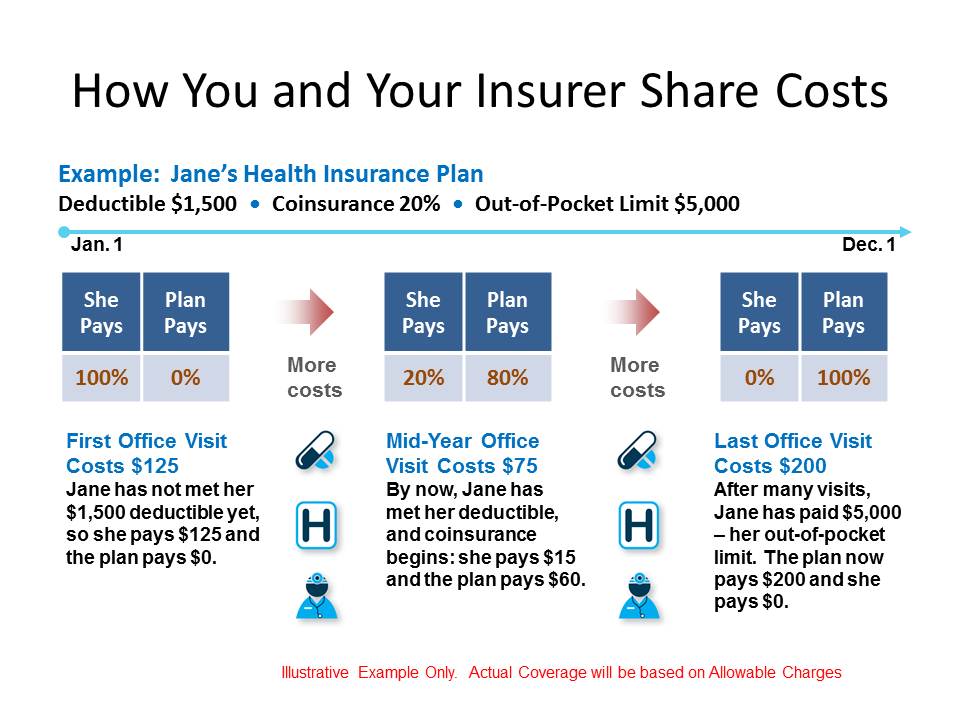

The remaining percentage that you pay is called coinsurance. Once youve reached your deductible coinsurance is the percentage of your medical bill youll pay and your insurer pays the rest.

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

No matter which type of health insurance policy you have its essential to know the difference between a copay and coinsurance.

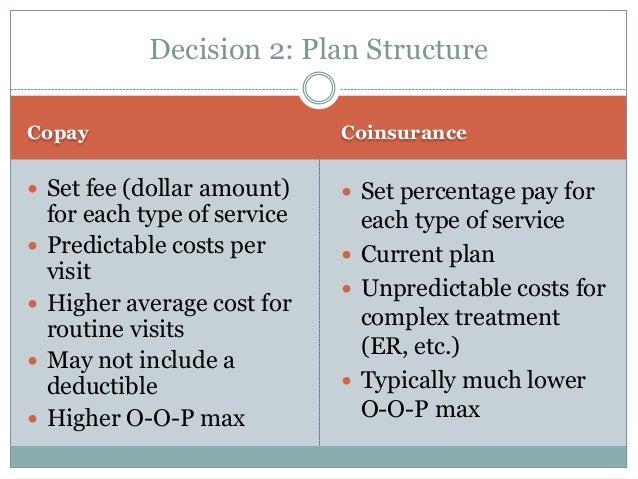

What is coinsurance vs copay. A copay is a type of insurance cost that is a set amount designated to be paid by the insured party whereas coinsurance is a percentage of health care costs covered by the insurer after the deductible is met. Copay count towards deductibles only under certain circumstances. Understanding copays coinsurance and deductibles can help prepare you for the costs of receiving medical treatment.

Coinsurance and copay as similar-sounding terms for your healthcare may be a little confusing. Your deductible is 1000 and your coinsurance responsibility is 20. 10-40 of the healthcare providers contracted rate with the insurer.

The copay is separate from your deductible so you still need to pay it even if youve met your deductible. Some types of visits will only require a copay. Youll continue to pay copays or coinsurance until youve reached the out-of-pocket maximum for your policy.

The definitions presented above make it all clearer. 7 Health Insurance Concepts You Need to Understand. Where a copay is a fixed amount that you pay in addition to your monthly dividend coinsurance is the percentage of the amount that is divided between the policyholder and the insurance agency and each party has to contribute to paying the total cost.

A flat amount that the patient pays a healthcare provider or pharmacy at every visit. Copays cover your portion of the. What are they and how do they differ.

A copay is a set rate you pay for prescriptions doctor visits and other types of care. The remaining balance is covered by the persons insurance company. You may have a copay before youve finished paying toward your deductible.

In that case youd pay the 1000 for the deductible portion and youd also be on the hook for the remaining 20 with the health plan picking up the other 80. Coinsurance and copays both refer to the portion of medical expenses covered by the patient rather than by insurance. You may also have a copay after you pay your deductible and when you owe coinsurance.

In this case youd pay. Though they share similarities theyre ultimately different plans for your insurance. Copay Now that we have fully rounded up the process of covering medical expenses from start to finish there is only one thing left to do understand the difference between copay and coinsurance.

What Your Insurance Company Means by. Your plan determines what your copay is for different types of services and when you have one. Coinsurance is paid only after.

Do Copays Count Toward Your Health Insurance Deductible. Other types of visits will. Both copays and coinsurance are forms of cost-sharing meaning you are splitting medical bills with your health insurance company.

The between both coinsurance and copay lies in how the cost is split between the policyholder and the insurance company. Whats the Difference and Which Is Riskier. Coinsurance versus Copay comparison chart.

The fact that both terms carry the same prefix may give you some initial idea. 4 Zeilen Your copay amount is printed right on your health plan ID card. Your Blue Cross ID card may list copays for some visits.

These and other out-of-pocket costs affect how much youll pay for the healthcare you and your family receive. A percentage of covered benefits that the patient is responsible for paying. What Is a Silver Health Care Plan Under the Affordable Care Act.

A copay short for copayment is a fixed amount a healthcare beneficiary pays for covered medical services. Coinsurance is the percentage of costs you pay after youve met your deductible.

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

Copay Vs Coinsurance The Differences And Why They Matter Professional Insurance Programs

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

25 Awesome Health Insurance Deductible Vs Copay

25 Awesome Health Insurance Deductible Vs Copay

Coinsurance Everything You Need To Know Harris Insurance

Coinsurance Everything You Need To Know Harris Insurance

Coinsurance Vs Copay Difference And Comparison Diffen

Coinsurance Vs Copay Difference And Comparison Diffen

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Texas

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Texas

Difference Between Coinsurance And Copay Difference Between

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

25 Fresh Copay Coinsurance And Deductible And Out Of Pocket

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

Out Of Pocket Maximums Copayments Coinsurance Bs Of Neny

Copays Vs Coinsurance For Health Insurance

Comments

Post a Comment