Featured

- Get link

- X

- Other Apps

Unemployment For Employers

If you are a new employer and need to set up your account you will need to start by registering your. This is the preferred method if your business has not yet closed and you believe you will reopen.

If you cannot file online call 1-877-FILE-4-UI 1-877-345-3484.

/GettyImages-182396779-56a0a54a3df78cafdaa38ff0.jpg)

Unemployment for employers. One exception is Georgia where employers. Changes to Employer Responsibility for Unemployment Benefits. Contributing employers file a report and pay UI taxes quarterly.

405 525-1500 Administrative Offices. In most states employer responsibilities and tax obligations have not changed. File a NYS 45 Quarterly Combined Withholding Wage Reporting and Unemployment Insurance Return.

Depending on the jurisdiction and the status of the person. The rate charged its called a tax is based on the type of business. PO Box 52003 Oklahoma City OK 73152-2003.

A Registration and Seeking Work Waiver may now be requested on-line. Employers provide a list of. 1 Unemployment benefits for employees are administered by the US.

Enroll in SIDES E-Response to respond electronically to requests for unemployment insurance information. Department of Labor Unemployment and Training Division. In the United States benefits are funded by a compulsory governmental insurance system not taxes on individual citizens.

In the past employers had to submit the request in writing and receive approval for the waiver request. Now the waiver can be requested and approved in minutes. Unemployment benefits also called unemployment insurance unemployment payment unemployment compensation or simply unemployment are payments made by authorized bodies to unemployed people.

Oklahoma Employment Security Commission. If the reason for your employees unemployment is due to a quit discharge for misconduct discharge for substantial fault or labor dispute employers will need to submit a request for relief of charging if the initial claim relates to the public health emergency declared by Executive Order 72. There has not been a breach of information stored by the Arizona Department of Economic Security DES however criminals are obtaining individuals personal information using.

Unemployment Insurance Fraud Toolkit for Employers. States across the nation have seen a surge in unemployment benefit fraud largely associated with identity theft. Use the employer online services portal to.

While it remains uncertain what may happen to unemployment benefits extended with the CARES Act employers need to understand how the COVID-19 pandemic has changed the unemployment landscape. 405 557-7100 Telecommunications Device for the Deaf TDD. The Unemployment Insurance Agency UIA has made it faster and easier for employers to request a Registration and Seeking Work Waiver for short term lay off periods.

Unemployment Insurance Handbooks for Employers Publications to help explain the unemployment insurance program in. There are two methods for taxing employers for unemployment insurance. Marylands BEACON Unemployment Insurance Application.

All employers must register for unemployment insurance when they meet liability. Unemployment Insurance UI benefits are available to workers who are unemployed or have reduced hours and meet eligibility requirements. If you are an existing employer accessing BEACON for the first time you will need to first activate your account.

Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by the United States Department of Labor USDOL and one administered by the State Workforce Agency which in Indiana is the Department of Workforce Development DWD. View your Unemployment Insurance Employer Information Page. The unemployment program for employers works like insurance meaning that employers pay for the coverage.

Apply for Shared Work - see the information below. Welcome to the Maryland Division of Unemployment Insurance BEACON Application. If your business is reducing hours or closing due to COVID-19 you may expedite the unemployment claim process for your employees by submitting an Employer-Filed Mass Claim.

If you are uncertain of a reopen date enter 16 weeks from the date of filing. Use our Online Claims System to apply for benefits. You may file a UI claim the first week your employment stops or your work hours are reduced.

All for-profit employers are contributing employers.

Employers Face Staggering Hike In Unemployment Taxes

Employers Face Staggering Hike In Unemployment Taxes

/GettyImages-182396779-56a0a54a3df78cafdaa38ff0.jpg) Important Unemployment Tax Questions For Employers

Important Unemployment Tax Questions For Employers

3 Common Reasons Why Employers Lose Unemployment Claims

3 Common Reasons Why Employers Lose Unemployment Claims

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes

Employer Handbook Iowaworkforcedevelopment Gov Www

Employer Handbook Iowaworkforcedevelopment Gov Www

Labour Tax Rates On Employees And Employers And Unemployment Benefit In Download Table

Labour Tax Rates On Employees And Employers And Unemployment Benefit In Download Table

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

It S Essential To Respond To Unemployment Insurance Claims

It S Essential To Respond To Unemployment Insurance Claims

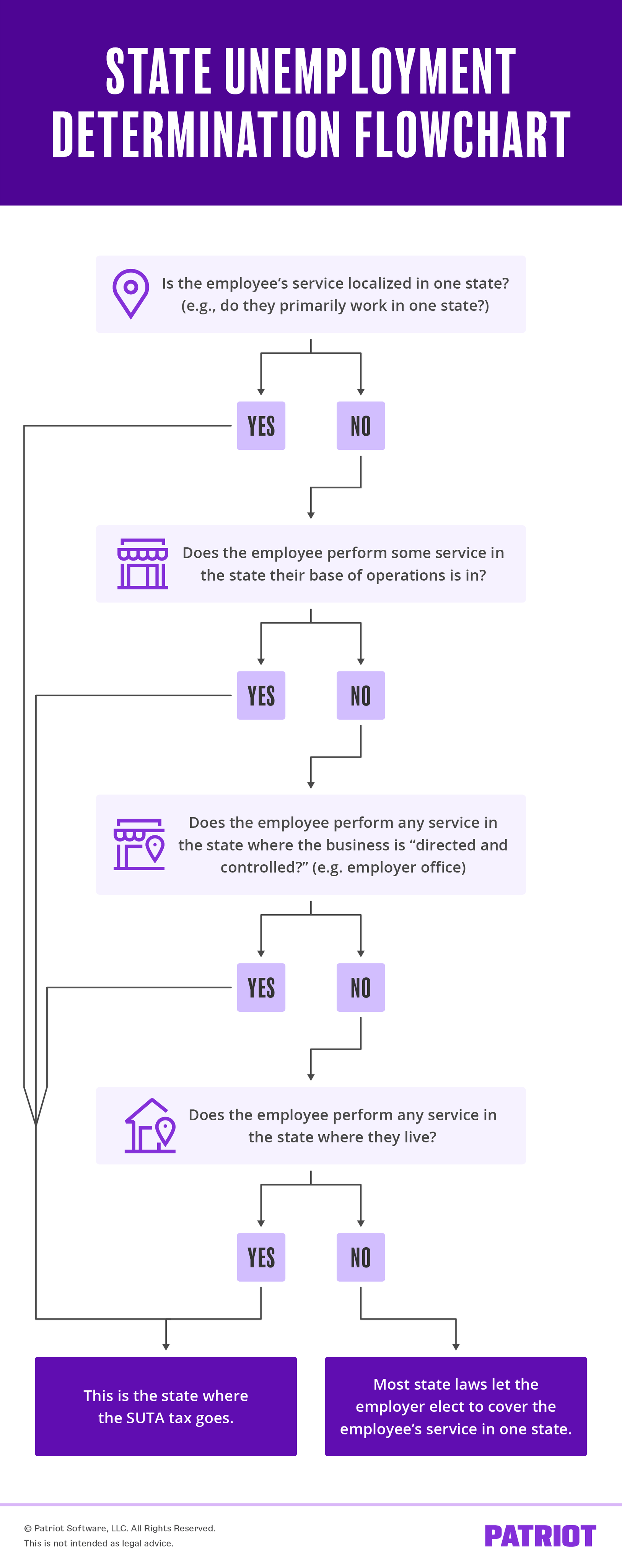

Unemployment Tax Rules For Multi State Employees Suta Tax

Unemployment Tax Rules For Multi State Employees Suta Tax

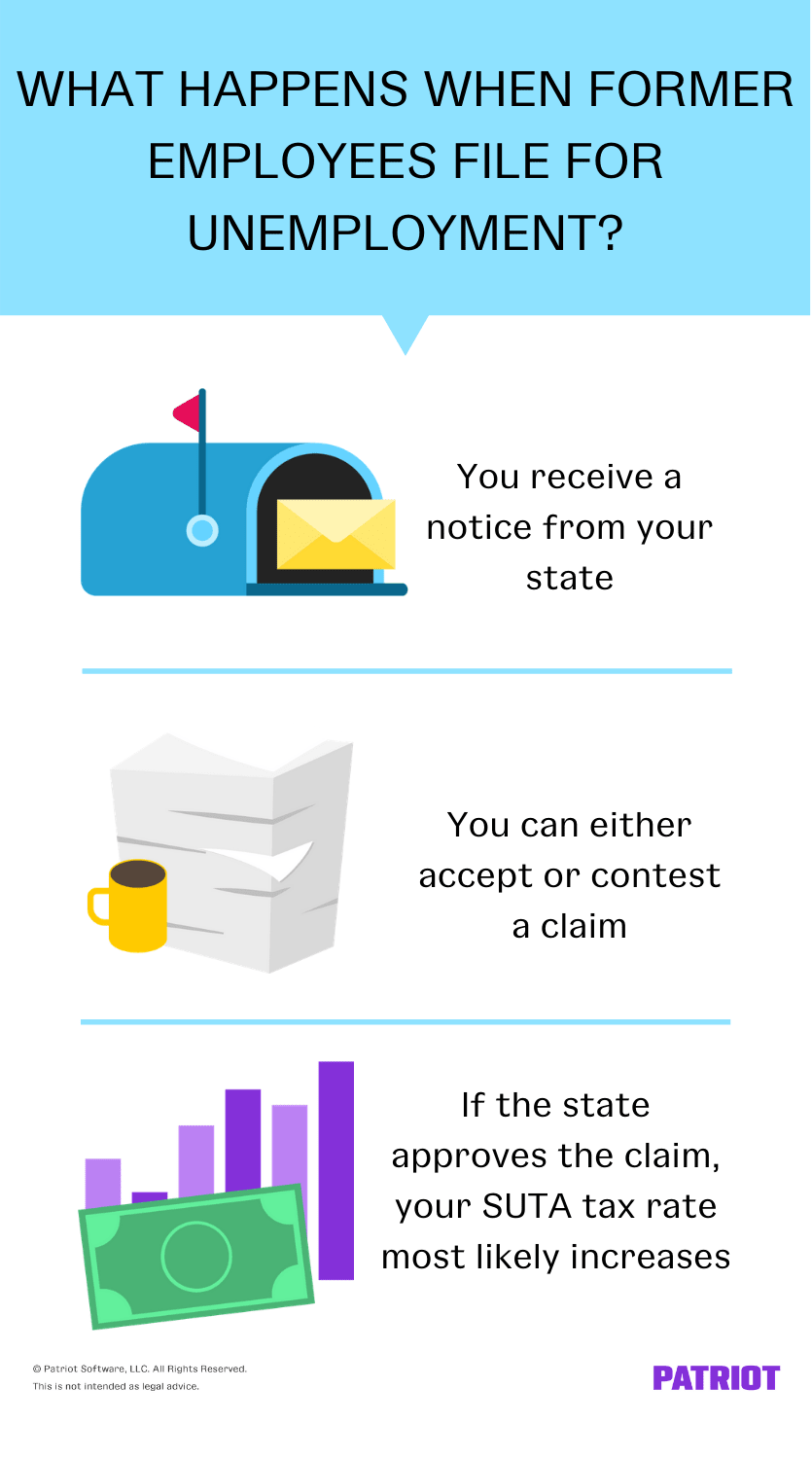

How Does Unemployment Work For Employers Handling Claims

How Does Unemployment Work For Employers Handling Claims

Comments

Post a Comment