Featured

How Long To Keep Tax Returns For Business

Self-employed Self Assessment taxpayers need to keep their business records for at least five years after the 31 January deadline of the relevant tax year. So if you filed your 2018-19 tax returns ready for the relevant deadline on 31 January 2020 youll need to keep your records until 31 January 2025.

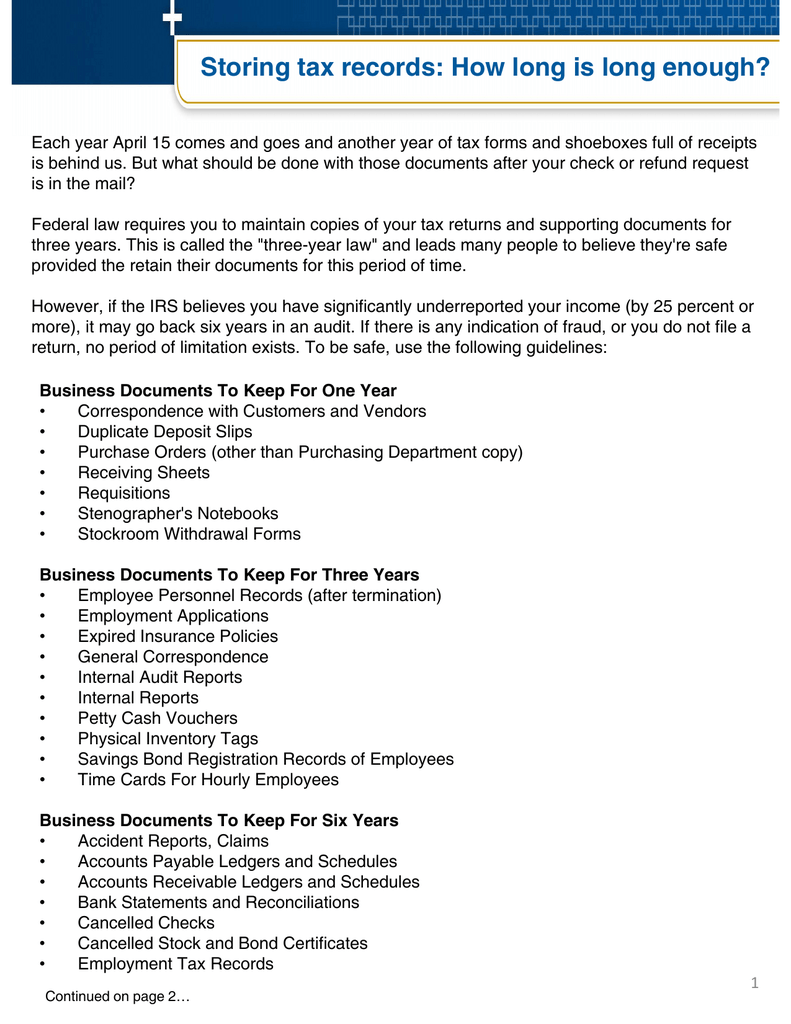

Here S How Long To Keep All Your Important Financial Documents

The records of the information you use to complete your tax return need to be kept for five years starting from when you prepared or obtained the records or completed the transactions or acts those records relate to whichever is later.

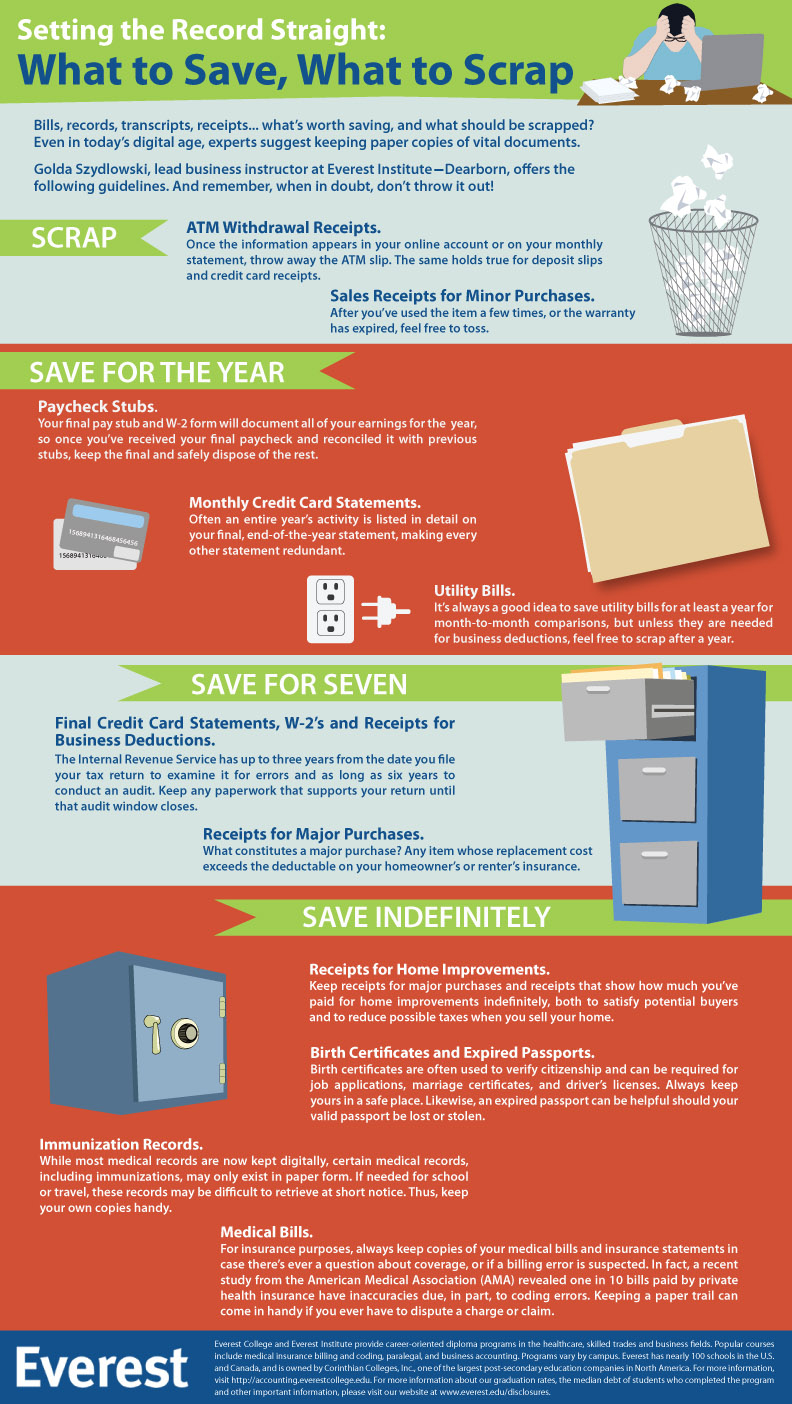

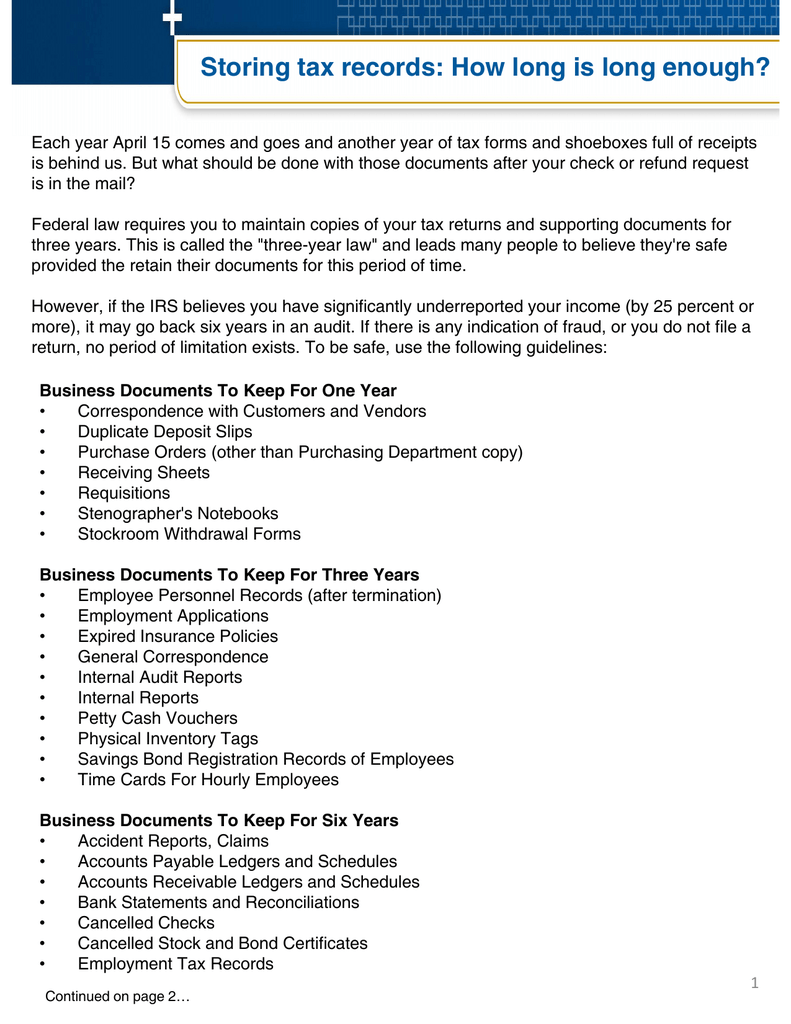

How long to keep tax returns for business. That is enough time to. Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax. What records should you keep and for how long.

You probably learned that you should keep a tax return for at least three years after filing it. HMRC can charge you a penalty if. The statute of limitations to examine your return and mail a Notice of Proposed Assessment NPA adjusting your return is usually 4 years from the due date of the return or the date the return is filed.

Keep business income tax returns and supporting documents for at least seven years from the tax year of the return. There are no rules on how you must keep records. How Long to Keep Tax Records The IRS advises that most businesses keep tax records for three years since the date the return was filed or for two years since the date the tax was paid whichever happens later.

Period of Limitations that apply to income tax returns Keep records for 3 years if situations 4 5 and 6 below do not apply to you. Heres what they advise for several common records. You can keep them on paper digitally or as part of a software program like book-keeping software.

Keep records for 7 years if you file a claim. You should keep records long enough to cover the period of review also known as the amendment period for an assessment that uses. According to Schenck a top CPA and consulting firm the answer to this is everything when it comes to sales and use tax documentation.

Sales receipts electronic or paper. You should keep your return and business tax records for 3 years from the date you filed the original return or 2 years after you paid your taxes on that return whichever one is later. You need to keep records related to your personal or business tax returns.

Keep all business tax records for six years if you didnt report income that you should have and its more than 25. If your business was set up as a corporation keep monthly and quarterly corporate financial statements for at least three years. How long to keep tax returns for business.

If your business filed a claim for a loss from worthless securities or a bad debt deduction you should keep your records for seven years. 6 rijen That means youd need to keep the receipts tax records and any other documentation related to. The reason for the three-year answer is that the IRS has up to three years to audit you and assess.

How long to keep tax records. However there are exceptions to the statute of limitations for tax returns. Keep records for three years from the date you filed your original return or two years from the date you paid the tax whichever is later if you file a claim for credit or refund after you file.

The IRS can audit your return and you can amend your return to claim additional credits for a period that varies from three to seven years from the date you first filed. As a general rule you should keep business tax records for a minimum of 3 yearsin accordance with the IRS Period of Limitations rule. How Long Should You Keep Business Tax Records.

Hold bank statements inventory records invoices sales records cash register tapes W-2s 1099s and other tax filing documents for at least six years. How long to keep tax return records. Although the IRS recommends keeping all your business tax records for three years most bookkeeping services and accountants recommend keeping these documents for at least seven years.

Tax Paperwork And Other Records What To Keep What To Toss Mksh

Keeping Records For Business What You Need To Know Gervis Accountants

How Long To Keep Tax Records And Other Statements Brandongaille Com

How Long To Keep Tax Records And Other Statements Brandongaille Com

How Long To Keep Tax Records And Other Statements Brandongaille Com

How Long To Keep Tax Records And Other Statements Brandongaille Com

Storing Tax Records How Long Is Long Enough

Storing Tax Records How Long Is Long Enough

Record Retention Policy How Long To Keep Business Tax Record

Record Retention Policy How Long To Keep Business Tax Record

What Business Records You Should Keep For Tax Purposes Mazuma Business Accounting

What Business Records You Should Keep For Tax Purposes Mazuma Business Accounting

How Long Should You Keep Tax Returns Longer Than You Think

How Long Should You Keep Tax Returns Longer Than You Think

The Important Documents You Ll Want To Save To Prepare Your Taxes Mazuma Business Accounting

The Important Documents You Ll Want To Save To Prepare Your Taxes Mazuma Business Accounting

How Long Should You Keep Business Tax Records And Receipts Outsourced Accounting Bookkeeping Basis 365

Record Retention Policy How Long To Keep Business Tax Record

Record Retention Policy How Long To Keep Business Tax Record

Record Retention Policy How Long To Keep Business Tax Record

Record Retention Policy How Long To Keep Business Tax Record

How Long To Keep Important Financial Documents

How Long To Keep Important Financial Documents

Comments

Post a Comment