Featured

When Paying Off A Credit Card It Is Best To

Since credit utilization counts for 30 of your FICO score and is second only to paying your bills on time your score should see a fairly immediate jump. In this video I share with you 5 tricks to pay off credit card debt fast.

How To Pay Off Credit Card Debt Fast Credible

How To Pay Off Credit Card Debt Fast Credible

Card issuers charge daily compounded.

When paying off a credit card it is best to. Some credit card issuers close credit cards that go unused for several months. Its also important to remember that your credit mix the number of installment loans and credit card accounts that show up on your credit report makes up 10 of your credit score. Having the best possible credit score is important if youre planning to apply for a major loan like a mortgage or car loan before your next account statement closing date rolls around.

That means that your paid-off credit card might help your credit score when combined with loans as part of your active credit history. Many credit card holders carry a balance from month to month but this strategy costs more in the long run and your credit score is better served by paying in full. Paying off your credit card is an accomplishment worth celebrating especially if you started out with a very high balance.

It can take months or years of financial discipline to pay off the interest fees and principle of a debtbut once your bill hits zeroyou are free to build a new strategy with the money and the credit youve freed up. But what happens next month or the months after that. Paying off credit card debt as quickly as possible will save you money in interest but also help keep your credit in good shape.

Paying a credit card balance off each month is one of the best ways to raise a credit score and more importantly it doesnt cost you in interest paid on the balance. News World Report. You can pay off your credit cards in whatever order makes you happy.

Payment history is the most important factor in credit scoring whether you pay on time or not. When you pay the bill early you save yourself some interest says Beverly Harzog credit card expert and consumer finance analyst for US. The answer in almost all cases is no.

The ultimate goal is to pay off your credit card balances by making a lump-sum payment to one credit card each month until that balance is repaid. Victories like this are vital when working toward paying off credit card debt. But whatever you do dont close it.

When you pay off your card completely with each billing cycle. 3 Otherwise you can ensure a lower balance is reported to the. If you have struggled with credit card debt and feel that leaving accounts open may be too much of a temptation to overspend closing them might be the safest and best option for you.

Does Paying Off Credit Cards Slowly Help My Credit Score. Read on to learn whyand what to do if you cant afford to pay off your credit card balances immediately. Past that though it also feels good to pay off a debt in its entirety especially if its been hanging around for a while.

Aim to pay off the entire bill each month so that you will not pay any interest at all. These are five strategies to pay off credit card debt fast that will have you debt. So paying off your credit card debt with an installment loan could significantly boost your credit especially if you dont already have any installment loans on your credit reports.

Although keeping your paid-off credit card accounts is usually best for credit scores consider your own unique situation when making this decision. By paying your cards off you will immediately decrease your credit utilization down to zero and get access to 100 of your available credit. With a standard credit card if you always pay off your monthly bill in full you can enjoy between 45 and 59 days of interest-free credit.

By following the best and avoiding the worst score-raising tips you could soon be seeing a better score lead you to a better mortgage. Paying off all your credit cards or installment loans quickly could raise your credit score because this behavior shows lenders that you can handle different types of credit. You can alphabetize them by credit card issuer or get rid of the balances on cards youre not using anymore.

When you use a personal loan to reduce the number of payments you need to make each month it can make managing your debts much easier. A personal loan can mitigate overload. By all means you should pay off that credit card or at least pay it down.

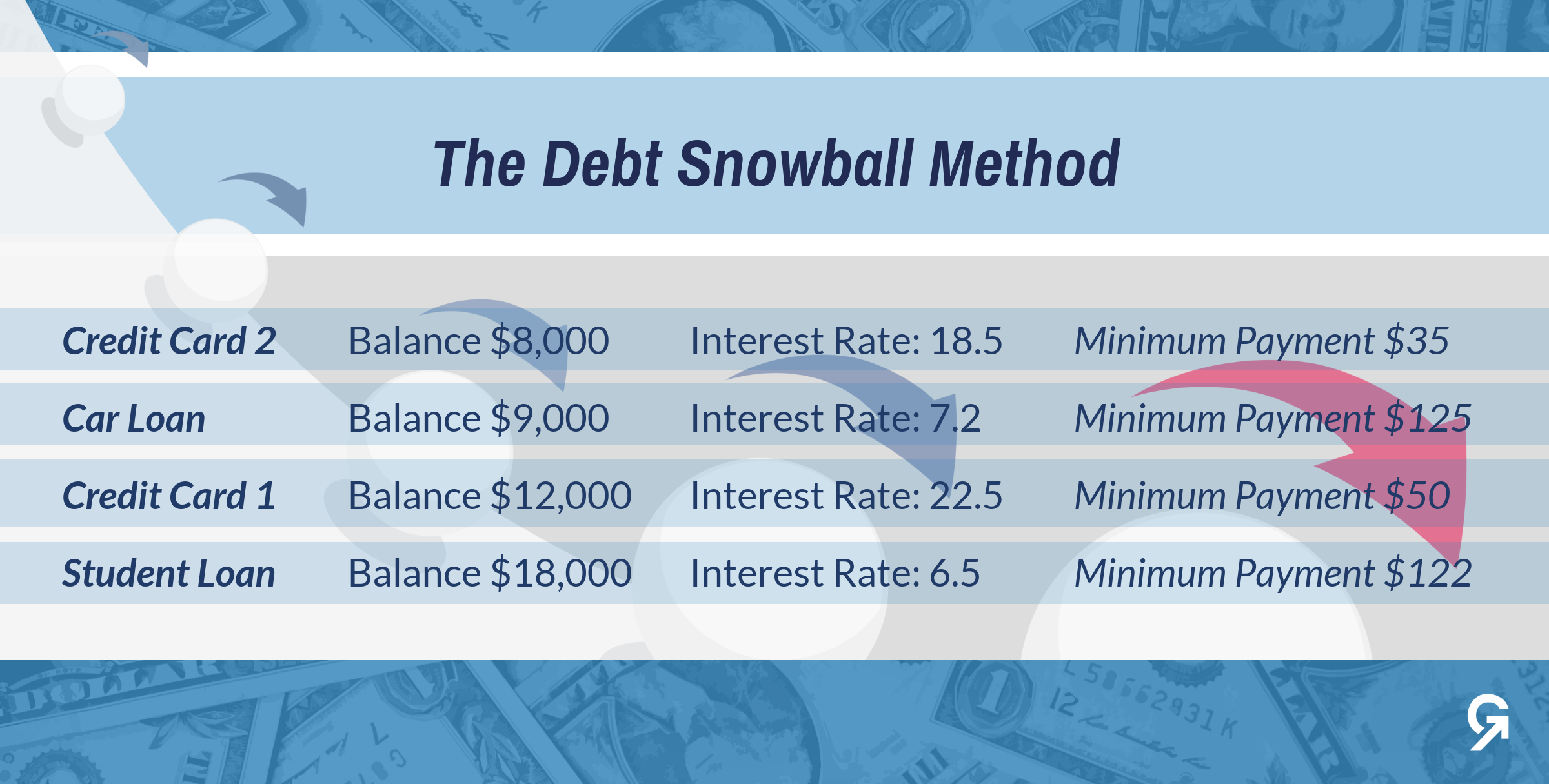

You prioritize paying off the credit card with the highest interest first because it is essentially costing you more the longer you carry a balance on the card. If thats not possible pay off as much as you can and work out a repayment plan. In general we recommend paying your credit card balance in full every month.

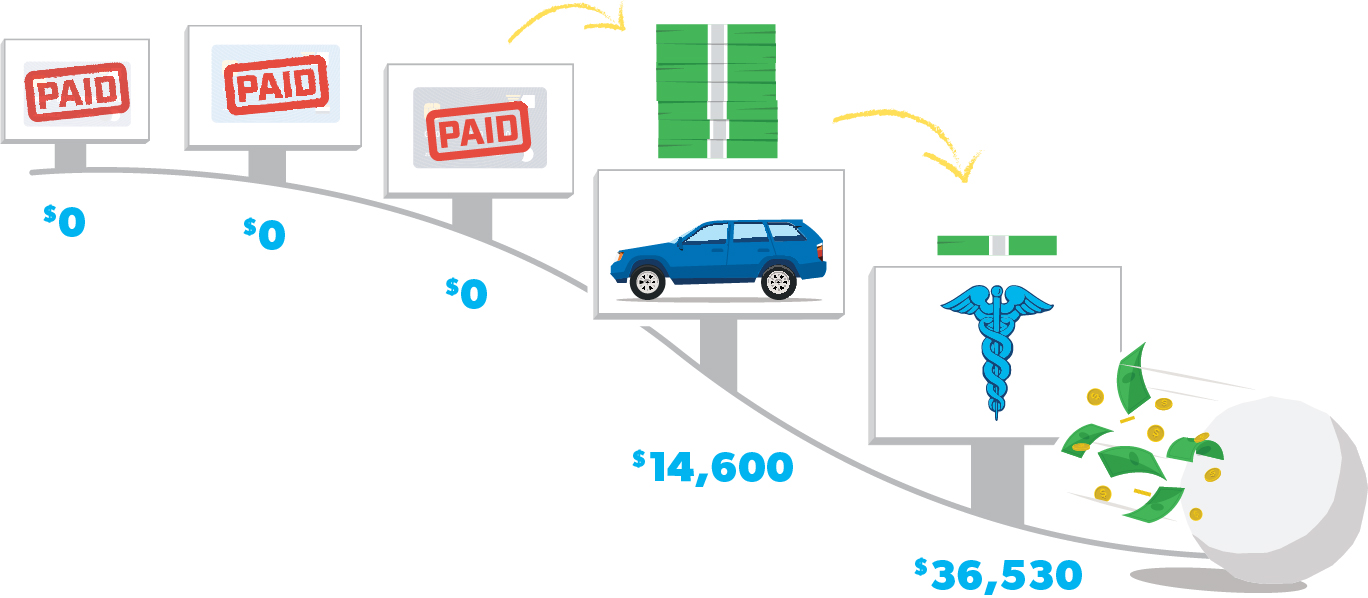

Its a snowball effect which is why this method of paying off debt is called the debt snowball. To keep your account open be sure to use it periodically.

How To Pick The Best Credit Card For Paying Off Debt

How To Pick The Best Credit Card For Paying Off Debt

How To Pay Off Credit Card Without Interest Charges The Millennial Bull Paying Off Credit Cards Credit Card Debt Payoff Best Credit Cards

How To Pay Off Credit Card Without Interest Charges The Millennial Bull Paying Off Credit Cards Credit Card Debt Payoff Best Credit Cards

Is It Always Best To Pay Off Credit Cards Before Saving For Retirement Gold Coast Veterans Foundation

Is It Always Best To Pay Off Credit Cards Before Saving For Retirement Gold Coast Veterans Foundation

How To Pay Off Credit Card Debt Ramseysolutions Com

How To Pay Off Credit Card Debt Ramseysolutions Com

How To Pay Off Credit Card Debt Fast 5 Foolproof Strategies Get Out Of Debt

How To Pay Off Credit Card Debt Fast 5 Foolproof Strategies Get Out Of Debt

How To Pay Off Credit Card Debt Best Strategies Money

How To Pay Off Credit Card Debt Best Strategies Money

9 Steps To Pay Off Credit Card Debt Mozo

9 Steps To Pay Off Credit Card Debt Mozo

Getting The Best Of Credit Card Four Simple Tips How To Pay Off Credit Card Loan Christian Financial Academy

Getting The Best Of Credit Card Four Simple Tips How To Pay Off Credit Card Loan Christian Financial Academy

Best Ways To Pay Off Credit Card Debt

Best Ways To Pay Off Credit Card Debt

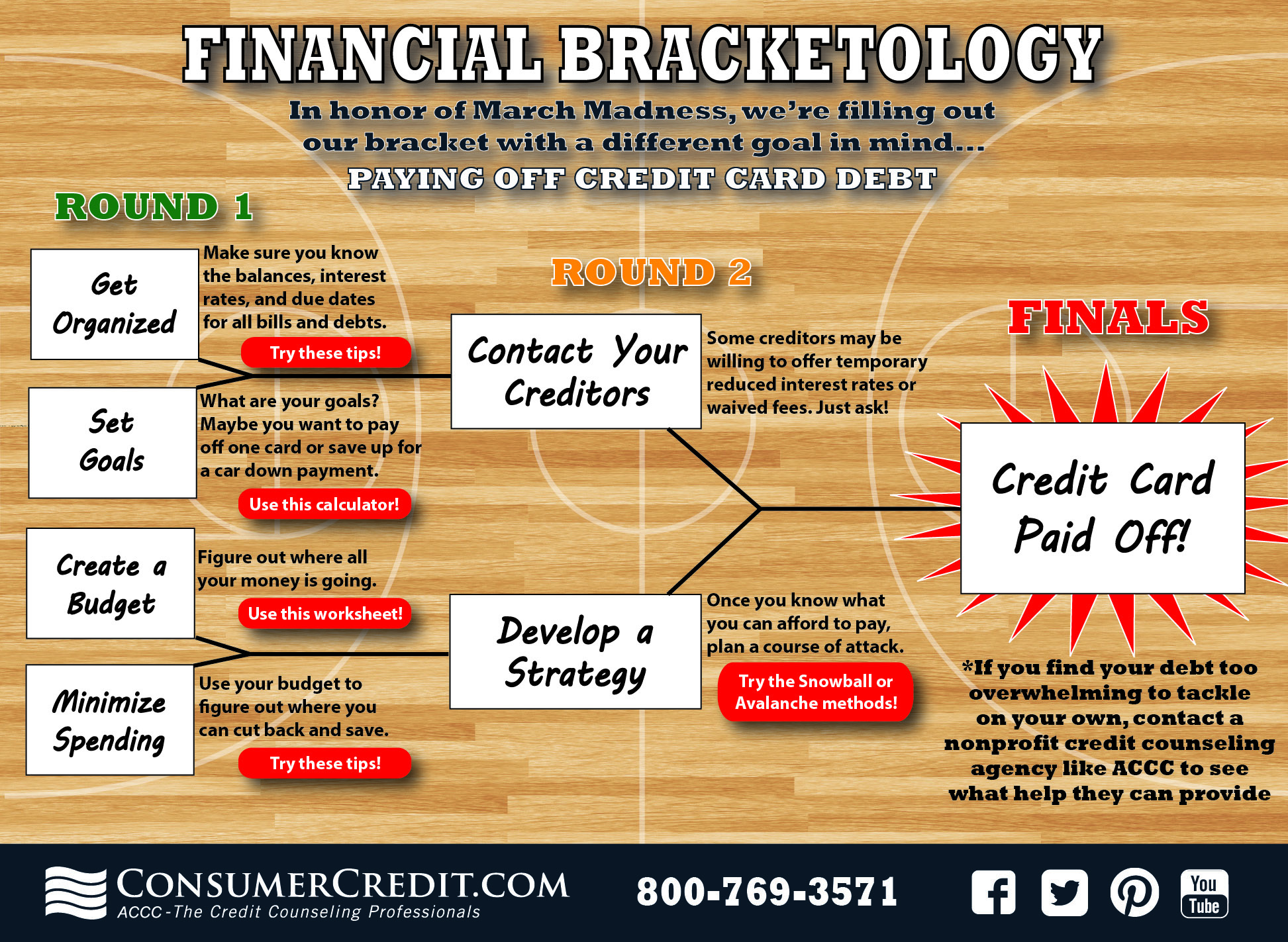

Paying Off Credit Card Debt Consumer Credit

Paying Off Credit Card Debt Consumer Credit

Debt Snowball Vs Debt Avalanche Paying Credit Card Debt Forbes Advisor

Debt Snowball Vs Debt Avalanche Paying Credit Card Debt Forbes Advisor

How To Pay Off Credit Card Debt Ramseysolutions Com

How To Pay Off Credit Card Debt Ramseysolutions Com

6 Best Loans To Pay Off Credit Card Debt 2021

6 Best Loans To Pay Off Credit Card Debt 2021

Best Way To Pay Off Credit Card Debt Making And Saving Money

Best Way To Pay Off Credit Card Debt Making And Saving Money

Comments

Post a Comment