Featured

Where Do I Mail My Federal Tax Return To

Call a Post Office near you to find out if it will be open late on tax day. After the three years the IRS will keep that money.

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

The zip code indicated in the chart below is exclusive to the corresponding IRS processing center.

Where do i mail my federal tax return to. Postal Service if youre mailing from inside the US but consider using a private delivery service otherwise especially if you want proof that your tax return was sent on time. File your past due return the same way and to the same location where you would file an on-time return. Taxes Online Or With An Expat Advisor From Anywhere In The World.

Steps to File a Tax Return. Note - Forms 1040 and 1040-SR use the same where-to-file addresses. Finally youll need to submit everything by May 17 2021.

Kansas City MO 64999-0002. File all tax returns that are due regardless of whether or not you can pay in full. And you ARE ENCLOSING A PAYMENT then use this address.

If you file your taxes by mail using USPS Certified Mail or other services at your local post office will allow you to track your tax return and get a confirmation when the IRS has received it. You can send your tax return or payment using the US. Mail your return in a USPS blue collection box or at a Postal location that has a pickup time before the deadline.

Taxes Online Or With An Expat Advisor From Anywhere In The World. If you have a tax due amount late penalties increase by the day. Where to File Addresses for Tax Returns by State.

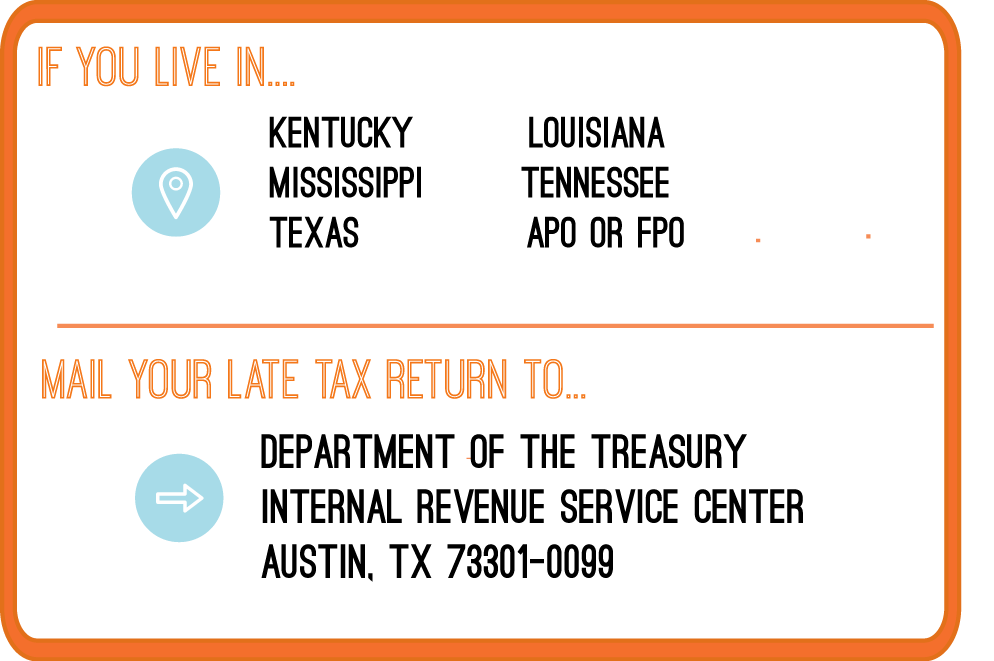

Where To Mail Your Federal IRS Tax Return. Before sending off your late tax return here are a few tips to keep in mind. For individuals who live in the following provinces territories or areas of Ontario or Quebec as shown below.

Post Office Box 14001 Station Main. Then youll need to decide whether to take the standard deduction or itemize your return. Be sure to make your check or money order payable to the United States Treasury Write your social security number daytime phone number and Form 4868 on your check or money order.

Alberta residents mail your tax return to. Department of the Treasury. Get A 100 Accuracy Guarantee With HR Block for your US.

Mail your return to. Mail your Form 4868 and your payment to the appropriate address based on the chart below. To get your tax return started youll first need to find out how much money you made in 2020.

Do not staple or attach your payment to Form 4868. Your return must be postmarked by April 15 have the correct postage and be addressed correctly to be considered on time by the IRS according to the. Tax tips for filing a late tax return.

Search by state and form number the mailing address to file paper individual tax returns and payments. Anzeige Its Easy To File US. Addresses by state for Forms 1040 and 1040-SR Forms 1040ES Forms 1040V amended returns and extensions also addresses for taxpayers in foreign countries US.

The IRS began accepting and processing federal tax returns on February 12 2021. Tax centre mailing address for resident individuals for their tax return. Get A 100 Accuracy Guarantee With HR Block for your US.

If you have received a notice make sure to send your past due return to. Anzeige Its Easy To File US. If you choose to print and mail your federal tax return mail your return to the address based on your region of residence as specified below.

Winnipeg MB R3C 3M3. Post Office Box 14001. The mailing addresses listed here are for 2020 IRS federal tax returns only - find state tax return mailing addresses here.

View CRA page on where to mail your tax return. 7 Zeilen and you ARE enclosing a payment use this address. Also find addresses for tax exempt and government entity returns.

There is no street address. From Texas use this IRS mailing address if you are not enclosing a payment. Some Post Office locations offer extended hours and late postmarking for tax filers.

Department of the Treasury. The mailing address to file your federal income tax return from Texas will depend on whether you are enclosing a payment or not. The zip code will identify it as going to the IRS.

Mail your federal return to the Internal Revenue Service Center listed for the state that you live in. Taxpayers and tax professionals are encouraged to file electronically. Arkansas Delaware Illinois Indiana.

If you are expecting a tax refund you must file your return within three years of the original due date. Possessions or with other international filing characteristics. The actual IRS tax return mailing address including UPS FEDEX options will be based on the state or territory you currently live or reside in and on.

Where To Mail Irs Tax Return Mailing Address Electronic Submit Tax Irs

Where To Mail Irs Tax Return Mailing Address Electronic Submit Tax Irs

Here S How Long It Will Take To Get Your 2019 Tax Refund Cnet

Here S How Long It Will Take To Get Your 2019 Tax Refund Cnet

/tax-documents-to-the-irs-3973948-v1-c43621daf8d548328ec95b4f53fd75ff.png) How To Mail Your Taxes To The Irs

How To Mail Your Taxes To The Irs

Where To Mail Tax Return Irs Mailing Addresses For Each State

Irs Mailing Addresses For 2020 Tax Returns By Residence

Irs Mailing Addresses For 2020 Tax Returns By Residence

A State By State Guide For Each Irs Mailing Address Workest

A State By State Guide For Each Irs Mailing Address Workest

Irs Mailing Address Priortax Blog

Irs Mailing Address Priortax Blog

Where To Mail Tax Return Irs Mailing Addresses For Each State

Where To Mail Tax Return Irs Mailing Addresses For Each State

Where Do I Mail My Federal Tax Return Tax Taxuni

Where Do I Mail My Federal Tax Return Tax Taxuni

5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes

How To Mail Documents To The Irs Bulletproof Method Youtube

How To Mail Documents To The Irs Bulletproof Method Youtube

Comments

Post a Comment