Featured

- Get link

- X

- Other Apps

Will I Get Taxes Back From Unemployment

Typically unemployment benefits are taxed like any other income. Anyone with an income below 150000 who claimed federal unemployment benefits last year is eligible for the refund.

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

Federal income tax is withheld from unemployment benefits at a flat rate of 10.

Will i get taxes back from unemployment. Neither your state unemployment or 600 federal unemployment are loans. Youll have to pay taxes on the remaining amount if you received more than 10200 in unemployment compensation. Workers filed for unemployment in 2020 as the COVID-19 pandemic ravaged American economy according to.

Until 1979 unemployment benefits werent taxed by the federal government. What if Im currently on an existing Installment Agreement with the IRS. You can use Form W-4V Voluntary Withholding Request to have taxes withheld from your benefits.

I made the decision way back in March not to have any income tax withheld on my unemployment benefits and Im certain I made the right choice I had mouths to feed and a. Youre not required to pay that back. Unemployment compensation has its own line Line 7 on Schedule 1.

Can I receive unemployment benefits if I owe back taxes. We use cookies to give you the best possible experience on our website. If you receive unemployment benefits you might be eligible for a second tax refund check in May.

ET 23 million US. However it is considered income and like any other paycheck you might receive youre gonna get taxed on it. - Answered by a verified Employment Lawyer.

You can ask to have taxes withheld from your payments when you apply for benefits or you can file IRS Form W-4V Voluntary Withholding with your. By law unemployment payments are taxable and must be reported on your federal tax return according to the IRS. Most taxpayers will not need to file an amended return to get back tax they overpaid on unemployment income the IRS said.

The agency recently announced that filers who are due money back for that now-exempt 10200 in unemployment income do not have to submit. You can request taxes be. The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes out of.

5 2021 Published 340 pm. The refunds will be going to the taxpayers who filed their federal tax returns without claiming the break on any unemployment benefits they received in 2020. How much exactly youll be taxed depends primarily upon where you live.

This includes the special unemployment compensation authorized under. However taxpayers will need to amend last years return if. The tax laws state that unemployment compensation is typically taxable and must be included in gross income for the year.

Also check back with the Unemployment Center for tax tips advice and up to date information related to COVID-19 to help you with your taxes and finances in this time of need. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. The benefits have been fully taxable since 1986.

IRS may refund you 10200 for taxes already filed. If you have an existing Installment Agreement with the IRS and cant afford to make any more payments as a result of your unemployment status call. The agency recently announced that filers who are due money back for that now-exempt 10200 in unemployment income do not have to submit.

8 Depending on the number of dependents you have this might be more or less than what an employer would have withheld from your pay. Your 1099-G will have the information youll need to transfer to your tax return. Get your maximum tax refund with TurboTax today.

If you are unemployed and owe back taxes you do not need to worry about an interruption of your unemployment benefits. People shouldnt have to pay taxes on their unemployment checks.

Refunds For 10 200 Unemployment Tax Break To Begin In May Kiplinger

Refunds For 10 200 Unemployment Tax Break To Begin In May Kiplinger

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Will I Get Money Back From Unemployment Taxes Irs Change Explained

Will I Get Money Back From Unemployment Taxes Irs Change Explained

Unemployment 10 200 Tax Break Some States Require Amended Returns

Unemployment 10 200 Tax Break Some States Require Amended Returns

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Paying Taxes On Income From Unemployment Insurance Fu

Paying Taxes On Income From Unemployment Insurance Fu

Taxes Q A How Do I File If I Only Received Unemployment

Taxes Q A How Do I File If I Only Received Unemployment

How To Get More Back On Taxes If You Got Unemployment In 2020 Wkyc Com

How To Get More Back On Taxes If You Got Unemployment In 2020 Wkyc Com

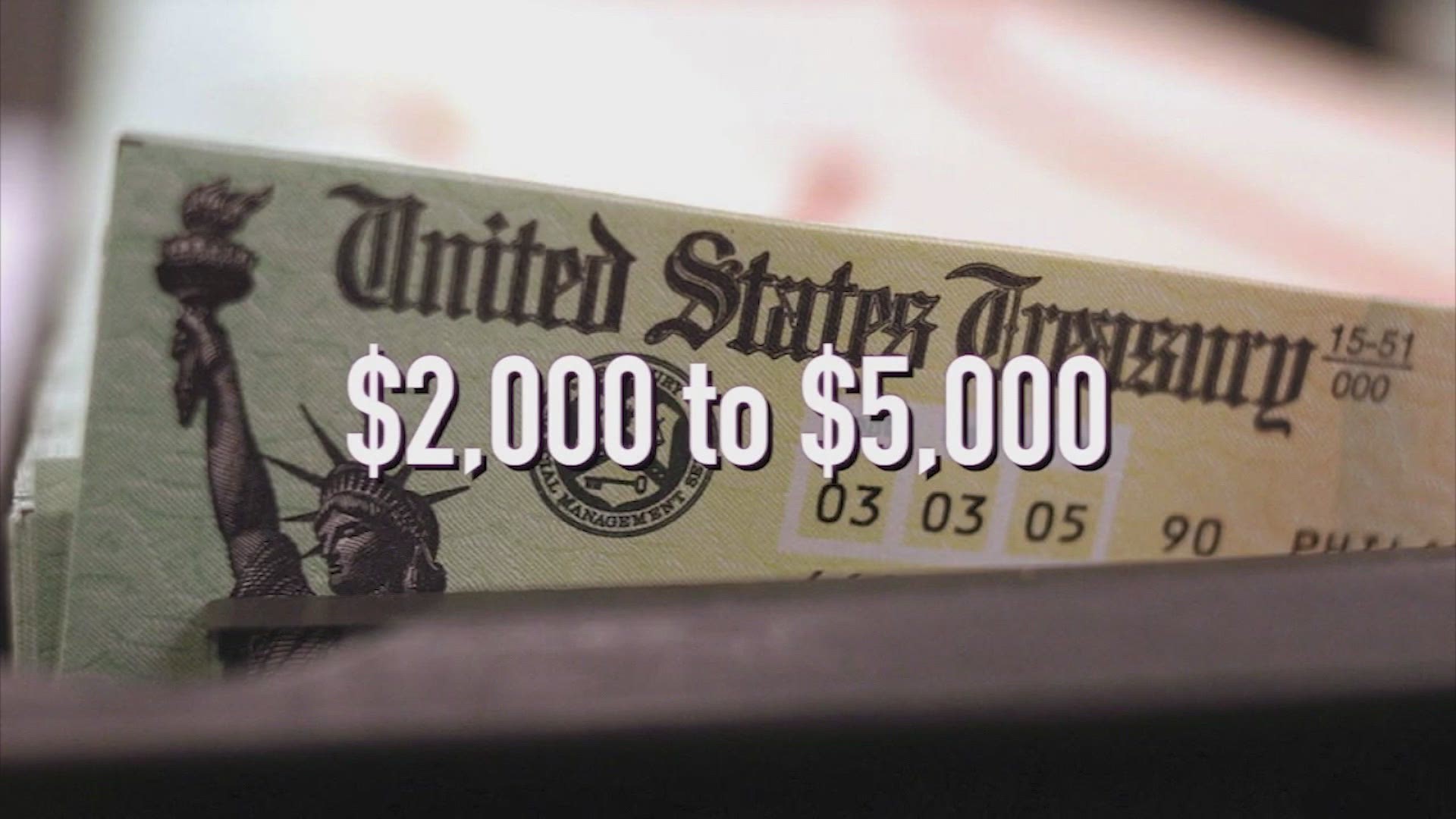

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Comments

Post a Comment