Featured

How Much Does It Cost To Refinance

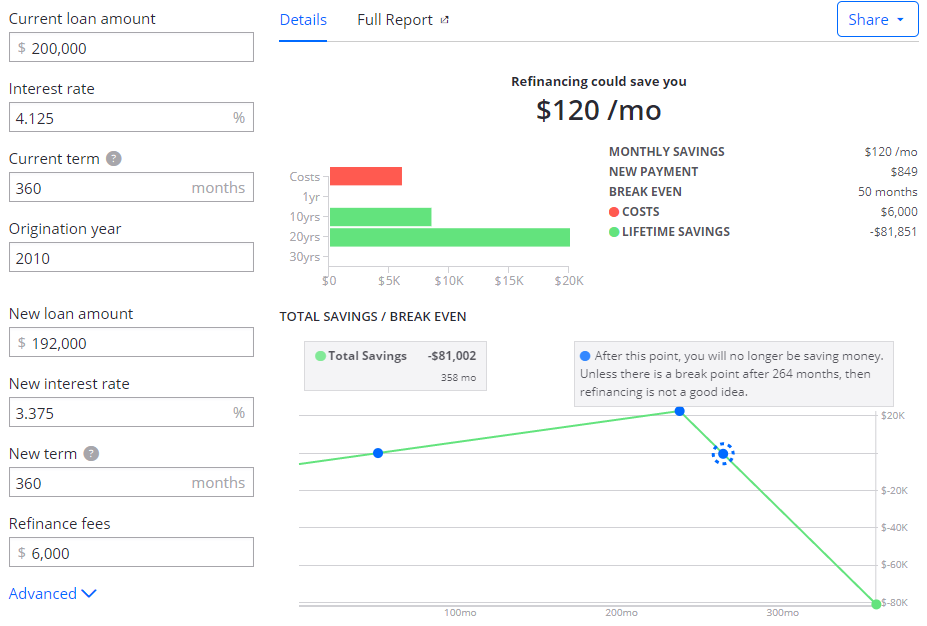

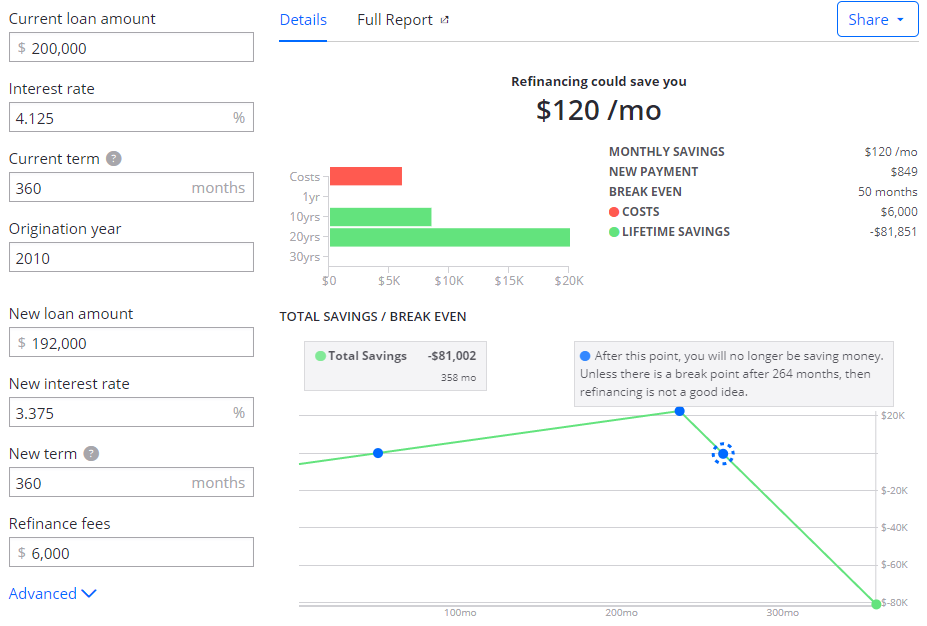

The exact amount is typically around 25 of your loan amount. Your total estimated refinancing costs will be4652.

How Much Does It Cost To Refinance A Mortgage Student Loan Hero

How Much Does It Cost To Refinance A Mortgage Student Loan Hero

However you can get competitive interest rates when you have a good credit score and personal finances.

How much does it cost to refinance. How much does it cost to refinance a mortgage. The cost to refinancea mortgage can range from 2 to 6 of your loan amount depending on several factors including. The cost to refinance a mortgage can go from 2 percent to 6 percent of your loan amount the other several factors are.

While each home loan will have its own terms and conditions there are some common terms and refinance costs to get familiar with when shopping around. Are there any negotiable costs in refinancing. NerdWallets auto loan refinance calculator will show you what your new monthly payment would be and how much you could save by refinancing your car loan.

Lets get you closer to your new home. Our top tip is to compare comparison rates as this is the true cost of the loan. The size of your loan.

Additionally the amount you borrow will impact the cost of the refinance. Lets get you closer to your new home. Your location.

The size of your loan Your lender Your location Your credit score Your available home equity Mortgage term Mortgage type. The average closing cost for refinancing a mortgage in America is 4345. On average you can anticipate paying between 2-6 of your total loan amount in closing costs.

0-1 of the loan amount. If youre ready to begin the process apply online now with Rocket Mortgage. Additionally the new reverse mortgage would need to provide a benefit of at least a 5x to you in cash benefit over the new closing costs.

Typical mortgage refinance closing costs can range from 2 to 6 of the loans principal. A refinance can be a good option if youre having trouble making your payments if you need cash or if you want to remove PMI. This single number can be compared to other lenders to work out how much the loan will really cost.

If you elect to roll these costs into your new refinanced. How much does it cost to refinance. The size of the loan.

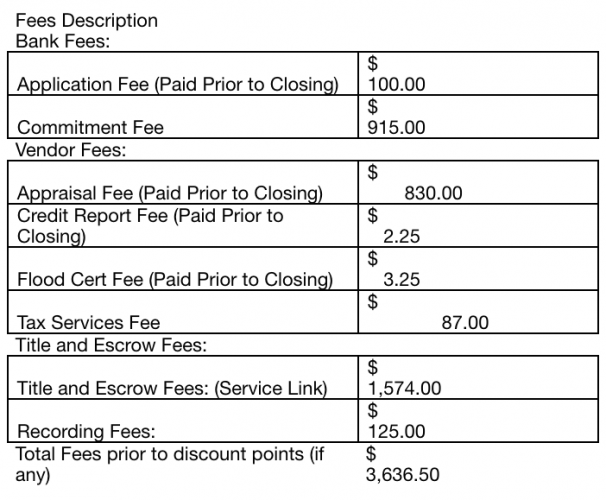

To get a precise estimate of closing costs youll have to factor in all of the fees required by your new mortgage. What kind of things do you have to consider though. These are optional and allow you to purchase a lower mortgage rate.

What the lender charges for setting up the loan. Here are the fees and costs that those refinancing commonly incur. Just like when you originally bought your home youll need to pay certain fees to close on a refinance.

Origination or underwriting fee. How much does it cost to refinance a mortgage. So how much does it cost to refinance.

The cost of a refinance is closely tied to the size of your loan. Typically most homeowners will pay between 2-6 of their total mortgage loan amount to refinance. The average closing costs for a mortgage refinance are about 5000 though costs vary according to the size of your loan and the state and county where you.

How much does it cost to refinance. Table of the breakdown of total estimated refinancing costs by total adjusted origination charges and total other settlement charges. Generally youll pay 2 3 of your refinances value in closing costs.

But there are costs to consider. The exact types of fees and how much youll pay all depend on several different factors. These costs may vary depending on the lender and location of the mortgaged property.

The comparison rate combines the interest rate on your loan plus the fees and charges you can expect to pay across the lifetime of your loan. In general it costs between 2-5 of your mortgages principal to refinance your home. These refinances can have higher credit and financial requirements compared to other mortgages.

On a 250000 loan for example refinance closing costs might be 5000-15000. Eg if your HECM refinance closing costs are 5000 you would need to receive at least 25000 in available proceeds from the HECM finance at closing. What are Closing Costs.

You may find that a refinance will save you money on your monthly mortgage payments or even let you tap into your home equity for cash at a low rate. It can cost between 2 and 6 of the loan amount to refinance a conventional loan. 0-2 of the loan amount.

It usually costs 2 to 5 of your mortgage amount to refinance. If the mortgage youre refinancing is 250000 you can expect to pay anywhere between 5000 and 15000 in closing costs. How much does it cost to refinance.

How Much Lower Should The Interest Rate Be To Refinance My Mortgage

How Much Lower Should The Interest Rate Be To Refinance My Mortgage

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

How Much Does It Cost To Refinance Teletype

How Much Does It Cost To Refinance Teletype

How A No Cost Refinance Loan Really Works The Truth About Mortgage

How A No Cost Refinance Loan Really Works The Truth About Mortgage

How Much Does It Cost To Refinance My Mortgage

How Much Does It Cost To Refinance My Mortgage

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

How Much Does It Cost To Refinance Mintlife Blog

How Much Does It Cost To Refinance Mintlife Blog

Average Cost Of A Mortgage Refinance Closing Costs And Interest Charges Valuepenguin

How Much Does It Cost To Refinance Mintlife Blog

How Much Does It Cost To Refinance Mintlife Blog

How Much Does It Cost To Refinance Mintlife Blog

How Much Does It Cost To Refinance Mintlife Blog

No Cost Refinance Loan There S Really No Such Thing

No Cost Refinance Loan There S Really No Such Thing

How Does Refinancing Work How And When To Refi Zillow

How Does Refinancing Work How And When To Refi Zillow

Hidden Costs When Refinancing Your Mortgage Bay National Title

Hidden Costs When Refinancing Your Mortgage Bay National Title

How Much Does It Cost To Refinance Bankrate

How Much Does It Cost To Refinance Bankrate

Comments

Post a Comment