Featured

- Get link

- X

- Other Apps

Credit Card Debt Settlement

If you have the means to pay more than your monthly minimums adopt a tried-and-true debt. Learn the process of DIY debt settlement Option 2.

Credit Card Debt Relief How The Government Has Incentives For Credi

Credit Card Debt Relief How The Government Has Incentives For Credi

Is Credit Card Debt Causing You To Stay Awake.

Credit card debt settlement. Each state has its own statute of limitations on debt collection. A settlement is when a credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount. As with all debts larger balances have a proportionately larger impact on your credit score.

If youve got to the point where your credit card provider is threatening to take you to court you need to take action. How To Report the Credit Card Settlement Scam. Lump-Sum Payment Agreement In this instance you negotiate with the credit card company to pay a lump sum of money that is less than what you owe.

Do-it-yourself credit card debt settlement. Credit Card Debt Termination Scam. Speak to your provider.

Alternatives to Credit Card Debt Settlement Let zombie debt lie. Working with a debt settlement company. Reach out to the credit card company.

Settlement of your credit card debt will impact your credit scorebut with persistence determination and a little bit of luck youll be able to raise your score to new heights. Debt settlement is an agreement between a lender and a borrower for a large one-time payment toward an existing balance in return for the forgiveness of the remaining debt. Debt settlement is for consumers experiencing a legitimate financial hardship.

For example you might owe your credit card company 5000 in charges interest and fees. Keep in mind that any forgiven debt may be taxed as income when tax season rolls around. Debt settlement refers to any solution that allows you to get out of debt for less than you owe.

If the credit card company is willing to entertain the idea of a debt settlement then the odds are high that they will want to make one of the following arrangements. Debt settlement can hurt your credit score almost as much as bankruptcy. What Is a Credit Card Debt Settlement.

The remaining amount can be repaid in one single payment or as a series of payments as determined through the specific agreement. Heres what you need to know about how to settle credit card debt before going to court. The financial credit crisis that began in 2008 has forced millions of people to search for alternatives to handling their credit card debt because the solution of the past refinancing your debt is all but gone.

There is no such thing dont enroll in a Credit Card Debt Termination program. To settle your credit card debt yourself youll need to reach out to your credit card company and try to get them to accept less than what you owe. As simple as that.

The remaining amount can be repaid in a single payment or over a series. Make your family and friends aware of the Credit Card Debt Settlement Scam by sharing it on social media using the buttons provided. Burying your head in the sand isnt going to work.

Many credit card companies however are prepared to work with customers impacted by the pandemic. If you cant make your credit card payment or think you might not be able to soon notify your credit card company as soon as possible. Settling debt for less than the total amount owed is better for your credit than ignoring your debt but its worth taking a closer look at bankruptcy if you cant afford to settle your debt.

Credit cards and medical bills are ideal for the debt settlement process because if the cardholder files for bankruptcy the card company or medical facility could get nothing. A debt settlement remains on your credit report for seven years. You dont need to hire someone to help settle your debts but it may help just watch out for scams.

Slash your interest rate. You pay back a percentage of the balance and then the creditor lender or collector discharges the remaining balance and closes the account. As stated above a credit card settlement is when a credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount.

Heres your guide to understanding your options and the right questions to ask. Credit card debt settlement is an arrangement that lets you pay less than you promised to pay in your original credit card agreement. Dust off your debate skills for this method.

Debt settlement works for more than just credit card debt although credit card settlement is the most common. Are You Concerned About Paying Your Bills. The Federal Reserve Board says that 71 of credit card debt was 90 days past due in Q4 of 2016.

Credit Card Debt Settlement How Fast Can You Become Debt Free Check

Credit Card Debt Settlement How Fast Can You Become Debt Free Check

Debt Settlement For Credit Card Debt How The Process Works

Debt Settlement For Credit Card Debt How The Process Works

/negotiating-credit-card-debt-settlement-5976c779b501e800119259c4.jpg) How To Negotiate Credit Card Debt

How To Negotiate Credit Card Debt

Credit Card Debt Settlement Settle Online And Save Now

Credit Card Debt Settlement Settle Online And Save Now

Consolidating Credit Card Debt Without Hurting Your Credit

Consolidating Credit Card Debt Without Hurting Your Credit

Credit Card Debt Consolidation Loan Credit Score Banking Finance

Credit Card Debt Consolidation Loan Credit Score Banking Finance

/how-will-debt-settlement-affect-my-credit-score-960540_V3-4a211a80452d4879a8240457b9f0e584.png) How Will Debt Settlement Affect My Credit Score

How Will Debt Settlement Affect My Credit Score

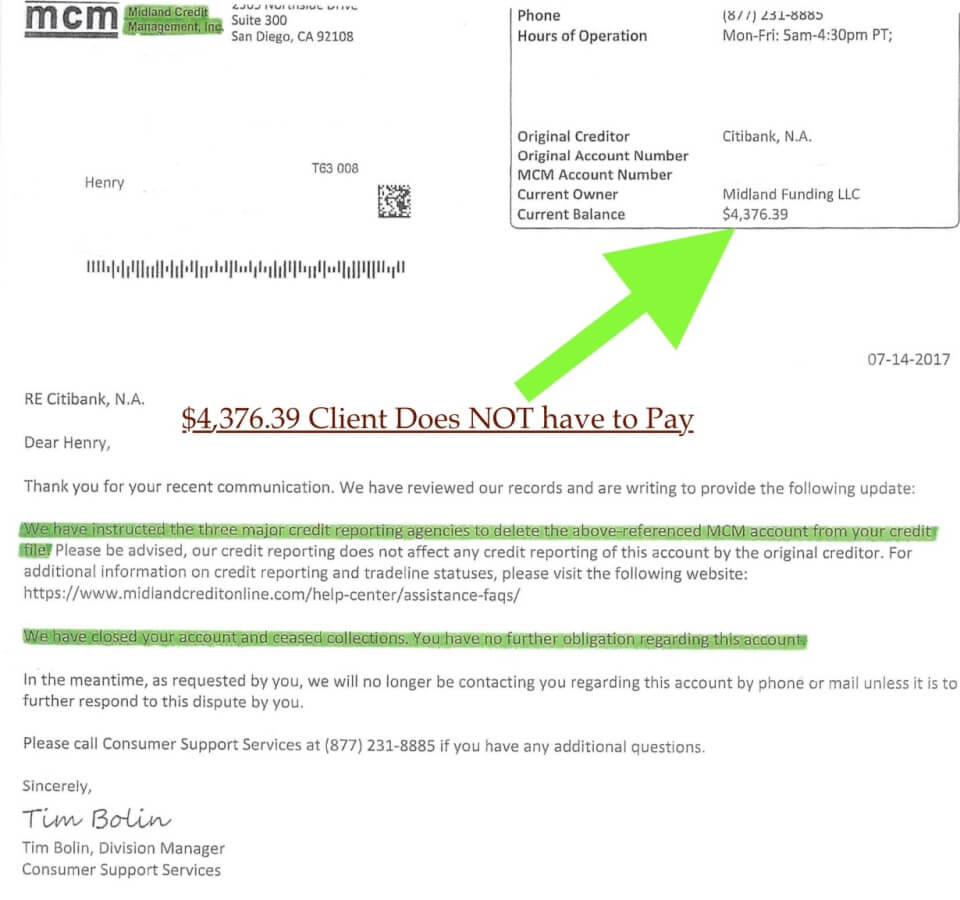

Debt Settlement Letter For Merrick Bank Client Saved 83

Debt Settlement Letter For Merrick Bank Client Saved 83

Debt Settlement Cheapest Way To Get Out Of Debt

Credit Card Debt Relief Find The Best Debt Settlement Programs And

Credit Card Debt Relief Find The Best Debt Settlement Programs And

Calameo How To Settle Credit Card Debt On Your Own

Calameo How To Settle Credit Card Debt On Your Own

Credit Card Debt Settlement What Is It How Does It Work And What To Watch Out For

Credit Card Debt Settlement What Is It How Does It Work And What To Watch Out For

Credit Card Debt Settlement Nomorecreditcards Com

Credit Card Debt Settlement Nomorecreditcards Com

How To Negotiate Credit Card Debt Settle On Your Own W 4 Easy Steps

How To Negotiate Credit Card Debt Settle On Your Own W 4 Easy Steps

Comments

Post a Comment