Featured

How To Get A Credit Line Increase

If you have an online account with Bank of America log. Add AutoPay and customized alerts to help you make more than your minimum payment on time each month.

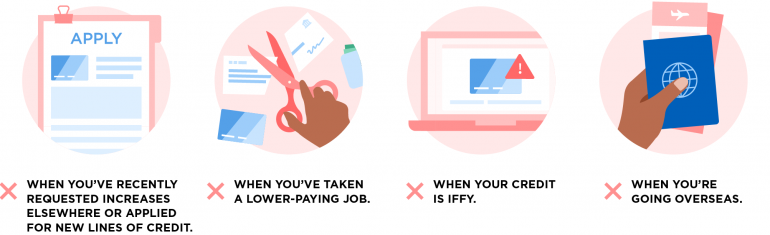

When Should You Request A Discover Credit Line Increase Discover

When Should You Request A Discover Credit Line Increase Discover

Pick a card in your wallet you want to have the limit increased on.

How to get a credit line increase. You can also do it online here. How to request a credit line increase with Chase. The final and most common way to get a credit limit increase with Chase is to call the number on the back of your card and request one.

Building a good credit history is partially about showing the credit issuer you can repay your balance on time every month. If you want to request a Capital One credit increase via phone then you can call the phone number. Capital One credit line increase application.

That is a credit line increase is not a pay raise. Online or over the phone. Click Increase Line of CreditYou can request a credit limit increase once your account has been opened for at least 60 days.

After that go to Settings and choose Credit Line Increase Youll be prompted to enter your personal information and indicate your desired limit increase. To increase your credit limit on your credit card the first step is simply to ask your card issuer to raise it. The representative will likely ask you why you need more credit so have all the information you gathered beforehand ready to go.

There are two ways to request a higher credit limit with Bank of America. Before you call in or make your request you should read the tips below so youll know what to expect. You can request a credit limit increase on your personal or small business OPEN Card through your online account.

Ask to speak to a customer service representative and ask the rep if youre eligible for a credit limit increase. Members have reported that on Citi cards if it says youre eligible and do you accept its a soft. To submit a request with Credit One Bank go to the issuers website and log into your account.

When you request an increase the issuer will need to pull your credit history to see if youre creditworthy. Credit card companies look for a long history of good repayment behavior. Keep in mind that this may require a hard inquiry which will make your credit score dip for a few months.

Dont assume if you ask all of your credit issuers that your chances of being approved are greater. Try going on your online account account and clicking Manage My Account up at the top in the orange bar and then Credit Line Increase. As you make payments on time maintain a healthy credit utilization debt-to-limit ratio and perhaps increase your income level you may become eligible for a credit limit increase.

Generally if you make substantially more than your minimum monthly payment on time for three months you can reapply for a credit line increase. If your credit score has increased since first getting a credit card youre in a good position to request a credit line increase. Probably the quickest way to get a limit increase is to request it online.

There are a few ways to ask your credit card issuer for more credit and well cover those options below. To get in touch with Target Red Card customer service call 800-659-2396 and enter your credit card number when prompted. Issuers will generally offer you a credit line increase periodically without you having to ask for it.

You can do it over the phone by calling. First you need to know how to request a credit line increase with Chase. Im not sure if theres a backdoor number for credit line increases but that number should do the trick.

You should be prepared to make a case for why you deserve the increase. Alternatively you can apply for and open a new credit card. So regardless of your credit limit its always a good idea to stick to a budget and make sure youre spending less than you earn.

For starters you should do all you can to increase your credit score including making on-time payments paying down debt and refraining from opening or closing other accounts you have. But it also comes with a word of caution. Choose one card to request an increase on.

And you will still need to pay off whatever money you charge to your credit card. Use CreditWise from Capital One to help monitor your credit score.

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

When Should I Ask For A Credit Limit Increase Nerdwallet

When Should I Ask For A Credit Limit Increase Nerdwallet

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

6 Expert Tips Increase Your Credit Limit Get Approved Now Cardrates Com

6 Expert Tips Increase Your Credit Limit Get Approved Now Cardrates Com

How To Request A Credit Limit Increase With Bank Of America Creditcards Com

How To Request A Credit Limit Increase With Bank Of America Creditcards Com

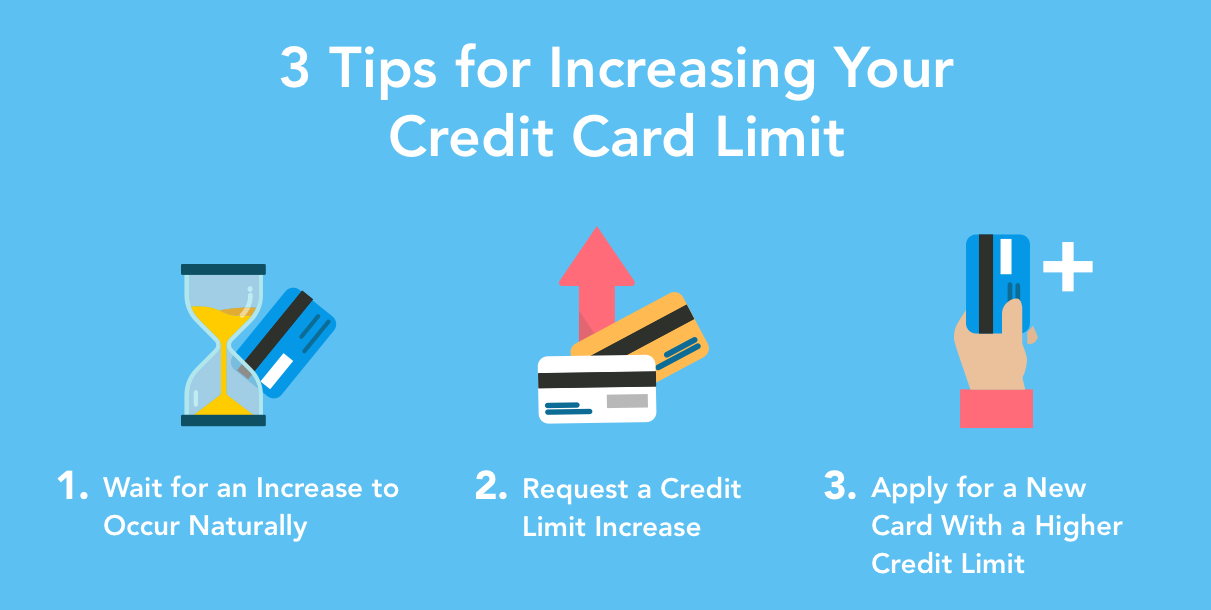

3 Easy Tips How To Increase Credit Card Limit Mintlife Blog

3 Easy Tips How To Increase Credit Card Limit Mintlife Blog

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

Why And How To Request A Credit Limit Increase Money Under 30

Why And How To Request A Credit Limit Increase Money Under 30

Bank Of America Allowing Some Cardholders To Request A Credit Limit Increase Without A Hard Pull Doctor Of Credit

Bank Of America Allowing Some Cardholders To Request A Credit Limit Increase Without A Hard Pull Doctor Of Credit

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

Comments

Post a Comment