Featured

- Get link

- X

- Other Apps

Debt To Income Ratio To Buy A Home

A back end debt to income ratio greater than or equal to 40 is generally viewed as an indicator you are a high risk borrower. Increasing your down payment can make the difference between buying a home and acquiring adequate financing.

Debt To Income Ratio Dti Limits For 2014 Fha Conventional And Qm

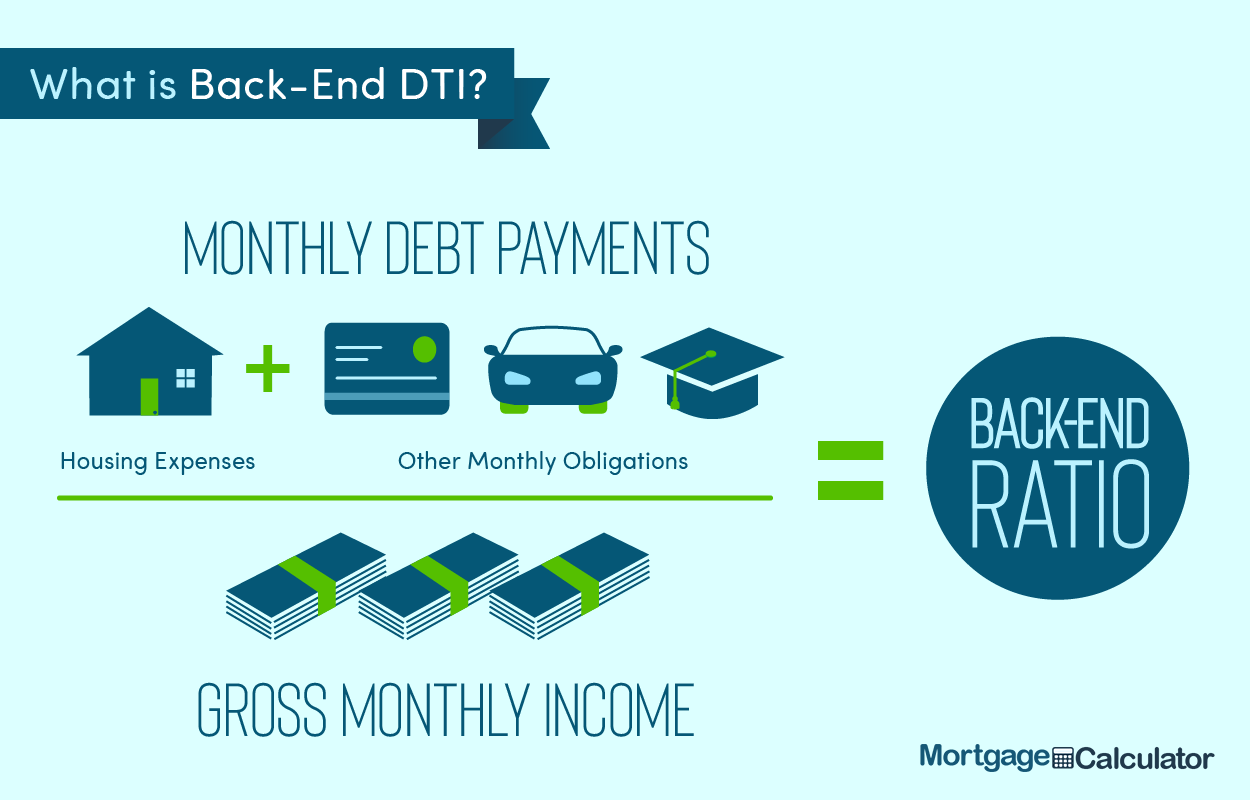

The back-end ratio is always higher than the front-end ratio.

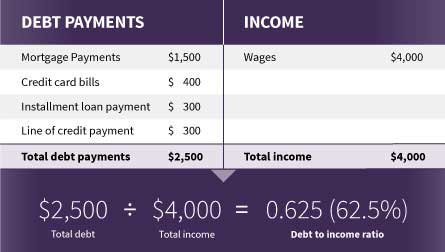

Debt to income ratio to buy a home. In most cases 50 is the highest debt-to-income ratio that a homebuyer can have. Here are a few tips on how to buy a home with high debt-to-income ratio. In this case its 11503000.

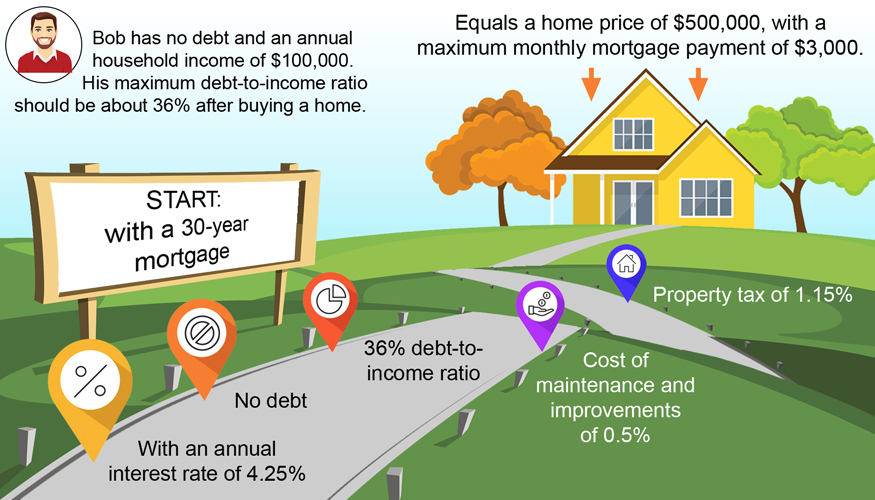

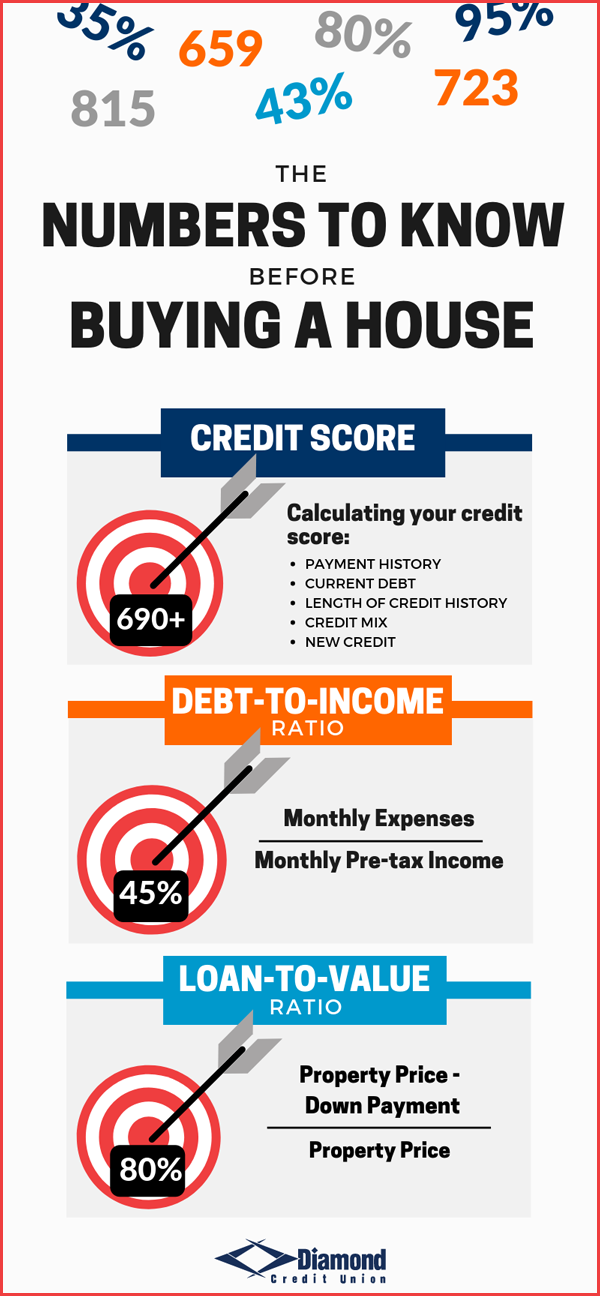

It too is computed on your gross monthly income. If you apply for a conventional home loan your ideal DTI ratio should be 36 or less. 2000 is 33 of 6000 Evidence from studies of mortgage loans suggest that borrowers with a higher debt-to-income ratio are more likely to run into trouble making monthly payments.

That makes your ratio about3833 or 3833. Your debt-to-income ratio or DTI is a value that represents your monthly debt obligations in relation to your monthly income. Although this might not be viable if you have a huge amount of debt CENTURY 21 Core Partners suggest that paying a down payment is a.

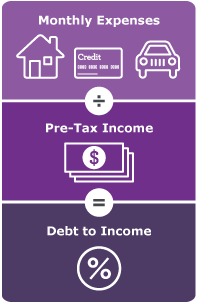

Simply put it is the percentage of your monthly pre-tax income you must spend on your monthly debt payments plus the projected payment on the new home loan. Back-End Debt Ratios. On the other hand if youre looking at an FHA home loan these programs may allow DTI ratios up to 43.

Your debt-to-income ratio equals your debt payments including house payment or rent divided by your gross before tax income. Traditional lenders generally prefer a 36 debt-to-income ratio with no more than 28 of that debt dedicated toward servicing the mortgage on your home. Use this to figure your debt to income ratio.

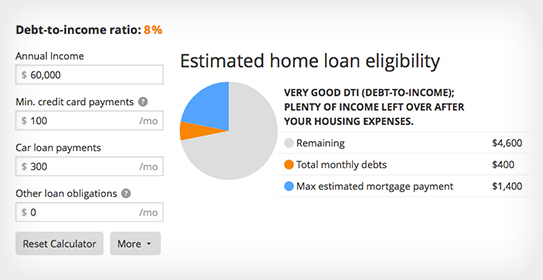

The ideal DTI ratio is around 36. If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent. Your DTI ratio tells lenders whether can afford to.

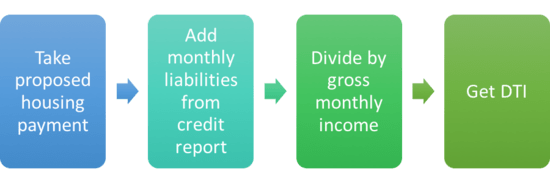

How to calculate your debt-to-income ratio. For your convenience we list current Redmond mortgage rates to help homebuyers estimate their. To be clear though these are only guidelines and not hard or fast rules.

The lower your DTI the more likely you will be able to afford a mortgage and the more loan options youll have. If you take home 6000 per month and are trying to buy a home that would require a 1500 monthly payment your front-end DTI would be. And the back-end ratio is 50 for a conventional loan.

The back-end ratio reflects your new mortgage payment plus all your recurring debt. The back-end ratio is 43 as of 2020 for an FHA loanbut can be higher depending on your credit score. Of course reducing debt.

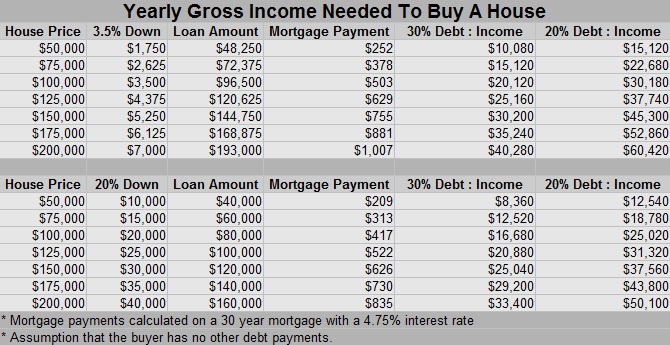

Generally the lower your debt-to-income ratio is the more likely you are to qualify for a mortgage. Total debt to income ratio calculation. For the sake of this calculation a 30-year fixed-rate home loan is presumed with a rate at 5 APR.

A good debt-to-income ratio to buy a house depends on your mortgage program. However having DTI ratio of 36 or less is considered ideal. If the DTI is higher than 36 percent it can be difficult to qualify for a mortgage.

Total housing payment HOA dues and other debts calculated income 1000 house payment HOA dues 1000 other debts 5000 income 40 total ratio These figures are then used in one of the automated systems or through a manual underwrite. It is the total of your monthly mortgage property taxes and property insurance payments divided by your gross monthly income. Increase Your Down Payment.

Your DTI ratio is equal to your debts divided by income. Also called a PITI ratio principal taxes interest and insurance this number reflects your total housing debt in relation to your monthly income. Similarly if debt stays the same as in the first example but we increase the income to 8000 again the debt-to-income ratio drops 2000 8000 025 or 25.

Your debt to income ratio or DTI tells lenders how much house you can afford and how much youre eligible to you borrow. The following table shows the required income needed to have a 28 DTI front end ratio on a home purchase with 20 down for various home values. There are two measures of DTI -- the first is a front-end or top-end ratio.

Calculate Your Debt To Income Ratio Wells Fargo

Calculate Your Debt To Income Ratio Wells Fargo

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How Much House Can I Afford Fidelity

How Much House Can I Afford Fidelity

What Is A Debt To Income Ratio Why Is The 43 Debt To Income Ratio Important Consumer Financial Protection Bureau

What Is A Debt To Income Ratio Why Is The 43 Debt To Income Ratio Important Consumer Financial Protection Bureau

Why You Need A Good Debt To Income Ratio To Buy A House

Why You Need A Good Debt To Income Ratio To Buy A House

Debt To Income Ratio Dti What It Is And How To Calculate It The Truth About Mortgage

Debt To Income Ratio Dti What It Is And How To Calculate It The Truth About Mortgage

Debt To Income Ratio Financial Literacy

3 Numbers You Should Know Before You Buy A Home Diamond Cu

3 Numbers You Should Know Before You Buy A Home Diamond Cu

What Is Debt To Income Ratio Omaha Ne Home Buyer S Guide Petrovich Team Home Loan

What Is Debt To Income Ratio Omaha Ne Home Buyer S Guide Petrovich Team Home Loan

This Is The Income You Need To Afford A Home Really Action Economics

This Is The Income You Need To Afford A Home Really Action Economics

How Much House Can You Afford Money Under 30

How Much House Can You Afford Money Under 30

Debt To Income Ratio Calculator What Is My Dti Zillow

Debt To Income Ratio Calculator What Is My Dti Zillow

Debt To Income Ratio Learn Calculate And Improve

Debt To Income Ratio Learn Calculate And Improve

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator

Comments

Post a Comment